Bitcoin, Ethereum, Crypto News & Price Indexes

Michael Saylor’s Strategy Makes Bold Bitcoin Move Despite Market Dip — But Did It Miss the Bottom?

In a move that has the crypto world buzzing, Michael Saylor’s Strategy (formerly MicroStrategy) has once again demonstrated its unwavering commitment to Bitcoin, adding another substantial tranche of BTC to its already massive holdings. The company’s latest acquisition has sparked intense debate among investors, analysts, and Bitcoin enthusiasts about whether this bold strategy will continue to pay dividends or if Strategy might be playing a dangerous game of timing the market.

The Numbers Behind the Latest Acquisition

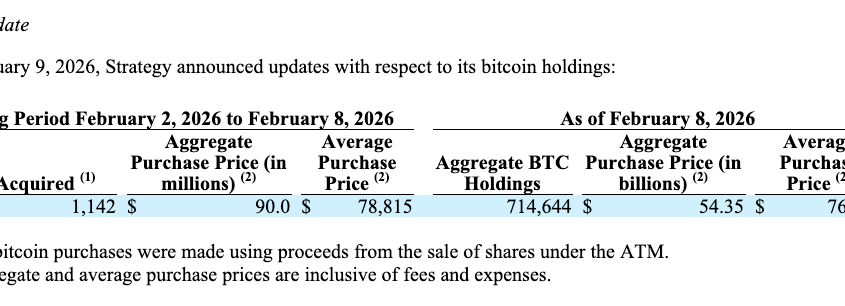

According to a recent Securities and Exchange Commission filing, Strategy acquired 1,142 Bitcoin (BTC) for approximately $90 million last week, representing an average purchase price of $78,815 per coin. This acquisition brings the company’s total Bitcoin holdings to an astounding 714,644 BTC, purchased for around $54.35 billion at an average price of $76,056 per coin.

What makes this purchase particularly noteworthy is the timing. Despite Bitcoin trading well below the $78,815 acquisition price for most of the week, and even briefly touching $60,000 on Coinbase last Thursday, Strategy proceeded with the purchase at what many would consider a premium to current market prices.

A Curious Strategy: Buying High in a Dipping Market

The timing of this acquisition has raised eyebrows across the crypto community. Bitcoin has traded well below $78,000 for almost a week, with the price falling sharply below that level last Tuesday and remaining below the $72,000 mark since then, according to Coinbase data.

This approach marks Strategy’s second Bitcoin acquisition while the cryptocurrency trades below the company’s average acquisition price of $76,056. The situation bears striking similarities to 2022 when Bitcoin fell below $30,000 while Strategy’s average purchase price stood at about $30,600. During that period, Strategy significantly slowed its buying pace, though it continued making smaller purchases even at prices below its cost basis.

The Optics of Unprecedented Scale

The optics surrounding Strategy’s Bitcoin holdings have become increasingly complex as the company’s position has grown to unprecedented levels. With over 714,000 BTC under management, Strategy now holds approximately 3.4% of all Bitcoin that will ever exist, given the cryptocurrency’s 21 million coin cap.

This massive position means that even small percentage movements in Bitcoin’s price can translate to billions in unrealized gains or losses on Strategy’s balance sheet. The company’s stock price (MSTR) has mirrored Bitcoin’s volatility, dropping to around $107 last Thursday before rebounding 26% to close at approximately $135 following a minor recovery in crypto markets.

Market Speculation and Saylor’s Next Move

In the lead-up to this latest purchase, market participants speculated extensively about Strategy’s approach to buying Bitcoin in the current market cycle. Some observers suggested that Strategy might try to avoid buying below its average cost this cycle, given the heightened scrutiny around unrealized losses on such a massive position.

The speculation became so intense that social media users began joking about what Saylor might announce next. One particularly viral post on X (formerly Twitter) quipped, “Saylor on Monday: We’ve added another 1,000 bitcoins at an average price of $95,000,” highlighting the skepticism about Strategy’s ability to time the market effectively.

The Broader Implications for Corporate Bitcoin Adoption

Strategy’s continued Bitcoin accumulation has significant implications for corporate adoption of cryptocurrency as a treasury asset. As the world’s largest public holder of Bitcoin, Strategy’s moves are closely watched by other corporations considering similar strategies.

The company’s approach demonstrates a long-term conviction in Bitcoin’s value proposition, even in the face of short-term price volatility. However, it also raises questions about the sustainability of such an aggressive accumulation strategy, particularly as Bitcoin’s price fluctuates significantly below Strategy’s average acquisition cost.

Technical Analysis and Market Context

From a technical perspective, Strategy’s latest purchase comes at an interesting juncture for Bitcoin. The cryptocurrency has been trading in a relatively tight range below $80,000, with analysts debating whether this represents a consolidation phase before another leg up or the beginning of a more extended correction.

The fact that Strategy chose to buy at $78,815 despite Bitcoin trading below this level for most of the week suggests a strategy that prioritizes consistent accumulation over perfect timing. This approach aligns with dollar-cost averaging principles but on a scale that most individual investors can only dream about.

Looking Ahead: What’s Next for Strategy and Bitcoin?

As Strategy continues to build its Bitcoin position, the market will be watching closely to see how this strategy evolves. Will the company maintain its aggressive accumulation pace even as Bitcoin trades below its average cost basis? Or will we see a repeat of 2022, where purchases slowed significantly during market downturns?

One thing is certain: Strategy’s Bitcoin strategy has become a defining feature of both the company and the broader cryptocurrency market. With over $54 billion invested in Bitcoin and a position that represents a significant percentage of all Bitcoin in existence, Strategy’s moves will continue to influence market sentiment and potentially impact Bitcoin’s price action.

The coming months will be crucial in determining whether Strategy’s bold bet on Bitcoin pays off or whether the company will face increasing pressure as unrealized losses mount. Either way, Michael Saylor and his company have cemented their place in cryptocurrency history, and their next moves will be watched with intense interest by the entire crypto community.

Tags & Viral Phrases:

- Michael Saylor Bitcoin Strategy

- Strategy buys 1,142 BTC

- Bitcoin accumulation at $78,815

- MicroStrategy Bitcoin holdings

- Corporate Bitcoin adoption

- Bitcoin price below Strategy’s average

- Saylor’s bold crypto move

- 714,644 BTC and counting

- Bitcoin treasury strategy

- Crypto market timing debate

- Strategy’s $54 billion Bitcoin bet

- Corporate crypto accumulation

- Bitcoin below $72,000

- Saylor’s next Bitcoin purchase

- Market speculation on Strategy

- Bitcoin volatility and corporate holdings

- The optics of unrealized losses

- Strategy’s average cost basis

- Bitcoin price action analysis

- Corporate treasury Bitcoin strategy

- Michael Saylor’s crypto conviction

- Bitcoin accumulation controversy

- Strategy’s market influence

- Corporate crypto adoption trends

- Bitcoin price prediction debate

- Strategy’s Bitcoin timing strategy

- The future of corporate Bitcoin holdings

- Saylor’s long-term Bitcoin vision

- Bitcoin market bottom speculation

- Strategy’s crypto legacy

,

Leave a Reply

Want to join the discussion?Feel free to contribute!