Bitcoin, Ethereum, Crypto News & Price Indexes

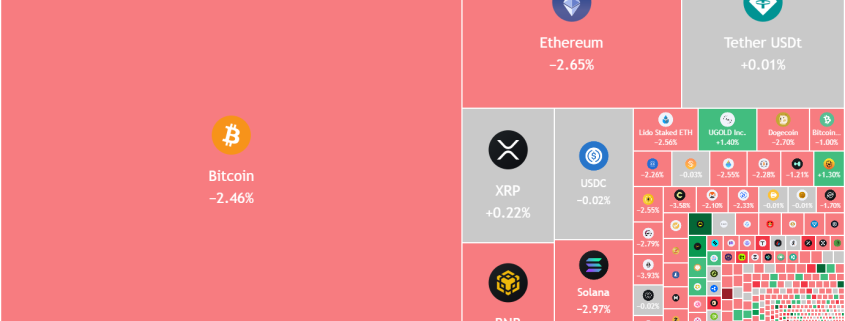

Bitcoin’s $72K Resistance Battle: Traders Eye $50K Bottom as Altcoins Falter

Bitcoin (BTC) is facing intense selling pressure near $72,000 as traders debate whether the cryptocurrency has truly bottomed out or if another leg down toward $50,000 is imminent.

The world’s largest cryptocurrency has slipped closer to $69,500, signaling that bearish traders are aggressively selling any rallies. This comes as several major altcoins struggle to maintain gains, suggesting that overall market sentiment remains decidedly negative.

Institutional ETF Buyers Underwater?

Prominent trader BitBull has sparked controversy by claiming that Bitcoin’s “real bottom will form below $50,000, where most of the ETF buyers will be underwater.” This provocative statement suggests that institutional investors who piled into Bitcoin ETFs may face significant losses before the market finds its true bottom.

However, crypto sentiment platform Santiment offers a more optimistic view. In their Saturday report, they suggested that the dramatic fall to $60,000 may have been the genuine bottom. For a sustained recovery, Santiment emphasizes that Bitcoin must maintain levels above key support while whales continue their tentative accumulation.

Sharpe Ratio Signals Potential Bottom

Adding to the bullish case, CryptoQuant analyst Darkfost points out that Bitcoin’s Sharpe ratio has fallen to -10, historically indicating the final phases of bear markets. While this doesn’t definitively confirm the bear market’s end, it suggests that the risk-to-reward profile may be reaching extreme levels that typically precede significant reversals.

Altcoin Market Shows Weakness

The broader cryptocurrency market is showing signs of strain. Several major altcoins are facing selling pressure at higher levels, indicating that traders remain cautious about the sustainability of any rallies. This lack of conviction across the altcoin space suggests that Bitcoin’s potential recovery could face significant headwinds.

Technical Analysis: What the Charts Reveal

Bitcoin’s recovery is currently stalling just below the critical $74,508 breakdown level. This indicates that bears are attempting to flip this level into resistance, a classic bearish reversal pattern. The downsloping 20-day EMA at $78,142 and the RSI in negative territory further favor sellers.

For bears to maintain control, they’ll need to pull Bitcoin back toward $60,000. However, if bulls can push the price above the 20-day EMA, it would signal strong buying interest at lower levels and potentially spark a rally toward the 50-day SMA at $86,636.

Market-Wide Implications

The current market dynamics extend beyond Bitcoin. The S&P 500 Index recently broke below its ascending channel pattern but quickly reversed, suggesting the breakdown may have been a bear trap. Meanwhile, the US Dollar Index is attempting to break below key support levels, which could provide tailwinds for risk assets like cryptocurrencies.

What’s Next for Crypto?

The coming days will be crucial for determining whether Bitcoin and major altcoins can mount a sustained relief rally or if the broader downtrend will resume. Traders are closely watching key support and resistance levels across multiple timeframes to gauge the market’s next move.

The cryptocurrency market stands at a critical juncture, with bulls fighting to establish a bottom while bears remain determined to push prices lower. As institutional investors, retail traders, and whales all position themselves for what could be a pivotal moment in crypto market history, volatility is likely to remain elevated.

Tags: Bitcoin bottom, BTC price prediction, crypto market analysis, Bitcoin ETF, Sharpe ratio, cryptocurrency trading, altcoin weakness, $50K Bitcoin, crypto sentiment, whale accumulation, technical analysis, bear market signals, institutional investors, market bottom, crypto volatility

Viral Phrases: “Bitcoin’s real bottom below $50K,” “ETF buyers underwater,” “Sharpe ratio hits -10,” “Bears defending $72K resistance,” “Altcoins facing selling pressure,” “Crypto market sentiment turns negative,” “Bitcoin bulls fighting for survival,” “Institutional money at risk,” “Bear trap or true breakdown?” “Whales accumulating cautiously”

,

Leave a Reply

Want to join the discussion?Feel free to contribute!