Solana Price Prediction: SOL Bounces 12% Overnight – But This One Signal Could Ruin Everything

Solana’s 12% Comeback Hits a Speed Bump: One Ominous Indicator Could Send SOL Spiraling Back Down

Solana ($SOL) has staged an impressive 12% rally in recent hours, pulling itself back from the brink of critical support levels. But beneath the surface of this bullish bounce lies a storm cloud that could quickly turn the celebration into chaos.

While traders toast to the recovery, seasoned analysts remain deeply skeptical. The question on everyone’s mind: Is this a genuine reversal or just another dead cat bounce before the next leg down?

The Hidden Warning Sign That Could Derail Everything

Here’s the uncomfortable truth that most Solana holders are missing: Long-term holders—the investors who typically provide crucial price support during market turbulence—are quietly exiting their positions.

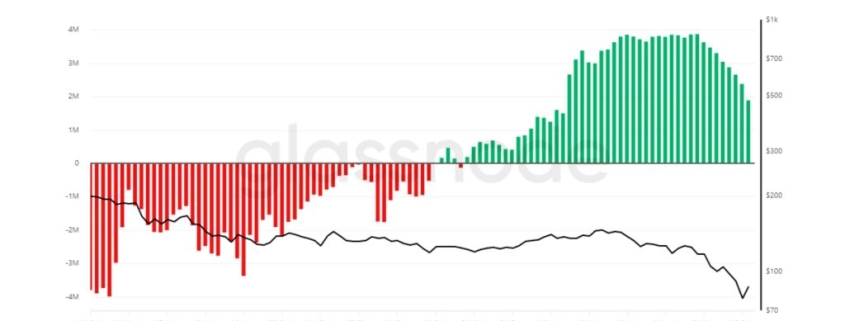

Glassnode’s HODLer Net Position Change data reveals a disturbing trend. Accumulation has slowed dramatically following last week’s sharp pullback, and this shift in behavior from the “smart money” represents a massive red flag for the rally’s sustainability.

These diamond-handed investors have historically been the backbone of Solana’s price stability, absorbing selling pressure and preventing catastrophic drops. But their waning conviction suggests they see something the rest of the market hasn’t yet recognized.

The Oversold Signal That’s Both Hope and Warning

Adding to the complexity, Solana’s Money Flow Index (MFI) has plunged below 20.0, entering deeply oversold territory. This typically indicates seller exhaustion and often precedes price stabilization or even reversals.

However, history shows this signal comes with a catch. Solana has only hit these extreme oversold levels three times in the past two and a half years. Each instance led to meaningful price stabilization—but only after significant additional downside first.

The market is essentially caught between two powerful forces: the technical oversold condition suggesting a bounce is due, and the deteriorating conviction from long-term holders suggesting more pain ahead.

Will $70 Become the Breaking Point?

From a technical perspective, Solana remains trapped in a descending channel pattern. The cryptocurrency has broken below this structure and is now hovering in the $85 to $90 range, which is providing temporary support.

But here’s the critical level everyone needs to watch: If this support fails, the next major downside target sits at $70. This represents the last significant demand zone before Solana enters truly dangerous territory.

The first resistance level appears around $100, but the real make-or-break point is $144. A daily close above $144 would signal that the downtrend has likely ended and a genuine bullish reversal is underway.

Until that happens, every rally remains suspect, and the threat of another leg lower looms large.

Why Smart Money Is Looking Beyond Price Action

As uncertainty grips the Solana market, sophisticated investors are beginning to shift their focus from pure price speculation to platforms offering real, immediate utility.

Enter SUBBD—a project that’s capturing attention precisely because it operates on a different paradigm entirely.

The New Frontier: AI-Powered Content Monetization

SUBBD represents a fundamental reimagining of how creators interact with their audiences and monetize their work. Built specifically for the $85 billion creator economy, the platform leverages artificial intelligence to help users generate actual income from their content—not speculative returns.

The platform’s core innovation lies in its removal of traditional intermediaries. Instead of relying on centralized platforms that take massive cuts and control creator relationships, SUBBD puts ownership and monetization directly in the hands of content creators.

A Platform Built for the Real World

The mechanics are straightforward but revolutionary. Creators maintain ownership of their audience relationships rather than “renting” them from platforms like YouTube or Instagram. Fans gain direct access to exclusive content through token-gated experiences and enhanced engagement opportunities.

This model addresses a fundamental problem in the current creator economy: platforms extract value while creators and fans bear the risks. SUBBD flips this dynamic, aligning incentives across the entire ecosystem.

The Numbers Tell a Compelling Story

The market has responded enthusiastically to this vision. SUBBD is rapidly approaching $1.5 million in presale funding, with investors backing what they see as a more sustainable model built around actual usage rather than hype cycles.

This traction suggests a broader shift in how crypto capital is being allocated—away from pure speculation and toward platforms with tangible utility that can generate revenue regardless of market conditions.

The Original Promise of Crypto, Realized

What makes SUBBD particularly compelling is how it embodies the original promise of cryptocurrency: decentralized ownership, direct access, and monetization systems that work for participants rather than platforms.

In a market where Solana’s price action remains uncertain and volatile, SUBBD offers something different—a platform that can generate value and utility even when broader crypto markets remain unpredictable.

The Bottom Line for Solana Holders

For SOL holders, the message is clear: while the 12% bounce provides temporary relief, the underlying technical and fundamental indicators suggest caution. The deteriorating conviction from long-term holders, combined with the need to reclaim key resistance levels, means the path forward remains treacherous.

Meanwhile, the emergence of utility-focused platforms like SUBBD highlights a potential evolution in how crypto capital is being deployed—toward projects that can generate real value regardless of market cycles.

The next few days will be critical for Solana. Will it reclaim $144 and signal a true bottom, or will the hidden warning signs prove prescient, sending SOL spiraling toward $70 and beyond?

Tags: Solana price prediction, SOL crypto, Solana bounce, Solana crash risk, HODLer Net Position Change, Money Flow Index, SOL technical analysis, Solana support levels, SUBBD presale, AI content platform, creator economy crypto, Solana $70 support, SOL $144 resistance, crypto utility tokens, decentralized content monetization

Viral Phrases: “Solana’s 12% miracle rally,” “The hidden signal that could crash Solana,” “Long-term holders are fleeing,” “Is this just another dead cat bounce?” “Solana at the edge of the abyss,” “The $70 make-or-break level,” “Smart money is looking elsewhere,” “Utility over hype,” “AI-powered content revolution,” “The future of creator monetization,” “Decentralized ownership is here,” “Token-gated exclusivity,” “Crypto’s original promise realized,” “Market uncertainty fuels innovation,” “Real revenue in a volatile market,” “The platform that works when markets don’t,” “Beyond price speculation,” “A new paradigm for creators,” “Ownership, not renting,” “The $1.5 million presale success,” “Built for the real world,” “The next evolution of crypto investment”

,

Leave a Reply

Want to join the discussion?Feel free to contribute!