Bitcoin Price Prediction: Satoshi’s Wallet Just Got $174K in BTC – Is the Creator About to Return?

Bitcoin Market Shaken as Satoshi-Era Wallet Receives $176K Transfer Amid Price Uncertainty

A mysterious Bitcoin transaction has reignited speculation about Satoshi Nakamoto’s potential return, sending ripples through the cryptocurrency market and casting doubt on bullish price predictions.

The Transaction That Sparked Global Speculation

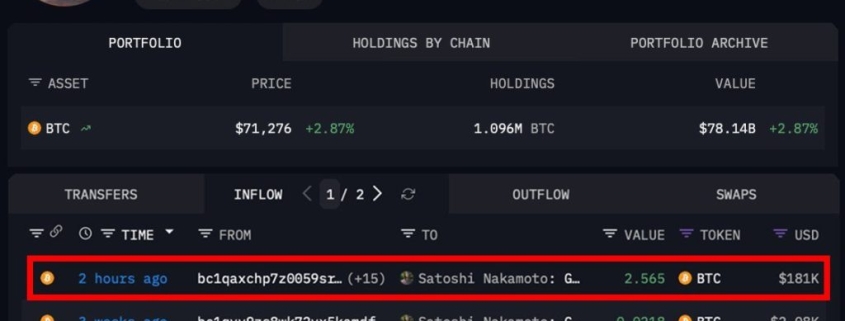

In an unexpected move that caught the attention of crypto analysts worldwide, a wallet associated with Bitcoin’s creator Satoshi Nakamoto received 2.56 BTC worth approximately $176,000. The transfer came from an unrelated wallet holding just 14.56 BTC, which had been funded through Binance’s hot wallet system.

The timing couldn’t have been more dramatic. Just as Bitcoin was attempting to maintain momentum above critical resistance levels, this transaction triggered immediate speculation about whether the anonymous creator might be preparing to re-enter the crypto scene after more than 15 years of silence.

“The crypto market absolutely lost its mind,” noted one prominent analyst, capturing the sentiment that spread across trading floors and social media platforms within minutes of the transfer being detected.

Market Reaction and Price Implications

While the broader market didn’t experience a full-blown crash, the transaction served as a stark reminder of how vulnerable Bitcoin’s price trajectory remains to psychological factors. The transfer occurred during a period when Bitcoin was already struggling to maintain support above $60,000, with technical analysis suggesting the $70,000-$71,000 zone had flipped from support to resistance.

This development effectively overshadowed many Bitcoin price prediction models that had been pointing toward continued bullish momentum. The psychological impact of any movement in Satoshi’s known addresses has historically proven capable of triggering significant market volatility, even when the actual implications remain unclear.

What Would Satoshi’s Return Actually Mean?

The crypto community found itself grappling with a fascinating hypothetical: what would happen if Satoshi Nakamoto actually returned tomorrow? Industry veterans suggest the impact would be “nuclear-level chaos.”

The mere possibility of Satoshi moving their estimated 1 million BTC stash has been enough to cause price drops in the past. An actual return would likely trigger immediate panic selling as traders rushed to interpret the move’s implications. Is Satoshi about to liquidate their holdings? Has their faith in Bitcoin been shaken? Or is this a signal of something entirely different?

Some analysts point out that the transfer could be as simple as a mistaken transaction, a random donation, or even a deliberate burn. However, when it comes to Satoshi, even the smallest action carries massive weight due to the legendary status and the sheer scale of their holdings.

Bitcoin’s Technical Picture Remains Uncertain

The recent market turbulence has highlighted Bitcoin’s vulnerability at current price levels. The rejection from the $70,000-$71,000 resistance zone has confirmed that this area has flipped to become a significant barrier to upward movement.

Traders are now closely watching the $60,000 level as the first major support zone. This represents the critical demand area that could potentially slow the current downward momentum and trigger a recovery bounce. However, if this level fails to hold, technical analysis suggests the next major support sits around $50,000, which would represent a significant correction from recent highs.

For a genuine bullish reversal, Bitcoin would need to reclaim the $80,000 level first, with a return above $97,000 necessary to shift the overall market structure back to a clearly bullish stance.

The Infrastructure Challenge Bitcoin Faces

Beyond the immediate price speculation, the Satoshi wallet transfer has reignited discussions about Bitcoin’s fundamental limitations. While Bitcoin’s value is built on belief and scarcity, its usability has struggled to keep pace with growing demand and evolving market needs.

This is where innovative projects like Bitcoin Hyper ($HYPER) are attempting to bridge the gap. The project represents a Bitcoin-focused Layer-2 solution that leverages Solana’s technology to address Bitcoin’s scalability and transaction cost challenges while maintaining the network’s core security principles.

Bitcoin Hyper: A New Approach to Bitcoin’s Limitations

Bitcoin Hyper is positioning itself as a solution to one of cryptocurrency’s most persistent challenges: making Bitcoin faster, cheaper, and more functional for everyday use. By implementing Layer-2 technology inspired by Solana’s architecture, the project aims to transform Bitcoin from a passive store of value into an active, functional blockchain capable of supporting payments, applications, and scalable on-chain activity.

The project has already demonstrated significant market interest, raising over $31 million in its presale phase. The $HYPER token is currently priced at $0.0136751, with the next price increase scheduled as part of the presale structure.

What makes Bitcoin Hyper particularly attractive to investors is its staking mechanism, which offers returns of up to 37% annually. This provides a yield-generating opportunity that Bitcoin’s base layer simply cannot offer, addressing one of the major limitations of holding Bitcoin directly.

The Broader Implications for Crypto Markets

The Satoshi wallet transfer serves as a reminder that cryptocurrency markets remain highly sensitive to both technical factors and psychological triggers. While projects like Bitcoin Hyper work to solve Bitcoin’s structural limitations, the market continues to be influenced by events that may have little to do with fundamental value.

The incident highlights the delicate balance between Bitcoin’s role as a store of value and its need for practical utility. As the market matures, solutions that can enhance Bitcoin’s functionality while preserving its core characteristics may become increasingly important for long-term adoption and price stability.

The coming weeks will be crucial in determining whether Bitcoin can establish solid support levels or whether the psychological impact of the Satoshi-related speculation will continue to influence price action. Meanwhile, innovative projects working to enhance Bitcoin’s capabilities continue to attract significant investor interest, suggesting that the market is actively seeking solutions to the cryptocurrency’s most pressing challenges.

Tags

Bitcoin #SatoshiNakamoto #CryptoNews #BTCPrice #BitcoinPrediction #Cryptocurrency #Blockchain #CryptoMarket #BitcoinHyper #Layer2 #CryptoTechnology #DigitalCurrency #Investment #Trading #MarketAnalysis

Viral Sentences

Satoshi’s wallet just received $176K in BTC – is the creator about to return?

Bitcoin price prediction models shattered by mysterious Satoshi wallet transfer

Crypto market shaken as legendary wallet stirs after 15 years of silence

Bitcoin Hyper raises $31M to solve BTC’s biggest problem

37% staking rewards on Bitcoin Layer-2 project – is this the future?

$60K Bitcoin support level under pressure as Satoshi speculation grows

The day Satoshi Nakamoto sells one Bitcoin is the day we go to 0

Bitcoin’s usability problem finally meets its match with Solana tech

Mysterious transaction triggers panic selling across crypto markets

Is Bitcoin’s legendary creator preparing to dump their 1 million BTC stash?

,

Leave a Reply

Want to join the discussion?Feel free to contribute!