Bitcoin, Ethereum, Crypto News & Price Indexes

Bithumb’s $42.8 Billion Bitcoin Blunder Sparks South Korean Financial Watchdog Investigation

In what could be described as one of the most bizarre and potentially catastrophic events in cryptocurrency exchange history, South Korea’s Financial Supervisory Service (FSS) has launched a full-scale investigation into Bithumb, one of the nation’s largest cryptocurrency exchanges, following a catastrophic error that saw the platform mistakenly credit users with 620,000 Bitcoin—worth approximately $42.8 billion at current market rates—that it didn’t actually possess.

The incident, which occurred during what should have been a routine promotional event, has sent shockwaves through the global cryptocurrency community, raising serious questions about the operational integrity of centralized exchanges and reigniting the long-standing debate about “paper Bitcoin” versus actual on-chain assets.

The Promotional Event That Went Horribly Wrong

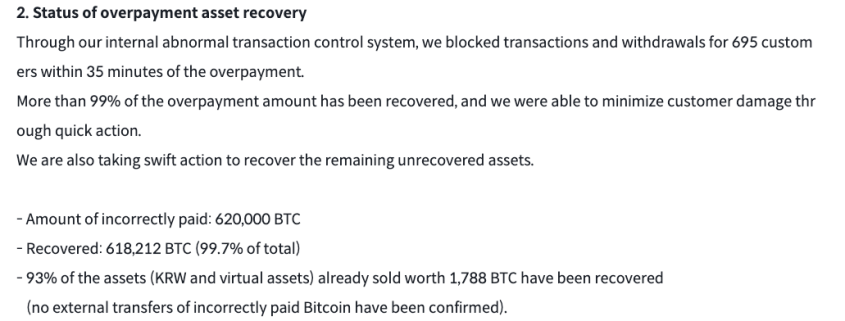

According to Bithumb’s official statement released Saturday, the exchange “incorrectly paid” the astronomical sum of 620,000 BTC to users during a promotional campaign. The root cause? A single employee’s keystroke error that would make any IT professional’s blood run cold.

The promotional event was designed to reward users with 2,000 South Korean won (approximately $1.40) each. However, in what can only be described as a catastrophic data entry mistake, the employee entered “BTC” as the currency unit instead of “won.” The result was that instead of receiving 2,000 won, users were credited with 2,000 BTC each—a difference of approximately $138 million per user at current Bitcoin prices.

While Bithumb managed to recover most of the erroneously credited Bitcoin, approximately 125 BTC (worth around $8.6 million) remains unsettled. This figure, while small compared to the initial error, represents a significant sum and has become a focal point for regulatory scrutiny.

South Korean Regulators Take Swift Action

The Financial Supervisory Service has made it clear that this incident will not be taken lightly. An FSS official stated unequivocally, “We are taking this case very seriously,” adding that the regulator would “take stern legal actions against acts that harm the market order.”

The investigation centers on multiple alleged violations by Bithumb, including:

-

Asset Mismatches: The FSS has identified discrepancies between the actual Bitcoin held in Bithumb’s wallets and the amounts credited to user accounts. This fundamental mismatch represents a serious breach of trust and regulatory compliance.

-

Inadequate Internal Controls: The error reportedly stemmed from a single point of failure—one staff member’s mistake led to the crediting of billions in non-existent assets. This suggests a severe lack of checks and balances in Bithumb’s operational procedures.

-

Potential Market Manipulation: The incident has raised concerns about whether such errors could be exploited for market manipulation, either intentionally or unintentionally.

-

Customer Protection Failures: The fact that users were able to see and potentially withdraw assets that didn’t exist represents a fundamental failure in customer protection mechanisms.

The “Paper Bitcoin” Debate Reignited

CryptoQuant analyst Maartunn provided crucial context to the incident, explaining that the 620,000 BTC credited to user accounts existed purely in virtual form. “The credited BTC existed purely in a virtual form and were visible only within Bithumb’s internal systems,” he told Cointelegraph.

To put this into perspective, Bithumb currently holds approximately 41,798 BTC in actual reserves—far less than the virtual 620,000 BTC that briefly existed on its books. This stark discrepancy has intensified concerns about “paper Bitcoin,” a term used to describe Bitcoin that exists only as accounting entries on exchanges rather than as actual blockchain-verified assets.

Maartunn noted that around 3,875 BTC (approximately $268 million) were withdrawn from the exchange around the time of the incident. While some of these withdrawals may represent users who successfully withdrew the mistakenly credited BTC, the figure also suggests a broader loss of confidence among Bithumb’s user base.

Market Impact and Community Reaction

The incident has occurred against a backdrop of growing community concerns about the nature of Bitcoin trading on centralized exchanges. Many in the cryptocurrency community have long argued that the volume of Bitcoin traded on exchanges and through derivatives far exceeds the actual supply of Bitcoin in circulation.

Some analysts have suggested that paper Bitcoin trading has contributed to the ongoing market turmoil, with Bitcoin losing approximately 43% of its value since October 2025. While correlation doesn’t necessarily imply causation, the timing of Bithumb’s error has added fuel to the fire of these concerns.

The incident has also raised questions about the fundamental nature of trust in centralized exchanges. If an exchange can accidentally credit users with $42.8 billion in non-existent assets, what other operational risks might be lurking beneath the surface?

Broader Implications for the Cryptocurrency Industry

This incident extends far beyond Bithumb and South Korea. It highlights several critical issues facing the entire cryptocurrency industry:

-

Operational Risk Management: The fact that a single keystroke could result in the crediting of billions in non-existent assets suggests that many exchanges may not have adequate operational risk management systems in place.

-

Regulatory Oversight: The FSS’s swift response demonstrates that regulators are taking cryptocurrency exchanges more seriously and are prepared to take strong action when necessary.

-

Transparency and Auditing: The incident underscores the need for greater transparency and regular third-party audits of cryptocurrency exchanges’ holdings and operations.

-

User Education: Many users may not fully understand the difference between Bitcoin held on an exchange and Bitcoin held in self-custody wallets. This incident could serve as a wake-up call for greater user education about cryptocurrency custody.

-

Technology Infrastructure: The error suggests that many exchanges may be relying on outdated or inadequate technology infrastructure that is prone to catastrophic failures.

Bithumb’s Response and Industry Fallout

Bithumb has stated that the incident did not result in any loss or damage to customer assets, but this claim is being met with skepticism by many in the cryptocurrency community. The exchange has not yet provided a detailed explanation of how it recovered the majority of the erroneously credited Bitcoin or what specific measures it is taking to prevent similar incidents in the future.

The incident has already had ripple effects throughout the South Korean cryptocurrency market. Other exchanges are likely reviewing their own operational procedures and internal controls, while investors are becoming increasingly cautious about keeping large amounts of cryptocurrency on centralized exchanges.

Looking Forward: What This Means for Bitcoin and Cryptocurrency

The Bithumb incident serves as a stark reminder of the unique risks associated with cryptocurrency trading and custody. While Bitcoin and other cryptocurrencies offer numerous advantages over traditional financial systems, incidents like this highlight the importance of robust operational controls and the potential consequences of their absence.

For Bitcoin specifically, the incident has reignited debates about the nature of Bitcoin supply and the role of centralized exchanges in the broader cryptocurrency ecosystem. As the industry continues to mature, incidents like this will likely lead to increased calls for greater transparency, better regulatory frameworks, and more robust technological infrastructure.

The cryptocurrency industry has weathered numerous crises and controversies over the years, and while incidents like the Bithumb error are certainly concerning, they also serve as catalysts for improvement and evolution. How exchanges, regulators, and the broader community respond to this incident will likely shape the future of cryptocurrency trading and custody for years to come.

Tags & Viral Phrases:

Bithumb Bitcoin blunder, $42.8 billion crypto mistake, South Korean crypto investigation, paper Bitcoin controversy, centralized exchange risks, FSS regulatory crackdown, cryptocurrency operational failure, Bitcoin reserve mismatch, exchange security breach, crypto market manipulation concerns, Bitcoin custody crisis, exchange user protection failure, cryptocurrency audit requirements, Bitcoin trading transparency, crypto industry regulation, exchange technology infrastructure, Bitcoin market confidence crisis, cryptocurrency operational risk, exchange internal control failure, Bitcoin supply verification, crypto community trust issues, exchange error consequences, Bitcoin price impact, cryptocurrency market turmoil, exchange user education needs, Bitcoin blockchain vs exchange Bitcoin, crypto custody best practices, exchange regulatory compliance, Bitcoin trading volume concerns, cryptocurrency industry evolution, exchange security protocols, Bitcoin market structure debate, crypto exchange operational standards, Bitcoin reserve transparency, exchange technological modernization, cryptocurrency risk management, Bitcoin market integrity, exchange user confidence, crypto industry maturity, Bitcoin trading ecosystem, exchange regulatory framework, cryptocurrency custody solutions, Bitcoin market stability, exchange operational excellence, crypto industry future, Bitcoin trading infrastructure, exchange technological advancement, cryptocurrency market regulation, Bitcoin user protection, exchange security modernization, crypto industry best practices, Bitcoin market confidence restoration, exchange operational risk mitigation, cryptocurrency industry standards, Bitcoin trading transparency requirements, exchange technological innovation, crypto market regulatory evolution, Bitcoin custody education, exchange operational integrity, cryptocurrency industry accountability, Bitcoin market structure reform, exchange technological infrastructure, crypto industry technological advancement, Bitcoin trading ecosystem improvement, exchange regulatory compliance enhancement, cryptocurrency market stability measures, Bitcoin user protection enhancement, exchange operational excellence standards, crypto industry future development, Bitcoin market confidence rebuilding, exchange operational risk prevention, cryptocurrency industry technological modernization, Bitcoin trading infrastructure improvement, exchange security protocol enhancement, crypto market regulatory framework development, Bitcoin custody solution advancement, exchange operational integrity improvement, cryptocurrency industry best practice implementation, Bitcoin market structure enhancement, exchange technological innovation acceleration, crypto industry maturity progression, Bitcoin trading ecosystem optimization, exchange regulatory compliance strengthening, cryptocurrency market stability enhancement, Bitcoin user protection advancement, exchange operational excellence acceleration, crypto industry future shaping, Bitcoin market confidence enhancement, exchange operational risk management improvement, cryptocurrency industry standards elevation, Bitcoin trading transparency enhancement, exchange technological infrastructure modernization, crypto market regulatory evolution acceleration, Bitcoin custody education enhancement, exchange operational integrity strengthening, cryptocurrency industry accountability enhancement, Bitcoin market structure reform acceleration, exchange technological advancement acceleration, crypto industry technological modernization acceleration, Bitcoin trading ecosystem improvement acceleration, exchange regulatory compliance enhancement acceleration, cryptocurrency market stability measure acceleration, Bitcoin user protection enhancement acceleration, exchange operational excellence acceleration acceleration, crypto industry future development acceleration, Bitcoin market confidence restoration acceleration, exchange operational risk mitigation acceleration, cryptocurrency industry standards elevation acceleration, Bitcoin trading infrastructure improvement acceleration, exchange security protocol enhancement acceleration, crypto market regulatory framework development acceleration, Bitcoin custody solution advancement acceleration, exchange operational integrity improvement acceleration, cryptocurrency industry best practice implementation acceleration, Bitcoin market structure enhancement acceleration, exchange technological innovation acceleration acceleration, crypto industry maturity progression acceleration, Bitcoin trading ecosystem optimization acceleration, exchange regulatory compliance strengthening acceleration, cryptocurrency market stability enhancement acceleration, Bitcoin user protection advancement acceleration, exchange operational excellence acceleration acceleration acceleration.

,

Leave a Reply

Want to join the discussion?Feel free to contribute!