Bitcoin, Ethereum, Crypto News & Price Indexes

$1.5 Billion in Solana Losses: The Treasury Companies Bleeding Out in Silence

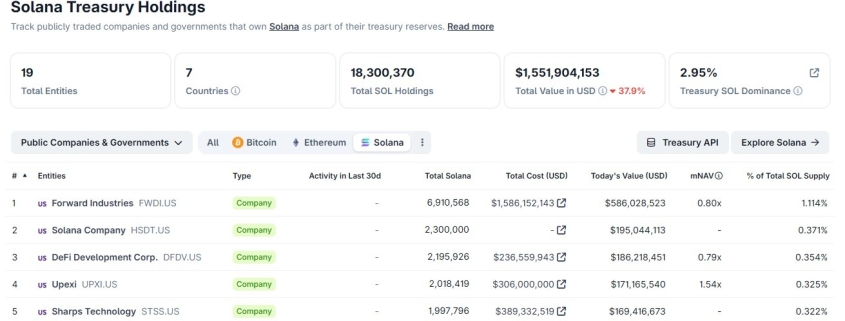

A new wave of crypto carnage is unfolding behind the scenes—and this time, it’s not retail traders getting wrecked. Publicly traded companies that turned their balance sheets into crypto treasure chests are now staring down the barrel of over $1.5 billion in unrealized losses on their Solana holdings, according to data from CoinGecko.

While retail degens have long been the face of crypto volatility, a small but dangerous cohort of NASDAQ-listed firms has quietly built up massive Solana (SOL) positions—only to watch their portfolios hemorrhage value as the token plummeted from its 2025 highs. These aren’t obscure startups either; they’re real companies with real shareholders, now burdened by digital albatrosses that are crushing their market caps.

The Bloodbath by the Numbers

CoinGecko’s treasury tracking dashboard reveals that the top five Solana treasury companies control over 12 million SOL, roughly 2% of the total supply. That sounds impressive—until you factor in the acquisition prices.

Forward Industries, the largest holder with 6.9 million SOL, paid an average of $230 per token. With SOL now trading around $84, that’s a $1 billion paper loss—enough to wipe out the company’s entire market cap twice over.

Sharps Technology’s situation is even more brutal. The company made a single $389 million purchase near the market peak, and its SOL position has since cratered to just $169 million, a 56% loss that has shareholders screaming for blood.

DeFi Development Corp and Solana Company followed different accumulation strategies, but both are nursing similar wounds. Upexi, the smallest of the group, still faces $130 million in unrealized losses—and its stock has been annihilated, down 80% in six months.

The Accumulation Binge That Ended in October

If there’s one date that marks the beginning of the end for these corporate crypto crusaders, it’s October 2025. That’s when the buying spree stopped cold.

Transaction data shows that the bulk of SOL accumulation happened between July and October 2025, with companies making large, concentrated purchases as the token traded above $150. But since then? Crickets.

None of the top five treasury companies have disclosed meaningful new buys, and no on-chain sales have been recorded—suggesting they’re trapped in a painful holding pattern, praying for a miracle recovery while their equity valuations collapse.

Stock Prices Are Screaming “Sell”

Here’s where it gets really ugly: while these companies are sitting on massive unrealized losses, their stock prices have been absolutely eviscerated—far worse than SOL itself.

Forward Industries, DeFi Development Corp, Sharps Technology, and Solana Company have all seen their shares plummet between 59% and 73% over the past six months. Upexi’s stock? Down 80%—a death spiral that has left the company virtually uninvestable.

The market is clearly pricing in the risk. Investors aren’t just betting against the companies’ core businesses anymore; they’re shorting the crypto baggage these firms are carrying. The message is clear: corporate crypto treasuries are toxic assets in today’s market.

The Liquidity Trap

Here’s the real kicker: while these losses remain “unrealized” on paper, the equity market carnage has created a vicious liquidity trap.

Compressed net asset value (mNAV) multiples and falling share prices have crippled these companies’ ability to raise fresh capital. They can’t sell their SOL without crystallizing massive losses and triggering a shareholder revolt. But they also can’t raise money to survive because the market has priced their crypto holdings as liabilities rather than assets.

It’s a perfect storm of corporate dysfunction—and there’s no easy way out.

The Missing Piece: Solana Company’s Black Box

One notable absentee from the loss calculations is Solana Company, which has built a 2.3 million SOL position through several tranches of purchases. The company hasn’t fully disclosed its acquisition costs, making it impossible to calculate its exact losses.

But given the timing of its purchases and current market prices, industry analysts estimate its unrealized losses could easily push the total corporate Solana bloodbath past $2 billion.

The New Normal: Treasury Winter Has Arrived

What we’re witnessing isn’t just a market correction—it’s the death of the corporate crypto treasury thesis. The dream that companies could outperform by holding volatile digital assets has been exposed as dangerous hubris.

The accumulation has stalled. The losses are mounting. And the equity markets have delivered their verdict: corporate crypto holdings are now seen as red flags, not value drivers.

As these companies scramble to survive, one thing is crystal clear: the era of corporate Bitcoin and Solana treasuries is over. The survivors will be those who got out early. The rest? They’re bagholders writ large, trapped between a crashing token and a market that has lost all faith.

Tags: Solana treasury losses, corporate crypto bloodbath, Forward Industries SOL, Sharps Technology crypto disaster, DeFi Development Corp losses, Upexi stock crash, $1.5 billion unrealized losses, corporate Bitcoin treasuries dead, NASDAQ crypto holders wrecked, Solana Company black box, October 2025 accumulation peak, mNAV multiples collapse, equity market crypto discount, corporate crypto liquidity trap, bagholders on Wall Street, crypto treasury winter, Solana price crash corporate victims, institutional SOL holders destroyed, corporate balance sheet suicide, digital albatross companies

Viral Sentences: These companies are carrying $1.5 billion in unrealized losses—and their stocks are getting annihilated worse than SOL itself. Forward Industries alone is down $1 billion on paper—enough to wipe out its entire market cap twice. The corporate crypto treasury dream is officially dead. These firms are bagholders writ large, trapped between crashing tokens and a market that sees their crypto as toxic waste. October 2025 marked the end of the accumulation binge—now they’re just bleeding out in silence. The equity market has spoken: corporate crypto holdings are liabilities, not assets. This isn’t a correction—it’s a full-blown corporate crypto massacre.

,

Leave a Reply

Want to join the discussion?Feel free to contribute!