BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week

Bitcoin Traders Eye $50,000 as Potential Bottom: Key Metrics to Watch This Week

The crypto market is holding its breath as Bitcoin (BTC) hovers around critical price levels, with traders laser-focused on the $50,000 mark as a potential bottom. After a brutal selloff that briefly pushed prices below $60,000, the recent bounce back above $70,000 has done little to convince the market that the worst is over.

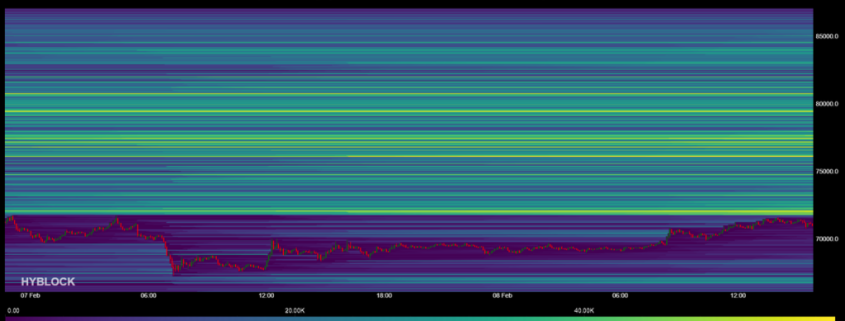

Bitcoin’s weekly close at $71,000 might look encouraging at first glance, but the suspiciously calm volatility has traders questioning whether this rally is genuine or merely a “bull trap” designed to liquidate short positions before another leg down. The market’s skepticism is palpable, with many viewing the current price action as a calculated move to shake out leveraged traders before potentially retesting lower support levels.

The $50,000 Question: Is This the Bottom?

The psychological $50,000 level has become the focal point for traders and analysts alike. While Bitcoin has shown resilience by reclaiming the $70,000 territory, the market structure suggests this could be temporary. The lack of strong conviction behind the recent rally has created an atmosphere of caution, with many expecting another test of support before any sustainable recovery can take hold.

Technical analysts are particularly concerned about the formation of bearish patterns that could accelerate selling pressure if key support levels fail to hold. The $67,350 level has emerged as the critical battleground, with a breakdown potentially opening the door to the $43,000-$50,000 region that many traders are dreading but preparing for.

Miner Economics Signal Potential Capitulation

One of the most concerning indicators comes from the mining sector, where economics are becoming increasingly strained. According to JPMorgan data, Bitcoin has traded below the estimated miner production cost of $87,000, a historical signal that often precedes capitulation events. When miners can’t cover their operational costs, they’re forced to sell their Bitcoin holdings to stay afloat, creating a vicious cycle of selling pressure.

The average mining cost, estimated at around $67,000 per Bitcoin, serves as a crucial support level in the market. Historically, prices tend to find support around this level as miners collectively decide whether to continue operations or shut down their equipment. If Bitcoin remains below this cost basis for an extended period, it could trigger widespread miner capitulation, leading to even more aggressive selling as unprofitable operations liquidate their holdings.

Crypto analyst CryptoGoos recently highlighted this dynamic, noting that Bitcoin appears “cheap here” from a mining cost perspective. However, cheap doesn’t always mean the bottom is in – it often means the market is testing how far it can push prices before miner selling pressure becomes overwhelming.

Stablecoin Inflows: Dry Powder Waiting for the Dip

While the technical and fundamental picture looks grim, there’s a massive amount of capital sitting on the sidelines ready to enter the market. Stablecoin inflows have doubled to an impressive $98 billion, representing significant buying power that could fuel the next leg up once market participants feel comfortable enough to deploy their capital.

This accumulation of stablecoin reserves suggests that large players are waiting for a better entry point rather than chasing the current price action. The market appears to be in a holding pattern, with buyers waiting for confirmation that the bottom is in before committing fresh capital to the market.

Technical Levels to Watch This Week

The immediate focus for traders is the $67,350 support level. This price point represents the last major defense before the market could see a significant breakdown. A daily close below this level would likely trigger a cascade of selling, potentially pushing Bitcoin toward the $50,000-$55,000 range.

On the upside, reclaiming and holding above $74,434 would invalidate the current bearish setup and could spark a relief rally toward $80,000. However, the market structure suggests that buyers will face significant resistance at these higher levels, particularly if the weekly close fails to show strong momentum.

The upcoming inflation data release adds another layer of complexity to the technical picture. Higher-than-expected inflation could strengthen the case for additional interest rate hikes, potentially creating more headwinds for risk assets like Bitcoin. Conversely, softer inflation data might provide the catalyst needed for a sustained recovery.

The Broader Market Context

Bitcoin’s price action can’t be viewed in isolation from broader market conditions. The cryptocurrency market remains highly correlated with traditional risk assets, and any significant moves in equity markets could amplify Bitcoin’s volatility in either direction.

The current environment is characterized by uncertainty and conflicting signals. While on-chain metrics and miner economics suggest further downside potential, the massive stablecoin reserves and historical precedent for strong bounces from key support levels create a compelling case for a reversal.

What Traders Should Watch For

This week’s key metrics to monitor include:

- The weekly close relative to the $67,350 support level

- Miner capitulation signals and hash rate adjustments

- Stablecoin inflow trends and exchange reserve changes

- Institutional buying patterns and ETF flows

- Broader market correlation with equities and macro data

The post BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week appeared first on Cryptonews

tags

Bitcoin bottom, $50K Bitcoin, Bitcoin crash, crypto market analysis, Bitcoin support levels, miner capitulation, stablecoin inflows, Bitcoin technical analysis, BTC price prediction, crypto trading strategies

viral sentences

Bitcoin traders are glued to $50K like it’s the only number that matters right now.

That $70K bounce? Looks more like a bull trap than a real recovery.

When miners start going broke, that’s when the real selling begins.

$98 billion in stablecoins is just waiting for the perfect dip to strike.

Break $67,350 and we might see Bitcoin test prices we haven’t seen in years.

The calm after the storm usually means the storm isn’t over yet.

Bitcoin mining at a loss is like running a marathon while paying for shoes that keep falling apart.

Stablecoins are the dry powder that could ignite the next crypto bull run.

Technical patterns suggest a 30% dive could be on the table if support fails.

The market is playing a game of chicken with $50K as the finish line.

,

Leave a Reply

Want to join the discussion?Feel free to contribute!