Bitcoin Price Prediction: Jim Cramer Says the US Could Buy at $60K – Is a Government Bitcoin Buy Coming?

Jim Cramer’s Bold Bitcoin Call: Could the U.S. Government Buy at $60,000?

In a surprising twist that’s sent shockwaves through the crypto community, legendary CNBC host Jim Cramer has hinted that the U.S. government might establish a Strategic Bitcoin Reserve if BTC’s price climbs back to $60,000. While Cramer himself isn’t exactly shouting “buy Bitcoin” from the rooftops, his comments during CNBC’s Squawk Box have ignited intense speculation about America’s potential embrace of cryptocurrency at the national level.

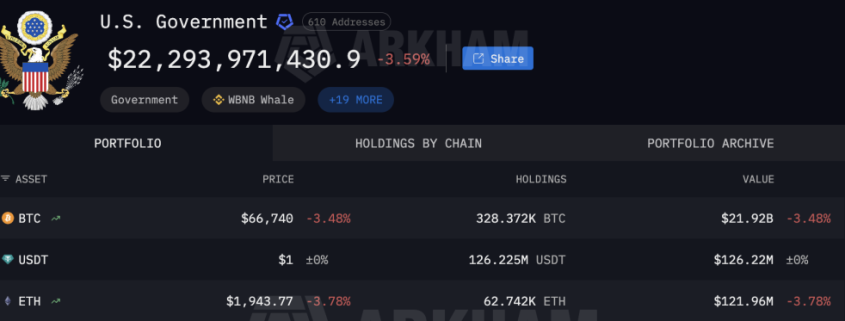

The $21 Billion Question: America Already Holds Bitcoin

Here’s what makes this story even more fascinating—the U.S. government already owns approximately 328,372 Bitcoin, worth over $21 billion at current prices. This massive stash came from various seizures over the years, including the infamous Silk Road bitcoins. According to on-chain data from Arkham Intelligence, these holdings haven’t moved significantly in recent months, suggesting the government is playing a long game.

But why would the U.S. consider adding to its Bitcoin holdings now? The answer lies in the growing global competition for digital asset supremacy. Countries like El Salvador have already made Bitcoin legal tender, while others are exploring central bank digital currencies. For America to maintain its financial leadership, some argue a strategic Bitcoin reserve could be the ultimate hedge against economic uncertainty and currency devaluation.

The Odds Are Better Than You Think

According to Polymarket, there’s roughly a 30% chance the U.S. government establishes a Strategic Bitcoin Reserve before 2027. That might not sound like much, but consider this: just six months ago, that probability was closer to 5%. The rapid shift reflects growing political momentum and increasing institutional acceptance of Bitcoin as a legitimate asset class.

The timing couldn’t be more interesting. With Bitcoin hovering around $66,000—down significantly from its all-time highs near $109,000—many analysts see this as a potential accumulation zone. If the government were to announce a reserve policy at these levels, it could trigger the exact price surge Cramer mentioned.

Technical Analysis: Is $60,000 the Magic Number?

From a technical perspective, Bitcoin’s current position is nothing short of fascinating. The cryptocurrency is trading around $66,000, sitting squarely in oversold territory according to the Relative Strength Index (RSI). This technical indicator suggests that selling pressure may be exhausted, creating a potential springboard for upward movement.

The chart reveals critical support levels that traders are watching like hawks. The $64,000 mark represents the first major floor—if Bitcoin breaks below this level, all eyes would immediately shift to the psychologically important $60,000 threshold. Conversely, resistance looms at $71,000, and a decisive break above this level could signal the beginning of a new bull run toward $80,000 and potentially $90,000.

What’s particularly intriguing is how this technical setup aligns with Cramer’s prediction. The $60,000 level represents both a strong support zone and a potential catalyst point for government action. It’s as if the technicals and fundamentals are converging on the same price point.

The Bigger Picture: Why a Bitcoin Reserve Makes Sense

The concept of a U.S. Strategic Bitcoin Reserve isn’t as far-fetched as it might sound. Consider the parallels with traditional strategic reserves:

- Gold Standard Evolution: Just as nations once held gold reserves to back their currencies, Bitcoin could serve as a digital gold standard for the 21st century.

- Economic Insurance: In an era of unprecedented monetary stimulus and inflation concerns, Bitcoin offers a non-correlated asset that could protect against currency debasement.

- Technological Leadership: Establishing a Bitcoin reserve would cement America’s position as a leader in financial innovation and blockchain technology.

Moreover, the geopolitical implications are enormous. If the U.S. moves first, it could force other nations to follow suit, creating a new global monetary order centered around Bitcoin rather than traditional fiat currencies.

Bitcoin vs. Bitcoin Hyper: The New Frontier

While Bitcoin’s price action captures headlines, a new player is emerging that could revolutionize how we think about Bitcoin’s utility. Enter Bitcoin Hyper ($HYPER), a Bitcoin-focused Layer-2 solution built using Solana technology that promises to make Bitcoin faster, cheaper, and actually usable for everyday transactions.

Bitcoin Hyper addresses one of Bitcoin’s biggest criticisms: its limited functionality. While Bitcoin remains the king of store-of-value cryptocurrencies, it struggles with speed and transaction costs that make it impractical for daily use. Bitcoin Hyper solves this by creating a parallel ecosystem where BTC can flow freely, powering decentralized applications, payments, and real on-chain activity without compromising Bitcoin’s core security.

The project has already raised over $31 million in its presale, with $HYPER tokens priced at $0.0136751 before the next increase. Early adopters can also stake their tokens for rewards up to 37%, making it an attractive proposition for those looking to maximize their Bitcoin exposure.

Why This Matters Now

The convergence of several factors makes this moment critical for Bitcoin:

- Institutional Adoption: Major corporations and financial institutions are increasingly adding Bitcoin to their balance sheets.

- Regulatory Clarity: The SEC’s approval of Bitcoin ETFs has legitimized the asset class for traditional investors.

- Technological Innovation: Solutions like Bitcoin Hyper are expanding Bitcoin’s use cases beyond simple HODLing.

- Political Momentum: Growing bipartisan support for cryptocurrency legislation in Congress.

When you combine these elements with Cramer’s prediction about government action at $60,000, you have a perfect storm of catalysts that could propel Bitcoin to new heights.

The Bottom Line

Whether Jim Cramer’s prediction comes true remains to be seen, but the fact that such speculation is even plausible speaks volumes about Bitcoin’s maturation as an asset class. The technical setup suggests we’re at a critical inflection point, with major support levels aligning with potential government action.

For investors, this creates both opportunity and risk. The possibility of a U.S. Bitcoin reserve could provide the ultimate price floor, while technical indicators suggest we may be near a bottom. Meanwhile, innovations like Bitcoin Hyper offer new ways to gain exposure to Bitcoin’s ecosystem beyond simply buying and holding.

As we watch Bitcoin hover around $66,000, the question isn’t just whether it will reach $60,000 again—it’s whether that price point will trigger the most significant Bitcoin catalyst yet: official government adoption at the highest levels.

Tags: Bitcoin price prediction, Jim Cramer Bitcoin, US Bitcoin reserve, Strategic Bitcoin Reserve, Bitcoin $60,000, cryptocurrency news, Bitcoin technical analysis, BTC support levels, Bitcoin Hyper, $HYPER token, Bitcoin Layer 2, crypto presale, institutional Bitcoin adoption, Bitcoin government adoption, Bitcoin $90,000 prediction, BTC oversold, Bitcoin RSI analysis, Polymarket Bitcoin odds, Arkham Bitcoin holdings, Bitcoin ETF approval, crypto regulation, Bitcoin innovation, digital asset reserve, Bitcoin store of value, Bitcoin payment solution

Viral Sentences:

- “Jim Cramer just predicted the U.S. government will buy Bitcoin at $60,000—here’s why that changes everything!”

- “America already owns $21 billion in Bitcoin, and now they might buy more at these levels!”

- “Bitcoin’s RSI is screaming ‘buy’ while Jim Cramer hints at a government Bitcoin reserve!”

- “Bitcoin Hyper raised $31 million—the future of Bitcoin is faster, cheaper, and more usable!”

- “30% chance of a U.S. Bitcoin reserve by 2027? That number just jumped from 5% in six months!”

- “Bitcoin at $66,000 with $60,000 support? The perfect storm for government action is brewing!”

- “Why Bitcoin Hyper could be bigger than Bitcoin itself—the Layer-2 solution everyone’s missing!”

- “Jim Cramer’s Bitcoin prediction might be the catalyst that sends BTC to $90,000!”

- “The U.S. government’s 328,372 Bitcoin stash just became the most important Bitcoin wallet in the world!”

- “Bitcoin’s technical setup and Jim Cramer’s prediction are perfectly aligned at $60,000—coincidence?”

,

Leave a Reply

Want to join the discussion?Feel free to contribute!