Intel’s tough decision boosted AMD to record highs

AMD Crushes Intel in Q4 2025 as Chip Giant’s Supply Woes Hand Over Market Share

The tectonic plates of the PC processor industry shifted dramatically in the final quarter of 2025, with AMD capitalizing on Intel’s self-inflicted wounds to capture record market share across both desktop and mobile segments. Industry analysts are calling it a watershed moment that could permanently reshape the competitive landscape.

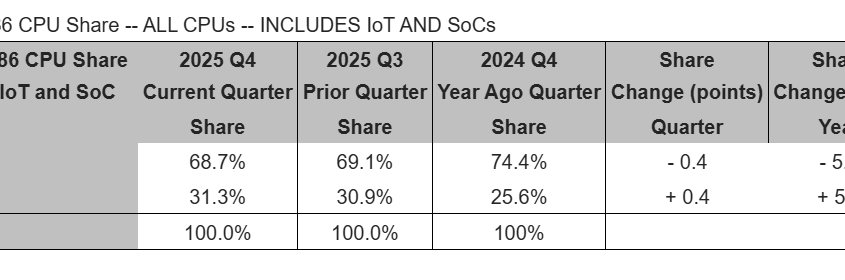

Intel’s decision to prioritize server-grade processors over consumer chips—a calculated move born from manufacturing constraints and poor process yields—backfired spectacularly in Q4. The company’s market share in the PC CPU space has now collapsed to roughly 70-30 from the traditional 80-20 dominance it maintained for years.

“Intel’s capacity reallocation hit the company’s mobile client CPU shipments the hardest,” noted Mercury Research president Dean McCarron. “This resulted in a large increase in AMD’s share of the mobile CPU market, which set a new record high in the quarter.”

While PC sales typically surge during the holiday season, Intel’s strategic pivot to favor higher-margin server parts created a perfect storm for AMD. The red team didn’t just benefit—they dominated, posting growth across all product segments including mid-range processors where they’ve historically lagged.

The numbers tell the story: AMD’s desktop CPU shipments hit an all-time high, breaking previous records as Intel’s constrained supply left retailers scrambling. In the mobile space, AMD’s gains were even more pronounced, with McCarron describing their performance as “far stronger than median seasonal growth.”

Meanwhile, the Arm architecture—primarily through Apple’s M-series chips—saw its PC market share dip slightly to 13.3 percent, down from 13.7 percent year-over-year. The uncertainty stems partly from Apple’s own sequential declines, though the broader Arm ecosystem continues to expand slowly in the Windows laptop segment.

The server market tells a different story, with both Intel and AMD posting substantial growth. Intel’s server CPU shipments grew at double the seasonal average, while AMD tripled its typical growth rate. This suggests Intel’s supply reallocation strategy may be paying dividends in the data center, even as it bleeds consumer market share.

Jon Peddie Research, a competing analysis firm, reported slightly different figures but confirmed the overall trend: the global client CPU market grew 2.7 percent sequentially, while server CPU shipments increased 14.1 percent year-over-year.

“We expect Q1’26 to be down due to memory constraints and higher process,” Peddie cautioned, hinting at potential headwinds ahead for the entire industry.

The timing couldn’t be more critical for Intel, which faces renewed pressure from investors and competitors alike. With AMD’s Lisa Su suggesting next-generation consoles could arrive as early as 2027, the chip wars are far from over.

Tags & Viral Phrases:

Intel market share collapse, AMD record growth, CPU shortage crisis, server vs consumer chip strategy, Mercury Research Q4 2025, desktop CPU dominance, mobile processor revolution, x86 processor shipments drop, Intel supply constraints backfire, AMD mid-range surge, Arm PC market share decline, data center chip wars, Lisa Su console prediction, chip manufacturing yields, PC holiday season sales miss, x86 vs Arm competition, semiconductor industry shakeup, processor market share battle, Intel’s strategic blunder, AMD’s moment of triumph

,

Leave a Reply

Want to join the discussion?Feel free to contribute!