Guys, I don’t think Tim Cook knows how to monetize AI

Apple’s AI Monetization Mystery: Cook’s “Great Value” Promise Leaves Investors Scratching Their Heads

In a stunning financial performance that sent shockwaves through Silicon Valley, Apple shattered Wall Street expectations by reporting a jaw-dropping $143.8 billion in revenue for the quarter—a remarkable 16% year-over-year surge that left analysts scrambling to adjust their projections. The tech giant’s earnings call on Thursday became the stage for what should have been a straightforward discussion about Apple’s artificial intelligence strategy, but instead evolved into an unexpected moment of financial theater that exposed a fundamental question haunting the entire tech industry.

As the call progressed with its usual parade of softball questions lobbed at CEO Tim Cook, one analyst from Morgan Stanley decided to channel the unspoken anxiety simmering beneath Silicon Valley’s AI gold rush. Erik Woodring, apparently summoning what must have been considerable professional courage, ventured into territory that most financial analysts treat as taboo: the actual business case for AI.

“When I think about your AI initiatives, you know, it’s clear there are added costs associated with that… Many of your competitors have already integrated AI into their devices, and it’s just not clear yet what incremental monetization they’re seeing because of AI…,” Woodring began, his voice likely betraying the slightest tremor of professional risk-taking.

The question hung in the air like a challenge to the entire industry’s prevailing wisdom: How exactly do you monetize artificial intelligence? This seemingly simple inquiry cuts to the heart of a massive economic gamble that Big Tech has been making for years, pouring billions into AI development while offering remarkably vague explanations about how these investments will eventually pay off.

The irony is that this question doesn’t get asked nearly enough, despite the staggering sums being invested. OpenAI, the company that essentially mainstreamed generative AI with ChatGPT, has become the poster child for this phenomenon. The company, despite its cultural ubiquity and technological prominence, isn’t planning to turn a profit until 2030—a timeline that even seasoned analysts from institutions like HSBC find dubious, especially given projections suggesting OpenAI will need another $207 billion in funding to reach that distant horizon.

Ask anyone in the tech industry about OpenAI’s path to profitability, and you’ll receive responses that amount to little more than sophisticated shoulder shrugs. The entire sector seems to be operating on what can only be described as “vibes-based” economics, where the mere presence of AI technology is assumed to eventually translate into financial success, even if no one can articulate exactly how.

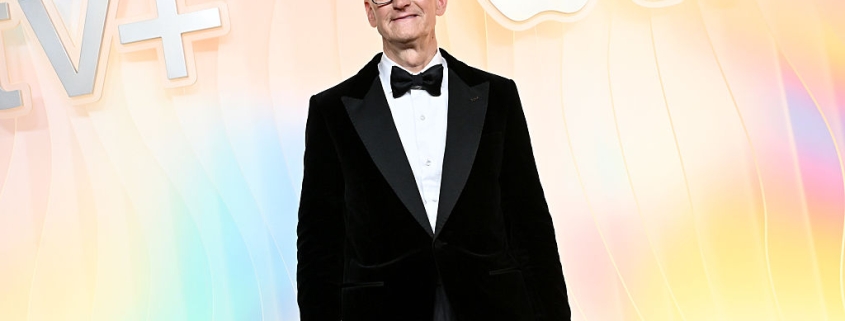

Enter Tim Cook, riding high on Apple’s record-breaking financial performance and perhaps feeling generous enough to finally reveal the secret sauce. What followed was a masterclass in corporate non-answering that would make even the most seasoned politician proud.

“Well, let me just say that we’re bringing intelligence to more of what people love, and we’re integrating it across the operating system in a personal and private way, and I think that by doing so, it creates great value, and that opens up a range of opportunities across our products and services,” Cook responded, deploying what might be described as the corporate equivalent of a smoke bomb.

There you have it, straight from the horse’s mouth: Apple will monetize AI by creating “great value.” And critically, this “great value” will “open up a range of opportunities.” These opportunities will manifest in “products and services.” It’s a response so perfectly circular and devoid of actual information that it deserves its own place in the corporate communications hall of fame.

The exchange perfectly encapsulates the current state of AI monetization in the tech industry. Companies are investing billions, developing increasingly sophisticated AI capabilities, and integrating them into products at a breakneck pace, all while maintaining an almost religious faith that profitability will somehow emerge from this technological proliferation. The business model appears to be: build amazing AI, integrate it everywhere, and trust that money will follow.

This approach stands in stark contrast to how other technological revolutions have typically been monetized. The internet boom had clear revenue models emerging relatively quickly. Mobile computing’s path to profitability was evident from early on. But AI, despite its transformative potential and massive investment, remains stubbornly resistant to traditional monetization frameworks.

The implications extend far beyond Apple. If the most valuable company in the world can’t articulate a clear AI monetization strategy, what does that say about the rest of the industry? Companies like Google, Microsoft, Meta, and Amazon are all making similarly massive AI investments with equally vague promises about future returns.

Some analysts suggest that the monetization strategy might involve a combination of premium pricing for AI-enhanced features, subscription models for advanced capabilities, and the gradual replacement of existing services with AI-powered alternatives. Others speculate about entirely new business models that haven’t yet been invented. The truth is, nobody really knows for certain.

What we do know is that the clock is ticking. Investors, despite their current enthusiasm for AI, will eventually demand returns on these massive investments. The current “build it and they will come” approach to AI development has a finite shelf life.

Tim Cook’s non-answer during Apple’s earnings call might go down in history as the moment when the AI monetization question finally penetrated the corporate veil of vagueness. Whether it will prompt more direct questioning remains to be seen, but one thing is clear: the tech industry’s AI gold rush is built on a foundation of assumptions about profitability that remain, at best, unproven.

As Apple continues its march toward AI integration across its ecosystem, users and investors alike will be watching closely to see if “great value” translates into actual revenue. Until then, the question that Erik Woodring dared to ask will continue to echo through boardrooms and earnings calls across Silicon Valley: How exactly do you monetize AI?

The answer, it seems, remains as elusive as ever. But with $143.8 billion in quarterly revenue giving Apple the luxury of patience, perhaps they can afford to wait and see how this grand AI experiment plays out. The rest of the industry might not have that luxury.

Tags: Apple earnings, AI monetization, Tim Cook, Morgan Stanley, Erik Woodring, OpenAI funding, Big Tech AI, artificial intelligence business model, Silicon Valley economics, tech industry profits, ChatGPT business, Apple AI strategy, AI investment returns, technology monetization, corporate earnings call, venture capital AI, future of AI, tech bubble concerns, artificial intelligence profitability, Apple quarterly results

Viral Phrases: “How do you monetize AI?”, “vibes-based economics”, “corporate non-answering hall of fame”, “build it and they will come AI”, “great value opens up opportunities”, “$143.8 billion in quarterly revenue”, “smoke bomb corporate response”, “AI gold rush foundation of assumptions”, “the question that lurks in darkest recesses”, “Herculean display of courage”, “tech industry’s AI monetization mystery”, “trusting money will follow”, “billion-dollar question nobody’s asking”, “corporate communications masterclass”, “the clock is ticking on AI investments”

,

Leave a Reply

Want to join the discussion?Feel free to contribute!