Apple blows away Wall Street expectations with record $143.8 billion quarter

Apple Shatters Records with $143.8 Billion Q1 2026 Revenue Surge

Cupertino, California – January 29, 2026 – Apple Inc. has once again proven why it sits atop the tech world’s throne, delivering a financial performance that has left Wall Street analysts speechless and competitors scrambling. The tech giant’s first fiscal quarter of 2026 has concluded with staggering numbers that not only exceed expectations but redefine what’s possible in the consumer technology sector.

Apple’s revenue for the quarter reached an unprecedented $143.8 billion, marking a monumental 15.7% year-over-year increase from the $124.3 billion reported in the same period last year. This astronomical figure represents more than just growth—it’s a testament to Apple’s unparalleled ability to capture consumer imagination and loyalty across every conceivable market segment.

The company’s Earnings Per Share (EPS) came in at $2.84, significantly outperforming analyst predictions and demonstrating the robust health of Apple’s business model. This performance comes during what is traditionally Apple’s strongest quarter, fueled by the holiday shopping season and the annual fall product launches that have become cultural events in their own right.

iPhone: Still the Crown Jewel

The iPhone continues to be Apple’s primary revenue driver, contributing approximately $69.7 billion to the quarter’s total. The latest iPhone 16 series, launched in September 2025, has been met with overwhelming demand, particularly the Pro models featuring Apple’s revolutionary A18 Pro chip and advanced camera systems. The introduction of satellite emergency services in more regions has also contributed to stronger upgrade cycles, with consumers recognizing the life-saving potential of the technology.

Services: The Silent Powerhouse

Apple’s Services segment has evolved from a supplementary revenue stream to a cornerstone of the company’s financial success. Generating $26.3 billion in revenue, the division encompasses everything from Apple Music and Apple TV+ to iCloud storage and the App Store. The recent bundling strategy, which offers significant savings for customers who subscribe to multiple services, has proven particularly effective in driving adoption and reducing churn.

The company’s push into financial services with Apple Card and Apple Pay continues to gain traction, with transaction volumes growing by 28% year-over-year. Apple’s recent expansion into buy-now-pay-later services in additional markets has further diversified this already robust segment.

Mac and iPad: Renaissance in Computing

After years of skepticism about the future of traditional computing devices, Apple’s Mac and iPad divisions have staged remarkable comebacks. Mac revenue reached $9.2 billion, driven by strong sales of the M4-powered MacBook Pro and Mac Studio models. The transition to Apple Silicon, now complete across the entire Mac lineup, has delivered performance gains that have convinced both consumers and enterprise customers to upgrade.

The iPad segment generated $7.1 billion, benefiting from the introduction of the iPad Air with M3 chip and the continued popularity of the entry-level iPad for education and creative professionals. The tablet market, once thought to be stagnating, has found new life through Apple’s relentless innovation and software optimization.

Wearables, Home, and Accessories: The Ecosystem Expander

Apple’s Wearables, Home, and Accessories category contributed $14.5 billion, with the Apple Watch Series 10 and new AirPods Pro 3 driving much of the growth. The integration of health monitoring features, including the ability to detect early signs of various medical conditions, has positioned these devices as essential health tools rather than mere accessories.

The Vision Pro headset, now in its second year, has found its footing in both consumer and enterprise markets. While not yet a mass-market product, its $1.8 billion contribution demonstrates Apple’s ability to create entirely new product categories that command premium prices.

Geographic Performance: A Global Triumph

Apple’s success isn’t confined to its home market. The company reported double-digit growth in nearly every geographic segment, with particularly strong performance in emerging markets. Greater China, once considered a potential weakness, contributed $20.3 billion, representing a 12% increase year-over-year. Apple’s strategy of offering more financing options and expanding its retail presence in the region appears to be paying dividends.

Europe and Japan both posted record quarters, while the rest of the Asia Pacific region showed particularly robust growth of 22%, driven by increased brand awareness and the expansion of Apple’s official retail channels in markets like India and Southeast Asia.

The AI Advantage

While Apple doesn’t break out specific AI-related revenue, executives noted during the earnings call that artificial intelligence and machine learning capabilities are increasingly becoming key differentiators across their product lineup. From the neural engine in Apple Silicon chips to on-device processing for Siri and photography, AI is enhancing user experiences in ways that are driving upgrades and attracting new customers.

The company’s commitment to privacy-focused AI processing has resonated with consumers increasingly concerned about data security, giving Apple a competitive edge in markets where privacy regulations are tightening.

Looking Ahead: Cautious Optimism

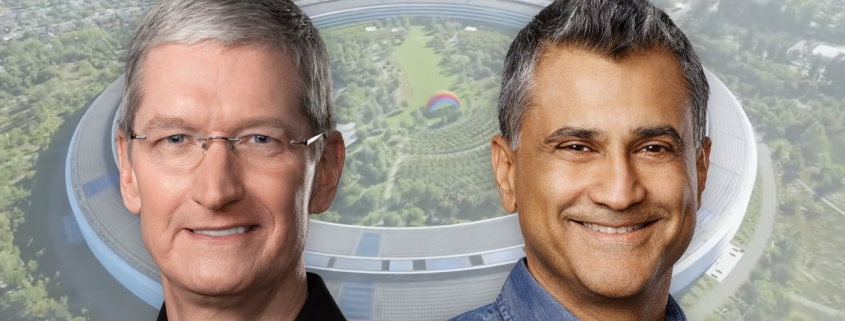

Despite the record-breaking performance, Apple’s management struck a tone of measured optimism for the coming quarters. CFO Kevan Parekh noted that while the company expects continued growth, macroeconomic uncertainties and potential trade tensions could impact future performance. The company has announced a $110 billion share repurchase program and a 4% increase in its quarterly dividend, signaling confidence in its long-term prospects while returning value to shareholders.

Apple’s R&D spending continues to climb, reaching $8.5 billion for the quarter as the company invests heavily in areas ranging from autonomous systems to advanced health monitoring technologies. This commitment to innovation suggests that the record-breaking performance of Q1 2026 may be just the beginning of a new era of growth for the world’s most valuable company.

As Apple prepares for its upcoming product launches, including the anticipated iPhone 17 series and potential new entries in the health and wellness space, the tech industry watches with bated breath. If Q1 2026 is any indication, Apple isn’t just maintaining its position at the top—it’s reaching new heights that few thought possible.

Tags: Apple earnings, record revenue, iPhone sales, Services growth, Mac renaissance, iPad revival, Wearables success, Vision Pro, Greater China growth, AI integration, Apple Silicon, ecosystem expansion, shareholder returns, R&D investment, fiscal Q1 2026, Wall Street beating, consumer technology, innovation leadership, market dominance, financial triumph, tech industry records, Cupertino success, product ecosystem, privacy-focused AI, emerging markets, global expansion, dividend increase, share repurchase, economic resilience, technological advancement, user experience innovation, health technology, financial services, enterprise adoption, cultural impact, consumer loyalty, premium pricing power, sustainable growth, competitive advantage, future outlook, product innovation, market segmentation, strategic positioning, technological differentiation, brand strength, customer satisfaction, upgrade cycles, retail expansion, digital services, hardware-software integration, technological ecosystem, market leadership, financial performance, earnings beat, analyst expectations, quarterly results, fiscal performance, revenue growth, profit margins, business strategy, corporate success, technology trends, industry leadership, market analysis, financial analysis, investment potential, stock performance, market valuation, corporate strategy, business model innovation, revenue diversification, product lifecycle management, customer acquisition, retention strategies, market penetration, competitive dynamics, industry transformation, digital economy, technological convergence, consumer behavior, purchasing patterns, demographic trends, geographic expansion, regional performance, market share, competitive positioning, strategic initiatives, operational excellence, financial health, profitability, cash generation, capital allocation, shareholder value, corporate governance, executive leadership, management effectiveness, organizational performance, business execution, strategic vision, long-term planning, sustainable competitive advantage, innovation culture, research and development, product development, go-to-market strategy, channel strategy, distribution network, retail operations, online presence, digital transformation, customer experience, brand loyalty, marketing effectiveness, pricing strategy,

,

Leave a Reply

Want to join the discussion?Feel free to contribute!