Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Hong Kong’s Stablecoin Revolution: The World’s Most Stringent Licensing Regime Set to Launch in March 2026

Hong Kong’s financial regulators are on the verge of making history as they prepare to approve the world’s first comprehensive stablecoin licensing regime, marking a watershed moment in the evolution of digital finance. The Hong Kong Monetary Authority (HKMA) has confirmed that the first wave of approvals will come in March 2026, following an exhaustive review process that has set new global standards for cryptocurrency regulation.

This groundbreaking development comes after Hong Kong implemented one of the most comprehensive stablecoin frameworks globally last August, positioning the city as a potential global hub for regulated digital asset innovation. The timing couldn’t be more significant, as nations worldwide grapple with how to approach the rapidly evolving cryptocurrency landscape.

At a recent Legislative Council meeting, HKMA Chief Executive Eddie Yue delivered the news that has the crypto world buzzing. “The review process is nearing completion,” Yue stated, adding a crucial caveat that will shape the market’s expectations: “Only a very small number of applicants will be approved initially.”

This selective approach reflects Hong Kong’s commitment to quality over quantity, ensuring that only the most robust and compliant stablecoin projects receive the green light to operate in what could become the world’s most tightly regulated digital currency market.

The HKMA’s assessment criteria are nothing short of comprehensive. Regulators are scrutinizing every aspect of potential stablecoin issuers, from their intended use cases and reserve backing mechanisms to their risk management frameworks and anti-money laundering controls. This multi-layered approach aims to create a bulletproof system that protects consumers while fostering innovation.

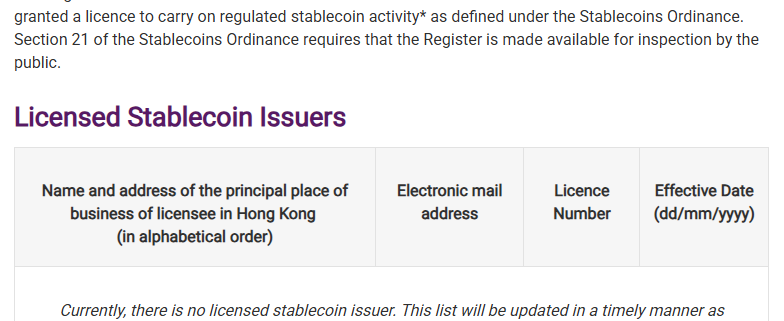

As of early February 2026, the stablecoin licensing landscape remains remarkably empty. Despite receiving 36 applications in the first round—down from an initial surge of over 40 prospective applicants—the HKMA’s public registry, launched in July 2025, shows zero licensed stablecoin issuers. This empty registry speaks volumes about the rigorous standards being applied.

The licensing regime, which took effect in August, covers all issuers of fiat-referenced stablecoins within Hong Kong and extends to foreign issuers creating tokens pegged to the Hong Kong dollar. The rules are exacting: licensed issuers must maintain full 1:1 reserve backing with high-quality, liquid assets held in trust arrangements with approved custodians.

Redemption requirements are equally strict. Issuers must honor redemption requests at par value within one business day—a standard that would make many current stablecoin operators reconsider their business models. Additionally, the prohibition on paying interest to stablecoin holders represents a significant departure from some existing market practices.

Governance and compliance receive extraordinary attention in Hong Kong’s framework. Issuers must be locally incorporated or authorized organizations with strong internal controls. Board composition is particularly scrutinized, requiring independent directors with specific compliance functions. The regime mandates comprehensive customer due diligence, wallet usage protocols, and strict adherence to anti-money laundering and counter-terrorist financing requirements.

The HKMA’s supervisory authority is sweeping. Regulators can add further conditions to licenses, appoint managers to oversee operations, or cancel licenses entirely in cases of non-compliance. This level of oversight creates a regulatory environment that prioritizes stability and consumer protection above all else.

The competitive landscape for these coveted licenses is fierce, with several high-profile companies already making their moves through the HKMA’s regulatory sandbox. The most prominent consortium includes Standard Chartered’s Hong Kong arm, gaming giant Animoca Brands, and telecommunications provider HKT, operating under the name Anchorpoint Financial. This partnership represents a fascinating convergence of traditional finance, blockchain gaming, and telecommunications infrastructure.

Ant Group’s digital technology unit has also confirmed its pursuit of a license, while Bank of China Hong Kong has been reported as an applicant. HSBC and ICBC have signaled their intentions to apply, though the HKMA has maintained strict confidentiality around applicant identities. The regulator has explicitly warned that early approvals should not be interpreted as endorsements of specific business models, maintaining a neutral stance while the market speculates wildly.

This stablecoin rollout is part of Hong Kong’s broader strategy to develop a complete digital asset ecosystem. The city already operates a sophisticated licensing regime for virtual asset trading platforms under the Securities and Futures Commission, with 11 exchanges approved to date, including major players like OSL, HashKey, and Bullish.

Government officials have consistently framed stablecoins as essential infrastructure rather than speculative instruments. At the World Economic Forum in Davos in January 2026, Financial Secretary Paul Chan emphasized that Hong Kong’s approach to crypto regulation is designed to be “responsible and sustainable.” Chan described digital finance as a strategic growth pillar for the city, positioning Hong Kong to compete with other global financial centers in the digital age.

However, the path forward isn’t without challenges. Industry groups have raised concerns that the rising compliance costs associated with Hong Kong’s stringent requirements could deter institutional participation if the rules become overly restrictive. The delicate balance between robust regulation and market viability remains a central tension in the stablecoin debate.

As March 2026 approaches, all eyes are on Hong Kong. The city’s experiment with comprehensive stablecoin regulation could serve as a blueprint for other jurisdictions or become a cautionary tale about over-regulation stifling innovation. What’s certain is that the outcomes will reverberate throughout the global cryptocurrency industry, potentially reshaping how digital currencies are issued, managed, and regulated for years to come.

The world watches as Hong Kong prepares to open the floodgates—or perhaps more accurately, carefully crack open the door—to the next evolution of digital finance. The first approvals in March won’t just be business licenses; they’ll be tickets to participate in what could become the most significant financial infrastructure development of the decade.

Tags: #HongKong #Stablecoin #Cryptocurrency #HKMA #DigitalFinance #CryptoRegulation #Blockchain #Fintech #VirtualAssets #FinancialInnovation #Web3 #DigitalCurrency #RegulatorySandbox #CryptoLicensing #HongKongDollar

Viral Sentences:

Hong Kong is about to make history with the world’s first comprehensive stablecoin licensing regime

Only a handful of companies will get approved in the initial wave

The HKMA’s registry remains empty despite 36 applications

March 2026 will mark the beginning of a new era in digital finance

Hong Kong positions itself as the global standard for stablecoin regulation

Traditional banks and crypto giants are competing for the same licenses

The city’s approach treats stablecoins as infrastructure, not speculation

Compliance costs could make or break institutional participation

The world is watching Hong Kong’s regulatory experiment

These aren’t just licenses—they’re tickets to the future of finance,

Leave a Reply

Want to join the discussion?Feel free to contribute!