Galaxy Digital shares jump 18% after company approves $200 million buyback

Galaxy Digital’s $200 Million Share Repurchase Sparks 18% Stock Surge as Crypto Market Heats Up

In a bold move that sent shockwaves through the cryptocurrency and financial markets, Galaxy Digital (GLXY) shares skyrocketed 18% to $19.90 on Friday following the announcement of a massive $200 million share repurchase program. The strategic buyback initiative, approved by the company’s board, grants Galaxy the authority to repurchase its Class A common stock over the next 12 months through various methods including open market purchases, privately negotiated transactions, and trading plans under Rule 10b5-1.

The timing of this announcement is particularly noteworthy, coming just days after Galaxy Digital reported fourth-quarter earnings that initially sent shares tumbling. The company posted a substantial net loss of $482 million for the quarter, which had investors questioning the firm’s financial health and future prospects. However, the share repurchase program has effectively shifted the narrative, demonstrating management’s confidence in the company’s underlying value and long-term potential.

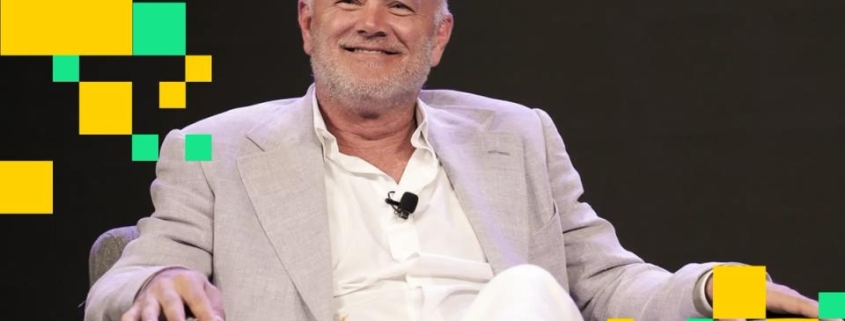

Mike Novogratz, the charismatic founder and CEO of Galaxy Digital, framed the buyback as a testament to the company’s robust financial position. “We are entering 2026 from a position of strength, with a strong balance sheet and continued investment in Galaxy’s growth,” Novogratz stated. “That foundation gives us the flexibility to return capital to shareholders when we believe our stock doesn’t reflect the value of the business.”

This strategic move is more than just a financial maneuver; it’s a powerful signal to the market about Galaxy’s internal assessment of its stock valuation. Share repurchase programs are often employed by companies that believe their shares are trading below their intrinsic value, and they can serve multiple purposes in the complex ecosystem of corporate finance.

First and foremost, buybacks reduce the number of outstanding shares, which can lead to an increase in earnings per share (EPS) – a key metric that investors and analysts closely monitor. This mathematical reality can make a company appear more profitable on a per-share basis, even if total earnings remain unchanged. Additionally, buybacks demonstrate that management has confidence in the company’s future prospects and believes that investing in its own stock is a wise use of capital.

The flexibility built into Galaxy’s program is also noteworthy. The company retains the right to suspend or discontinue the buyback at any time, depending on market conditions and other factors. This adaptability allows Galaxy to respond to changing market dynamics while still committing to the program as a long-term strategy.

Despite the quarterly loss that initially weighed on investor sentiment, Galaxy Digital’s full-year performance provides important context. The company generated $426 million in adjusted gross profit for the full year and ended 2025 with a substantial $2.6 billion in cash and stablecoins. This impressive liquidity position underscores the firm’s financial resilience and ability to weather market volatility while pursuing strategic initiatives like the share repurchase program.

The broader cryptocurrency market appears to be experiencing a significant upswing, with Galaxy Digital’s positive news coinciding with substantial gains across the sector. Bitcoin has climbed back to the $70,000 mark, while Ethereum has broken through the $2,000 barrier. Major crypto-related stocks are also seeing impressive gains, with Coinbase (COIN) climbing over 10% to $163.

This market-wide rally extends beyond the crypto sphere, with traditional markets also reaching new heights. The Dow Jones Industrial Average has broken the 50,000-point barrier for the first time, signaling broad-based optimism across financial markets. This confluence of positive developments suggests a growing appetite for risk assets and a renewed confidence in the cryptocurrency sector’s long-term viability.

The sharp 18% move higher in Galaxy Digital’s stock price reflects more than just algorithmic trading or short-term speculation. It represents a fundamental shift in how investors are perceiving the company’s value proposition and management’s ability to navigate challenging market conditions. The share repurchase program serves as a concrete demonstration of Galaxy’s commitment to shareholder value and its belief in the strength of its business model.

As the cryptocurrency industry continues to mature and integrate with traditional finance, moves like Galaxy’s share buyback program become increasingly significant. They not only impact the company’s stock price but also send ripples through the entire crypto ecosystem, potentially influencing investor sentiment and market dynamics across the sector.

Looking ahead, the success of Galaxy’s share repurchase program will likely depend on several factors, including the company’s ability to execute the buyback efficiently, broader market conditions, and the ongoing performance of the cryptocurrency market. However, the initial market reaction suggests that investors are responding positively to management’s proactive approach to capital allocation and their confidence in the company’s long-term prospects.

In conclusion, Galaxy Digital’s $200 million share repurchase program represents a significant strategic move that has captured the attention of investors and industry observers alike. By demonstrating confidence in its own valuation and committing substantial capital to support its stock price, Galaxy is positioning itself as a leader in the evolving cryptocurrency financial services landscape. As the program unfolds over the coming months, it will be closely watched as a barometer of both Galaxy’s financial health and the broader sentiment in the cryptocurrency market.

Tags & Viral Phrases:

Galaxy Digital share repurchase program, $200 million buyback, Mike Novogratz, cryptocurrency market rally, Bitcoin $70,000, Ethereum $2,000, Coinbase stock surge, Dow Jones 50,000, crypto stocks booming, Galaxy Digital earnings, digital asset management, institutional crypto adoption, blockchain finance revolution, crypto market confidence, shareholder value creation, financial markets transformation, digital currency investment, crypto financial services, market sentiment shift, institutional crypto investment, blockchain technology adoption, cryptocurrency price surge, financial innovation, digital asset trading, crypto market recovery, institutional investment in crypto, blockchain financial services, cryptocurrency market analysis, digital asset liquidity, crypto market trends, institutional crypto custody, blockchain investment opportunities, cryptocurrency market dynamics, digital asset portfolio management, crypto market momentum, institutional crypto trading, blockchain financial products, cryptocurrency market outlook, digital asset market growth, crypto market volatility, institutional crypto custody solutions, blockchain market analysis, cryptocurrency investment strategies, digital asset market trends, crypto market sentiment, institutional crypto adoption trends, blockchain technology investment, cryptocurrency market performance, digital asset market analysis, crypto market opportunities, institutional crypto investment trends, blockchain financial innovation, cryptocurrency market insights, digital asset investment strategies, crypto market developments, institutional crypto market growth, blockchain technology trends, cryptocurrency market dynamics analysis, digital asset market opportunities, crypto market momentum analysis, institutional crypto custody trends, blockchain investment analysis, cryptocurrency market outlook 2026, digital asset market growth trends, crypto market sentiment analysis, institutional crypto adoption analysis, blockchain technology investment trends, cryptocurrency market performance analysis, digital asset investment opportunities, crypto market developments analysis, institutional crypto market trends, blockchain financial products analysis, cryptocurrency market insights analysis, digital asset market analysis trends, crypto market opportunities analysis, institutional crypto investment analysis, blockchain technology trends analysis, cryptocurrency market dynamics analysis, digital asset market growth analysis, crypto market momentum trends, institutional crypto custody analysis, blockchain investment opportunities analysis, cryptocurrency market outlook analysis, digital asset market trends analysis, crypto market sentiment trends, institutional crypto adoption trends analysis, blockchain technology investment analysis, cryptocurrency market performance trends, digital asset investment strategies analysis, crypto market developments trends, institutional crypto market analysis, blockchain financial innovation analysis, cryptocurrency market insights trends, digital asset market opportunities analysis, crypto market momentum analysis trends, institutional crypto custody trends analysis, blockchain investment analysis trends, cryptocurrency market outlook analysis trends, digital asset market growth trends analysis, crypto market sentiment analysis trends, institutional crypto adoption analysis trends, blockchain technology investment analysis trends, cryptocurrency market performance analysis trends, digital asset investment strategies analysis trends, crypto market developments analysis trends, institutional crypto market trends analysis, blockchain financial products analysis trends, cryptocurrency market insights analysis trends, digital asset market analysis trends analysis, crypto market opportunities analysis trends, institutional crypto investment analysis trends, blockchain technology trends analysis trends, cryptocurrency market dynamics analysis trends, digital asset market growth analysis trends, crypto market momentum analysis trends analysis, institutional crypto custody analysis trends analysis, blockchain investment opportunities analysis trends analysis, cryptocurrency market outlook analysis trends analysis, digital asset market trends analysis trends analysis, crypto market sentiment analysis trends analysis, institutional crypto adoption analysis trends analysis, blockchain technology investment analysis trends analysis, cryptocurrency market performance analysis trends analysis, digital asset investment strategies analysis trends analysis, crypto market developments analysis trends analysis, institutional crypto market trends analysis trends, blockchain financial innovation analysis trends analysis, cryptocurrency market insights analysis trends analysis, digital asset market opportunities analysis trends analysis, crypto market momentum analysis trends analysis trends, institutional crypto custody analysis trends analysis trends, blockchain investment opportunities analysis trends analysis trends, cryptocurrency market outlook analysis trends analysis trends, digital asset market growth analysis trends analysis trends, crypto market sentiment analysis trends analysis trends, institutional crypto adoption analysis trends analysis trends, blockchain technology investment analysis trends analysis trends, cryptocurrency market performance analysis trends analysis trends, digital asset investment strategies analysis trends analysis trends, crypto market developments analysis trends analysis trends, institutional crypto market trends analysis trends analysis, blockchain financial products analysis trends analysis trends, cryptocurrency market insights analysis trends analysis trends, digital asset market analysis trends analysis trends analysis, crypto market opportunities analysis trends analysis trends, institutional crypto investment analysis trends analysis trends, blockchain technology trends analysis trends analysis trends, cryptocurrency market dynamics analysis trends analysis trends, digital asset market growth analysis trends analysis trends, crypto market momentum analysis trends analysis trends analysis, institutional crypto custody analysis trends analysis trends analysis, blockchain investment opportunities analysis trends analysis trends analysis, cryptocurrency market outlook analysis trends analysis trends analysis, digital asset market trends analysis trends analysis trends analysis, crypto market sentiment analysis trends analysis trends analysis, institutional crypto adoption analysis trends analysis trends analysis, blockchain technology investment analysis trends analysis trends analysis, cryptocurrency market performance analysis trends analysis trends analysis, digital asset investment strategies analysis trends analysis trends analysis, crypto market developments analysis trends analysis trends analysis, institutional crypto market trends analysis trends analysis trends, blockchain financial innovation analysis trends analysis trends analysis, cryptocurrency market insights analysis trends analysis trends analysis, digital asset market opportunities analysis trends analysis trends analysis, crypto market momentum analysis trends analysis trends analysis trends, institutional crypto custody analysis trends analysis trends analysis trends, blockchain investment opportunities analysis trends analysis trends analysis trends, cryptocurrency market outlook analysis trends analysis trends analysis trends, digital asset market growth analysis trends analysis trends analysis trends, crypto market sentiment analysis trends analysis trends analysis trends, institutional crypto adoption analysis trends analysis trends analysis trends, blockchain technology investment analysis trends analysis trends analysis trends, cryptocurrency market performance analysis trends analysis trends analysis trends, digital asset investment strategies analysis trends analysis trends analysis trends, crypto market developments analysis trends analysis trends analysis trends, institutional crypto market trends analysis trends analysis trends analysis, blockchain financial products analysis trends analysis trends analysis trends, cryptocurrency market insights analysis trends analysis trends analysis trends, digital asset market analysis trends analysis trends analysis trends analysis, crypto market opportunities analysis trends analysis trends analysis trends, institutional crypto investment analysis trends analysis trends analysis trends, blockchain technology trends analysis trends analysis trends analysis trends, cryptocurrency market dynamics analysis trends analysis trends analysis trends, digital asset market growth analysis trends analysis trends analysis trends, crypto market momentum analysis trends analysis trends analysis trends analysis, institutional crypto custody analysis trends analysis trends analysis trends analysis, blockchain investment opportunities analysis trends analysis trends analysis trends analysis, cryptocurrency market outlook analysis trends analysis trends analysis trends analysis, digital asset market trends analysis trends analysis trends analysis trends analysis, crypto market sentiment analysis trends analysis trends analysis trends analysis, institutional crypto adoption analysis trends analysis trends analysis trends analysis, blockchain technology investment analysis trends analysis trends analysis trends analysis, cryptocurrency market performance analysis trends analysis trends analysis trends analysis, digital asset investment strategies analysis trends analysis trends analysis trends analysis, crypto market developments analysis trends analysis trends analysis trends analysis, institutional crypto market trends analysis trends analysis trends analysis trends, blockchain financial innovation analysis trends analysis trends analysis trends analysis, cryptocurrency market insights analysis trends analysis trends analysis trends analysis, digital asset market opportunities analysis trends analysis trends analysis trends analysis

,

Leave a Reply

Want to join the discussion?Feel free to contribute!