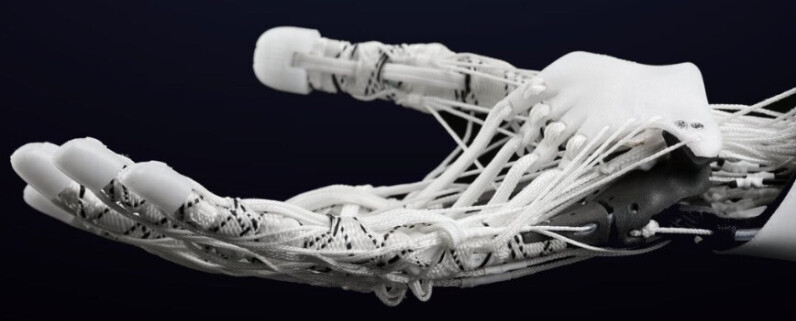

Allonic is rebuilding robotics from the inside out

Budapest’s Allonic Lands $7.2M Pre-Seed, Shattering European Robotics Funding Records

In a seismic shift for European deep tech, Budapest-based robotics startup Allonic has secured $7.2 million in pre-seed funding—a figure that not only sets a new benchmark for Hungarian startups but also signals a radical departure from conventional European venture capital wisdom. The round, led by Visionaries Club with participation from Day One Capital, Prototype, SDAC Ventures, TinyVC, and over a dozen angels from powerhouses including OpenAI and Hugging Face, represents more than just capital—it’s a statement about where the future of robotics is headed.

What makes Allonic’s achievement particularly striking is the nature of the problem it’s tackling. While much of the robotics world has been captivated by software advancements and AI interfaces, Allonic is diving deep into the physical layer of robotics—the often-overlooked but critically important hardware foundations that make everything else possible. This isn’t about building another AI wrapper or software layer; it’s about rebuilding robotics from the inside out.

The $7.2 million figure is remarkable for several reasons. First, it’s the largest pre-seed round in Hungarian startup history, a country that has been steadily building its reputation as a European tech hub but hasn’t previously seen investments of this magnitude at such an early stage. Second, and perhaps more importantly, it challenges the unspoken European venture capital rule that truly hard hardware problems should wait for later funding rounds—or perhaps even be tackled in more hardware-friendly ecosystems like the United States or Israel.

This investment suggests a maturing European venture landscape that’s willing to place substantial bets on fundamental technological challenges early in a company’s lifecycle. It’s a vote of confidence not just in Allonic’s team and technology, but in the broader thesis that Europe can and should be a leader in deep tech innovation, particularly in areas that require significant upfront capital and long development cycles.

Allonic’s approach appears to be addressing one of robotics’ most persistent challenges: the disconnect between sophisticated AI brains and the physical bodies that need to execute their commands. While AI models have made tremendous strides in reasoning, planning, and decision-making, the hardware layer—the actual robots and robotic systems—hasn’t kept pace. This creates a bottleneck where brilliant software is constrained by mediocre hardware, limiting the real-world impact of AI advancements.

The company’s backers bring an interesting mix of expertise to the table. Visionaries Club, known for backing category-defining companies at their earliest stages, clearly sees Allonic as something special. The participation of angels from OpenAI and Hugging Face is particularly noteworthy, suggesting that even within the AI community, there’s recognition that hardware limitations are becoming the next frontier to conquer.

What’s particularly fascinating about this funding round is what it might portend for the European tech ecosystem. Europe has long been criticized for being too risk-averse when it comes to deep tech investments, particularly in hardware. The continent has produced world-class software companies but has struggled to match the hardware innovation coming out of the US and parts of Asia. Allonic’s success could be the first domino in a shift toward more aggressive deep tech investment across Europe.

The implications extend beyond just robotics. If European VCs are willing to back hard hardware problems at the pre-seed stage, it could unlock innovation across multiple sectors—from quantum computing to advanced manufacturing to next-generation medical devices. It suggests a recognition that the future of technology isn’t just about bits and bytes, but about the physical systems that will shape our world.

For Allonic itself, the funding provides crucial runway to tackle what are likely to be multi-year development cycles. Building better robotic hardware isn’t a quick process—it requires extensive R&D, prototyping, testing, and iteration. The $7.2 million gives the company the breathing room to focus on solving fundamental problems rather than rushing to market with a suboptimal solution.

The Budapest location also adds an interesting dimension to the story. While many European deep tech companies gravitate toward established hubs like London, Berlin, or Paris, Allonic’s decision to build in Hungary—and the investors’ willingness to back a Budapest-based company at this scale—suggests that the geography of European tech innovation is becoming more distributed. This could have significant implications for talent acquisition, cost structures, and the overall competitiveness of European startups.

As Allonic moves forward with its mission to rebuild robotics from the inside out, the tech world will be watching closely. The company’s success or failure could influence investment patterns across Europe for years to come, potentially unlocking billions in capital for deep tech startups that have historically struggled to secure early-stage funding.

What’s clear is that Allonic has already achieved something significant: it has proven that European investors are willing to back truly ambitious hardware projects from day one. Whether this represents a one-off anomaly or the beginning of a new era in European deep tech investment remains to be seen, but the $7.2 million bet on Budapest suggests that the rules of the game may be changing.

Tags

European robotics funding, Allonic robotics, Budapest startup, Visionaries Club investment, pre-seed funding record, deep tech hardware, European venture capital, OpenAI angels, Hugging Face investors, robotics hardware innovation, Hungarian tech ecosystem, European deep tech, hardware AI integration, robotics physical layer, European startup investment trends, robotics infrastructure, hardware-software convergence, European tech hubs, robotics development funding, deep tech venture capital

,

Leave a Reply

Want to join the discussion?Feel free to contribute!