Bitcoin Price Prediction: Billion-Dollar Firm Says BTC is Acting Like a Growth Stock – Is That Good or Dangerous for You?

Bitcoin’s Identity Crisis: Billion-Dollar Firm Declares BTC is Acting Like a Growth Stock – Is That Good or Dangerous for You?

In a bombshell report that’s sending shockwaves through the crypto community, Grayscale Investments has just dropped a market analysis that’s forcing everyone to question what they actually own. The numbers don’t lie, and they’re painting a picture that’s making Bitcoin maximalists extremely uncomfortable.

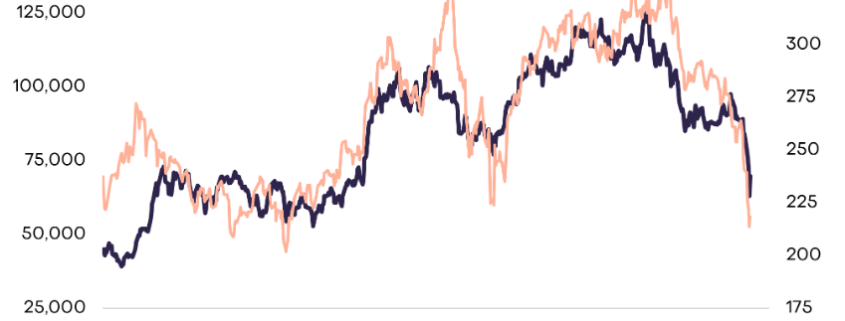

Bitcoin’s recent price movements have been tracking software stocks rather than gold or precious metals, especially since early 2024. When AI fears hit the software sector, Bitcoin crashed right alongside it. Down 50% from October highs while gold hit records. This correlation is more than just a statistical anomaly—it’s a fundamental shift in how Bitcoin behaves as an asset.

This is catastrophic for those who see Bitcoin as a “safe haven” digital gold. The narrative that Bitcoin would be the ultimate store of value during market turmoil has taken a massive hit. When traditional markets get spooked, Bitcoin isn’t holding strong—it’s diving headfirst into the red alongside growth stocks and tech companies.

However, Grayscale’s Zach Pandl still views Bitcoin as a long-term store of value due to its fixed supply and independence from central banks. But here’s the problem: Bitcoin’s only 15 years old. Gold’s had millennia to prove itself. During the 2020 COVID crash, Bitcoin initially dropped but then crushed every asset as central banks printed money. When Silicon Valley Bank collapsed in 2023 and trust in traditional finance cracked, Bitcoin rallied while bank stocks tanked. The growth stock correlation exists because Bitcoin’s still in price discovery with institutional money flooding in.

The narrative debate will continue raging, but meanwhile, Bitcoin price action is telling its own story. And right now, that story is one of uncertainty and identity crisis.

Bitcoin Price Prediction: Why Bitcoin Seems To Be Bottoming Out Here

Bitcoin recently broke out of that tight falling channel. Now it is chopping right above the $64K support like it is deciding its next big move. That breakdown structure is technically done, but price still needs to prove it can hold this higher low zone.

$64K is the key floor. If BTC price goes below that, $60K comes back into play. But if buyers keep defending this range, the squeeze higher could get very interesting. $71K is the first real target and resistance. Clear that cleanly and the path toward $80K starts opening up.

While Bitcoin price stays choppy and boring like this, a lot of whales might already be rotating into new plays like Bitcoin Hyper, which is gaining traction fast.

Bitcoin Hyper Builds Bitcoin Utility: Whales Loves That

Bitcoin Hyper ($HYPER) is built for traders who want more than waiting on correlations to break. This Bitcoin-focused Layer-2 uses Solana technology to make BTC faster, cheaper, and usable for payments, apps, and staking, without touching Bitcoin’s core security. It keeps Bitcoin brand power but adds real functionality on top.

Momentum is already clear. The Bitcoin Hyper presale has raised over $31 million so far, with $HYPER priced at $0.0136751 before the next increase, plus staking rewards reaching up to 37%. If Bitcoin is still figuring out what it wants to be, Bitcoin Hyper is already positioning for what comes next.

Bitcoin’s identity crisis isn’t just academic—it’s hitting portfolios right now. The question isn’t whether Bitcoin will find its true nature, but whether investors can afford to wait while it figures itself out.

Bitcoin acting like growth stock

Bitcoin correlation with tech stocks

Bitcoin safe haven debate

Bitcoin price prediction 2024

Bitcoin bottoming out

Bitcoin Hyper presale

Bitcoin Layer-2 solutions

Bitcoin institutional investment

Bitcoin vs gold comparison

Bitcoin market structure

Bitcoin whales rotating

Bitcoin staking rewards

Bitcoin trading analysis

Bitcoin identity crisis

Bitcoin utility tokens

,

Leave a Reply

Want to join the discussion?Feel free to contribute!