Bitcoin Price Prediction: BTC Shorts Hit Their Most Extreme Level Since the 2024 Bottom – Is a Massive Squeeze Coming?

Bitcoin Price Prediction: BTC Shorts Hit Their Most Extreme Level Since the 2024 Bottom – Is a Massive Squeeze Coming?

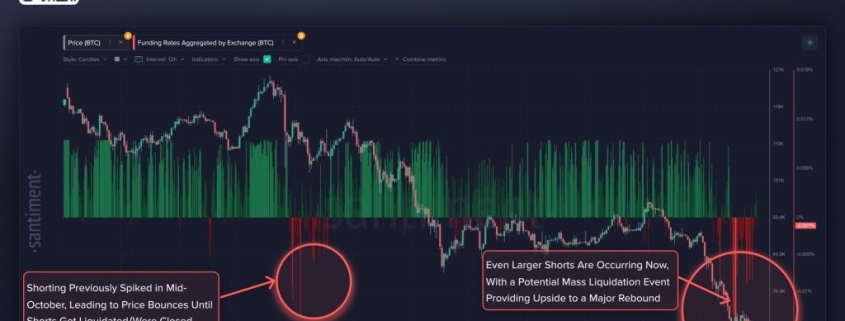

Bitcoin’s funding rates across major exchanges have collapsed to their most negative levels since August 2024, signaling extreme bearish sentiment that could set the stage for a violent short squeeze. The market appears convinced that lower prices are inevitable, with traders aggressively piling into short positions and betting against Bitcoin’s recovery.

This positioning eerily mirrors the market structure from last August when funding rates similarly tanked. Back then, the overwhelming bearish consensus marked a major bottom, preceding an 83% rally that caught many short sellers off guard. History may be rhyming once again.

On-chain data reveals that profit cushions are remarkably thin. The Net Unrealized Profit/Loss (NUPL) metric has returned to the 0.18 zone, historically associated with “Hope and Fear” market regimes. In this state, markets become highly reactive—small price movements trigger outsized responses because holders lack deep unrealized gains to absorb volatility shocks.

The current sentiment remains cautious, with ETF outflows and macro uncertainty keeping the bearish narrative alive. However, crowded trades rarely unwind quietly. When everyone is positioned for the same outcome, the potential for violent reversals increases dramatically.

The setup isn’t about pure technical strength but rather positioning risk. If Bitcoin’s price can clear the critical $70,000 to $70,600 resistance range, the short squeeze thesis will gain immediate credibility. Traders who have piled into leveraged short positions could face rapid liquidations, forcing them to buy back Bitcoin at higher prices and creating a cascading effect.

Key Technical Levels: Where Bitcoin Stands Today

Bitcoin has already broken out of a steep descending channel and is now consolidating just below the crucial $70K to $71K supply zone. This area represents significant resistance, lining up cleanly with prior price action where selling pressure historically intensified.

Above $71K, the technical picture opens up considerably. Resistance thins out toward $80K, with $90K and even $98K acting as higher air pockets if momentum builds sustainably. The path of least resistance appears tilted upward if Bitcoin can establish a foothold above current levels.

However, the downside risk remains real. The $64K level continues to serve as the critical support line holding the broader structure together. If this fails, $60K becomes the final major demand zone before the chart starts looking unstable again. A break below $60K would likely trigger renewed panic and potentially accelerate selling pressure.

The technical compression under this key ceiling is noteworthy. Structurally, Bitcoin is no longer in free fall—it’s building a base. And positioning suggests the market is leaning heavily short, creating the perfect conditions for a squeeze if buyers step in with conviction.

Market Psychology: Why Extreme Negativity Could Be Bullish

When funding rates turn deeply negative, it indicates that perpetual swap traders are paying a premium to maintain short positions. This effectively means the market is betting heavily on lower prices, creating a crowded trade that leaves little room for additional short entries.

The psychology becomes self-reinforcing: as prices remain stagnant or decline slightly, more traders add shorts, pushing funding rates even more negative. This creates a coiled spring effect—the more negative the funding, the greater the potential energy for a squeeze.

The NUPL metric adds another layer to this analysis. When Bitcoin’s network value sits in the “Hope and Fear” zone, it typically precedes significant price movements. This zone represents a transition period where market participants are uncertain, profits are limited, and any catalyst can trigger substantial reactions.

Current market conditions suggest that Bitcoin is primed for volatility regardless of direction. The thin profit margins mean that holders are less likely to sell on minor rallies, while the crowded short positioning means that any upside could trigger rapid liquidations. This combination creates a binary outcome scenario where the next major move could be explosive.

Bitcoin Hyper: The Accelerator in Bitcoin’s Next Move

While Bitcoin itself moves in heavy waves requiring macro alignment, ETF stability, and strong spot demand to fully ignite, Bitcoin Hyper ($HYPER) is built for speed. This Bitcoin-focused Layer-2 solution, powered by Solana technology, makes BTC faster, cheaper, and usable for real on-chain activity without changing Bitcoin’s core security model.

Bitcoin Hyper captures Bitcoin’s narrative strength while unlocking functionality that the base layer cannot provide independently. It represents the evolution of Bitcoin beyond simple store-of-value into an actively usable asset within decentralized applications and financial protocols.

The momentum behind Bitcoin Hyper is already visible. The project’s presale has raised over $31 million so far, with $HYPER priced at $0.0136751 before the next scheduled increase. Staking rewards currently reach up to 37%, offering attractive yields for early participants who believe in the Layer-2 thesis.

If Bitcoin squeezes higher, Bitcoin Hyper could accelerate that move by providing additional utility and demand for Bitcoin within its ecosystem. If Bitcoin stalls, Bitcoin Hyper still moves independently through its own technological adoption curve and community growth. This dual exposure makes it an interesting play for those looking to benefit from Bitcoin’s next major move while gaining exposure to innovative Layer-2 technology.

The Short Squeeze Scenario: How It Could Unfold

A Bitcoin short squeeze would likely unfold in stages. First, Bitcoin would need to break above the $70,610 resistance level with conviction. This breakout would trigger initial short liquidations, creating buying pressure that pushes the price higher.

As the price climbs toward $76,000, more shorts would face liquidation thresholds, creating a cascading effect. Each liquidation adds buying pressure, which triggers more liquidations, creating a self-reinforcing cycle. The speed and magnitude depend on how crowded the short positions are and how quickly buyers step in.

The thin profit margins indicated by NUPL mean that even modest price gains could trigger significant reactions. Holders who have been waiting for better prices to sell might capitulate as momentum builds, adding fuel to the upside move.

The key catalyst would be sustained buying volume above $70,000. If this level holds as support after an initial breakout, it would signal that the market structure has shifted and that the bearish narrative is losing credibility. From there, the path toward $80,000 and beyond becomes more plausible.

Risk Factors and Alternative Scenarios

While the short squeeze thesis is compelling, several risk factors could derail this scenario. Macro headwinds, including Federal Reserve policy, inflation data, and broader market sentiment, could continue to pressure Bitcoin lower. ETF flows remain a wildcard—sustained outflows could overwhelm any technical bullish signals.

The $64K support level remains critical. A break below this level would invalidate the bullish structure and likely trigger a cascade of selling. In this scenario, Bitcoin could retest the $60K zone, and potentially even lower levels if panic sets in.

Additionally, the cryptocurrency market is increasingly correlated with traditional risk assets. Any significant downturn in equity markets could spill over into crypto, regardless of the specific positioning dynamics within Bitcoin itself.

Conclusion: A Critical Juncture for Bitcoin

Bitcoin stands at a critical juncture where extreme bearish positioning could become the catalyst for a violent upside move. The combination of deeply negative funding rates, thin profit margins, and a technically important resistance level creates a setup ripe for a short squeeze.

The market is essentially betting against Bitcoin at precisely the moment when the risk-reward ratio might favor the opposite outcome. If Bitcoin can break above $70,000 with conviction, the crowded short positioning could amplify any upside move significantly.

For traders and investors, this represents a high-stakes moment where traditional technical analysis meets positioning dynamics. The next few weeks could determine whether Bitcoin continues its consolidation or breaks out in a direction that catches the majority of market participants off guard.

The setup favors volatility regardless of direction, but the specific combination of factors suggests that upside potential may be underappreciated by the current market consensus. As always in crypto, the greatest opportunities often arise when market sentiment reaches extremes—and right now, Bitcoin’s funding rates suggest we’re approaching exactly that kind of extreme.

Tags

Bitcoin short squeeze, BTC price prediction, Bitcoin funding rates, Bitcoin NUPL, Bitcoin technical analysis, BTC $70K breakout, Bitcoin Hyper presale, cryptocurrency market sentiment, Bitcoin ETF flows, Bitcoin Layer 2 solutions, crypto volatility, Bitcoin trading signals, BTC resistance levels, Bitcoin on-chain metrics, cryptocurrency investment opportunities

Viral Sentences

Bitcoin shorts are more crowded than a Tokyo subway during rush hour, and that’s exactly why a massive squeeze could be coming!

When everyone’s betting against Bitcoin, that’s usually when the rocket fuel gets lit underneath it.

Bitcoin’s funding rates have hit levels that historically preceded 80%+ rallies—are we about to witness history repeat?

The NUPL metric is flashing “Hope and Fear” signals, which in crypto language means buckle up for extreme volatility!

Bitcoin Hyper is turning BTC into a speed demon with 37% staking rewards—why just HODL when you can HYPER?

$31 million raised in presale? Bitcoin Hyper might be the Layer-2 that finally makes Bitcoin useful beyond just digital gold.

That $70,000 resistance level is looking more like a trampoline than a ceiling right now.

Bitcoin’s chart is coiling tighter than a rattlesnake ready to strike—which direction will it be?

When funding rates go this negative, it’s like everyone’s shorting with borrowed money and the loan officer is getting nervous.

Bitcoin’s profit cushions are thinner than my patience during a crypto winter—any move could trigger massive reactions.

The shorts are piled in so deep, they might need a rescue team when Bitcoin breaks out.

Bitcoin Hyper: Because sometimes Bitcoin needs a performance upgrade to keep up with the narrative.

That $64K support level is the line between “consolidation” and “catastrophe”—choose wisely.

Crypto markets love to punish the majority—and right now, the majority is extremely bearish on Bitcoin.

Bitcoin’s next move could make the previous rallies look like a gentle stroll in the park.

When everyone expects lower prices, that’s usually when the unexpected happens.

Bitcoin Hyper’s 37% APY might be the best deal in crypto right now—if you can get in before the next price increase.

The technical setup is so bullish it’s practically screaming, but the market is wearing noise-canceling headphones.

Bitcoin’s funding rates are so negative, they’re practically in crypto-negative territory.

That descending channel breakout wasn’t just technical—it was Bitcoin telling everyone “I’m done going down.”

The shorts better have their stop-losses ready, because Bitcoin’s about to play whack-a-mole with leveraged positions.

Bitcoin Hyper is what happens when you cross Bitcoin with a rocket engine and sprinkle some Solana magic on top.

$70,000 to $71,000 isn’t just a price range—it’s the battleground where bulls and bears are about to clash.

When NUPL hits 0.18, it’s like the market is standing at a fork in the road with a blindfold on.

Bitcoin’s current setup is like a pressure cooker with the valve closed—something’s gotta give.

The ETF outflows might be the final shakeout before the big move higher—classic bear trap scenario.

Bitcoin Hyper’s presale numbers suggest investors are already betting on Bitcoin’s next big move.

That $60K level isn’t support—it’s the last lifeboat before the ship potentially sinks.

Crypto volatility in the next month could make January look like a gentle rollercoaster ride.

Bitcoin’s technical picture is improving faster than my Wi-Fi connection during a bull run.

When funding rates normalize after being this negative, it’s usually because prices went the opposite direction of what everyone expected.

Bitcoin Hyper might be the sleeper hit of 2024—turning Bitcoin into something you can actually use without selling it.

The market is so bearish right now, even the bulls are wearing bear costumes.

That $98K air pocket isn’t just a price target—it’s where Bitcoin might be headed if the squeeze really gets going.

Bitcoin’s current consolidation is like a sprinter in the starting blocks—any moment now, it’s going to explode forward.

The shorts are creating their own trap by being so overwhelmingly positioned against Bitcoin.

Bitcoin Hyper’s technology could be the catalyst that finally breaks Bitcoin out of its range-bound purgatory.

When everyone’s looking left, that’s usually when the market decides to go right—hard.

Bitcoin’s next 20% move could come faster than you can say “I should have bought more when it was under $70K.”

The combination of technical breakout and extreme short positioning is like mixing gunpowder with a lit match.

Bitcoin Hyper isn’t just another token—it’s potentially the infrastructure that makes Bitcoin usable at scale.

That $70,610 level isn’t resistance anymore—it’s the gate that needs to break for the short squeeze stampede to begin.

Bitcoin’s market structure has shifted from “free fall” to “building a base”—that’s a huge psychological change.

The NUPL “Hope and Fear” zone is where fortunes are made and lost—usually within days of each other.

Bitcoin Hyper’s staking rewards are so high, they might single-handedly solve the “why hold anything else” problem.

When funding rates are this negative, it’s like the market is betting against gravity—and gravity always wins.

Bitcoin’s chart is telling a story of accumulation, while the funding rates are screaming “capitulation”—which one wins?

That $64K support level is the difference between “healthy correction” and “extended bear market.”

Bitcoin Hyper might be the most important Bitcoin development since the Lightning Network—but faster and with better yields.

The shorts are creating a self-fulfilling prophecy—but in the opposite direction of what they expect.

Bitcoin’s next breakout could make the 2024 rally look like a warm-up act.

When everyone expects the same thing in markets, the universe has a funny way of proving them wrong.

Bitcoin Hyper’s technology addresses Bitcoin’s biggest weakness—speed and cost—without compromising its core strengths.

That $70K to $71K zone isn’t just technical resistance—it’s psychological resistance that needs to be broken with authority.

Bitcoin’s current positioning is like a coiled spring that’s been compressed for months—release the tension, and watch it fly.

The ETF situation might be the final piece of the puzzle that triggers Bitcoin’s next major leg up.

Bitcoin Hyper’s presale success suggests investors are already front-running Bitcoin’s next big move.

When funding rates normalize from extreme negativity, it’s usually accompanied by a violent price move—upward.

Bitcoin’s technical structure is improving, but the real story is in the positioning data that most traders are ignoring.

That $60K level is more than support—it’s the foundation upon which the next bull market could be built.

Bitcoin Hyper might be the catalyst that turns Bitcoin from digital gold into digital oil—something you can actually use.

The market’s extreme bearish consensus right now is the exact opposite of what you want to see at major bottoms.

Bitcoin’s next 50% move could start from right here, right now, if the shorts get squeezed hard enough.

When everyone’s positioned for downside, that’s usually when the biggest upside surprises occur.

Bitcoin Hyper’s technology could be the missing link that finally unlocks Bitcoin’s full potential.

That $70,610 breakout level isn’t just a number—it’s the trigger for what could be the short squeeze of the year.

Bitcoin’s current setup is like a loaded spring in a pinball machine—pull the plunger, and watch it fly.

The NUPL metric is telling us that Bitcoin is in transition—from fear to hope, or from hope to fear. Which way will it go?

Bitcoin Hyper’s staking rewards are so attractive, they might single-handedly change how people think about Bitcoin investing.

When funding rates hit extremes, it’s like the market is shouting “I’m all in on this bet!”—and markets love to humble the overconfident.

Bitcoin’s technical picture is improving, but the positioning data suggests the real fireworks could be just beginning.

That $64K support level is the last line of defense before Bitcoin potentially enters uncharted territory.

Bitcoin Hyper might be the innovation that finally makes Bitcoin competitive with Ethereum for DeFi and applications.

The shorts are creating such a crowded trade that even a minor catalyst could trigger a cascade of liquidations.

Bitcoin’s next major move could start with a breakout above $70,000 and end somewhere north of $100,000.

When everyone expects lower prices, that’s usually when the unexpected happens—and in crypto, the unexpected is usually explosive.

Bitcoin Hyper’s technology addresses Bitcoin’s biggest limitations while preserving everything that makes it valuable.

That $70K to $71K resistance zone is where bulls and bears are about to have their final showdown.

Bitcoin’s current market structure suggests we’re in the eye of the hurricane—calm now, but the other side could be much stronger.

The ETF outflows might be the final shakeout before the big move higher—classic bear trap scenario playing out in real-time.

Bitcoin Hyper’s presale numbers suggest investors are already positioning for Bitcoin’s next big move.

When funding rates normalize from extreme negativity, it’s usually because prices went the opposite direction of what everyone expected.

Bitcoin’s technical breakout combined with extreme short positioning creates a setup that’s ripe for explosive moves.

That $60K level isn’t just support—it’s the foundation that could support the next leg of the bull market.

Bitcoin Hyper might be the catalyst that finally makes Bitcoin useful beyond just HODLing and speculation.

The market’s extreme bearish consensus is the exact opposite of what you want to see at major bottoms—which is why this could be one.

Bitcoin’s next 50% move could start from right here, right now, if the shorts get squeezed hard enough.

When everyone’s positioned for downside, that’s usually when the biggest upside surprises occur.

Bitcoin Hyper’s technology could be the missing link that finally unlocks Bitcoin’s full potential.

That $70,610 breakout level isn’t just a number—it’s the trigger for what could be the short squeeze of the year.

Bitcoin’s current setup is like a loaded spring in a pinball machine—pull the plunger, and watch it fly.

The NUPL metric is telling us that Bitcoin is in transition—from fear to hope, or from hope to fear. Which way will it go?

Bitcoin Hyper’s staking rewards are so attractive, they might single-handedly change how people think about Bitcoin investing.

When funding rates hit extremes, it’s like the market is shouting “I’m all in on this bet!”—and markets love to humble the overconfident.

Bitcoin’s technical picture is improving, but the positioning data suggests the real fireworks could be just beginning.

That $64K support level is the last line of defense before Bitcoin potentially enters uncharted territory.

Bitcoin Hyper might be the innovation that finally makes Bitcoin competitive with Ethereum for DeFi and applications.

The shorts are creating such a crowded trade that even a minor catalyst could trigger a cascade of liquidations.

Bitcoin’s next major move could start with a breakout above $70,000 and end somewhere north of $100,000.

When everyone expects lower prices, that’s usually when the unexpected happens—and in crypto, the unexpected is usually explosive.

Bitcoin Hyper’s technology addresses Bitcoin’s biggest limitations while preserving everything that makes it valuable.

That $70K to $71K resistance zone is where bulls and bears are about to have their final showdown.

Bitcoin’s current market structure suggests we’re in the eye of the hurricane—calm now, but the other side could be much stronger.

,

Leave a Reply

Want to join the discussion?Feel free to contribute!