Bitcoin Price Slides After US Admits Nearly 1 Million ‘Phantom’ Jobs in Data Revision

Bitcoin Plunges After US Admits Nearly 1 Million “Phantom” Jobs in Major Data Revision

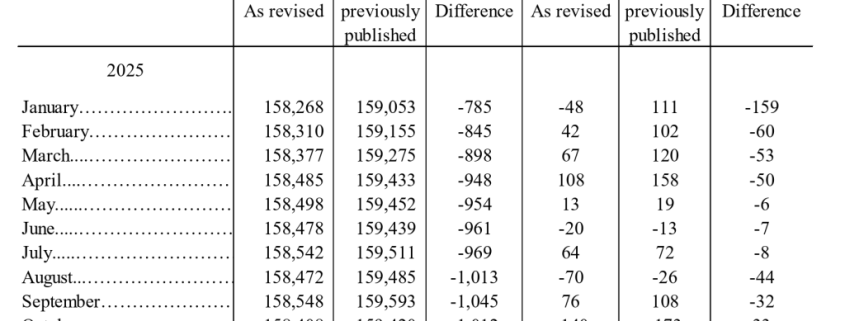

Bitcoin’s recent price dip isn’t just another market correction—it’s a direct response to a seismic revelation that has sent shockwaves through the entire financial ecosystem. The U.S. government has just admitted to massively overstating last year’s job numbers, revising them down by nearly 900,000 positions in what can only be described as one of the most significant economic data corrections in recent history.

This bombshell announcement from the Bureau of Labor Statistics has fundamentally altered the narrative about America’s economic health. While January’s report showed a respectable 130,000 new jobs, the massive downward adjustment for 2025 changes everything we thought we knew about the labor market’s strength.

Markets have an interesting psychological profile—they can weather bad news if it’s predictable and consistent. What they absolutely cannot tolerate is unreliable data and the uncertainty that comes with it. The BLS revision has injected exactly that kind of toxic uncertainty into the system, and risk assets like Bitcoin are bearing the brunt of the fallout.

The scope of the revision is staggering. Much of the reported job creation strength from last year was based on preliminary estimates, including the controversial birth-death model. This statistical methodology attempts to estimate jobs created by new businesses and lost by those that have closed, but it can significantly overstate job creation during periods of economic transition. In this case, it appears to have added nearly a million “phantom” jobs to the official tally.

What Does This Mean for Bitcoin Price?

Since this revelation of unreliable data, risk assets have been pummeled across the board. Treasury yields jumped immediately, with the benchmark 10-year moving from 4.15% to 4.20% in a matter of hours. This flight to safety is a classic market response to economic uncertainty.

The derivatives markets are telling a particularly concerning story. Whale perpetual contract activity has spiked dramatically, indicating that institutional players are aggressively hedging against further downside. When the big money starts positioning for more pain, it’s usually a sign that they see something the rest of us don’t—or at least, that they’re not willing to take any chances.

The probability of a Federal Reserve rate cut in March collapsed from 22% to just 9% within minutes of the jobs data revision. This dramatic shift in monetary policy expectations changes the entire market mood. Lower rates typically benefit risk assets like Bitcoin by making holding cash less attractive, but the market is now pricing in a much more hawkish Fed stance.

Adding another layer of complexity, fresh warnings about volatility risks across large chunks of Bitcoin supply have emerged. When you combine unreliable macroeconomic data, shifting Fed expectations, and concerns about Bitcoin’s own market structure, you get a perfect storm of uncertainty that’s keeping traders on edge.

The chart patterns are equally concerning. Bitcoin has broken below key support levels, and the technical indicators suggest further downside potential. Volume has increased on the sell-offs, confirming the bearish momentum. The Relative Strength Index (RSI) has dipped into oversold territory, but in strongly bearish markets, oversold conditions can persist for extended periods.

Could this be the bottom? It’s possible, but the market’s behavior suggests it’s not ready to commit to that narrative just yet. Bitcoin has shown remarkable resilience throughout its history, bouncing back from numerous corrections and crashes. However, each recovery requires a catalyst, and right now, the market lacks a clear positive catalyst to drive a sustained recovery.

The Bond Market Connection

If there’s one market to watch for clues about Bitcoin’s near-term trajectory, it’s the bond market. As long as Treasury yields continue pushing higher, Bitcoin will struggle to find stable ground. This relationship exists because higher yields make fixed-income investments more attractive relative to risk assets, drawing capital away from cryptocurrencies and other speculative investments.

The liquidity game is fundamental to understanding Bitcoin’s price action. When central banks tighten monetary policy and government bond yields rise, liquidity is effectively drained from the financial system. Bitcoin, being a risk asset with no yield of its own, suffers disproportionately in such environments.

However, it’s worth noting that chaos often creates opportunity. While the current environment is challenging for Bitcoin holders, periods of extreme uncertainty and volatility have historically been when the most significant market opportunities emerge. Traders who can navigate the turbulence and identify genuine value amidst the noise often find themselves well-positioned for the subsequent recovery.

The massive data revision also raises questions about the reliability of other economic indicators. If the jobs data was this far off, what other metrics might be misleading investors? This broader uncertainty could eventually benefit Bitcoin as a hedge against traditional financial system risks, though that narrative may take time to develop.

Looking Ahead

The coming weeks will be crucial for Bitcoin’s price action. Key levels to watch include the recent lows around $92,000, with significant support potentially forming near the $85,000-$88,000 zone. On the upside, resistance now forms at previous support levels around $98,000-$100,000.

Institutional flows will be particularly important to monitor. If large players continue to reduce exposure and increase hedging, it could signal further downside. Conversely, if institutional buying re-emerges, it could provide the foundation for a recovery.

The macroeconomic picture remains fluid. Any additional data revisions or economic surprises could trigger further volatility. The market is essentially in a wait-and-see mode, trying to determine whether this is a temporary setback or the beginning of a more prolonged bear market.

For now, caution appears warranted. The combination of unreliable economic data, shifting monetary policy expectations, and technical weakness suggests that Bitcoin may face additional headwinds before finding a sustainable bottom. However, for those with a long-term perspective, these periods of uncertainty often create some of the best entry points in the market cycle.

The post Bitcoin Price Slides After US Admits Nearly 1 Million ‘Phantom’ Jobs in Data Revision appeared first on Cryptonews.

Bitcoin #Crypto #BitcoinPrice #USJobs #BLS #DataRevision #PhantomJobs #CryptoNews #BitcoinCrash #MarketVolatility #Fed #InterestRates #TreasuryYields #RiskAssets #CryptoMarket #BitcoinAnalysis #EconomicData #FinancialMarkets #CryptoTrading #BitcoinDownturn #MarketUncertainty #WhaleActivity #Derivatives #InstitutionalInvestors #BitcoinSupport #BitcoinResistance #CryptoOpportunities #MarketChaos #Liquidity #BondMarket #BitcoinBottom #CryptoVolatility #EconomicRevision #MarketSentiment #BitcoinOutlook #CryptoFuture

,

Leave a Reply

Want to join the discussion?Feel free to contribute!