BlackRock exec says even a 1% crypto allocation in Asia could unlock $2 trillion in new flows

A Modest 1% Shift Could Unleash a $2 Trillion Crypto Tsunami, BlackRock Executive Warns

In a revelation that could send shockwaves through both traditional finance and the digital asset world, BlackRock’s head of APAC iShares, Nicholas Peach, has dropped a jaw-dropping prediction: even a tiny allocation of just 1% from Asia’s massive household wealth pool into cryptocurrencies could trigger an unprecedented $2 trillion inflow into the market.

Speaking at Consensus Hong Kong, one of the crypto industry’s most influential gatherings, Peach laid out a scenario that would effectively double the current size of the entire cryptocurrency market. With Asia holding approximately $108 trillion in household wealth, a seemingly conservative 1% reallocation would funnel nearly $2 trillion into digital assets—a figure that represents roughly 60% of the current crypto market capitalization.

“The math is both simple and staggering,” Peach explained to an audience of institutional investors, blockchain innovators, and crypto enthusiasts. “When you’re dealing with pools of capital this enormous, even modest shifts in allocation models create seismic impacts.”

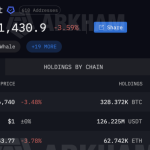

This isn’t theoretical speculation from the sidelines. BlackRock, the world’s largest asset manager with over $10 trillion in assets under management, has positioned itself at the forefront of bridging traditional finance with digital assets. The firm’s spot Bitcoin ETF, IBIT, launched in January 2024, didn’t just enter the market—it exploded onto the scene, becoming the fastest-growing ETF in history and amassing nearly $53 billion in assets under management within record time.

But here’s where the narrative takes an even more compelling turn: Peach emphasized that this crypto revolution isn’t confined to American shores. Asian investors have emerged as a powerhouse force behind the flows into U.S.-listed crypto ETFs, demonstrating a sophisticated appetite for digital asset exposure that’s reshaping global investment patterns.

The institutional embrace of crypto ETFs represents more than just another investment product—it signals a fundamental shift in how traditional finance views digital assets. No longer relegated to the fringes as speculative instruments, cryptocurrencies are increasingly being recognized as legitimate portfolio components deserving of strategic allocation.

Several Asian financial hubs are racing to capitalize on this momentum. Hong Kong has established itself as a crypto-friendly jurisdiction, rolling out regulatory frameworks designed to attract digital asset innovation. Japan, traditionally conservative in its approach to cryptocurrencies, is gradually warming to the idea of crypto ETFs as part of a broader financial modernization strategy. South Korea, with its tech-savvy population and vibrant trading culture, represents another massive potential market for regulated crypto investment products.

The implications extend far beyond simple asset allocation. As more institutional-grade crypto products become available across Asian markets, we’re witnessing the democratization of digital asset access. Retail investors who once faced significant barriers—ranging from complex wallet management to concerns about exchange security—can now gain exposure through familiar, regulated vehicles like ETFs.

However, Peach was quick to note that product availability alone won’t drive the transformation. The real challenge lies in education and strategic integration. Asset managers must work diligently to help investors understand not just how to access crypto markets, but why these allocations make sense within broader portfolio strategies.

“The pools of capital available in traditional finance are unbelievably large,” Peach emphasized. “It doesn’t take much in terms of adoption to lead to really significant financial results.” This statement encapsulates the core thesis: we’re not talking about mass retail adoption or crypto becoming everyone’s primary investment. Instead, we’re looking at measured, strategic allocations from the world’s largest capital pools—allocations that, despite their modesty in percentage terms, represent absolutely massive dollar amounts.

The timing of this revelation is particularly significant. As global markets grapple with inflation concerns, geopolitical tensions, and questions about traditional asset performance, cryptocurrencies are increasingly being viewed through the lens of portfolio diversification rather than pure speculation. The maturation of the ETF market has provided the regulatory clarity and institutional-grade infrastructure that many traditional investors were waiting for.

For Asia specifically, the opportunity is compounded by several factors. The region boasts some of the world’s highest savings rates, a young and tech-savvy population, and rapidly growing wealth accumulation. Moreover, Asian investors have historically shown a willingness to embrace innovative investment products, particularly when they offer exposure to emerging trends.

The $2 trillion figure isn’t just a number—it represents a fundamental reshaping of the crypto landscape. Such inflows would provide the liquidity, stability, and institutional backing that could help cryptocurrencies mature into the mainstream financial asset class that many have long predicted.

As regulatory frameworks continue to evolve and more jurisdictions launch their own crypto ETF products, the flywheel effect could accelerate. Greater accessibility leads to increased adoption, which in turn drives product innovation and further regulatory acceptance. The result could be a virtuous cycle that transforms the crypto market from its current state into something far more integrated with traditional finance.

BlackRock’s aggressive push into the crypto space, exemplified by IBIT’s success, suggests that other major asset managers are likely to follow suit. The firm’s size and influence mean that its moves often set industry trends, and the enthusiastic reception of its Bitcoin ETF has likely emboldened competitors to accelerate their own crypto strategies.

For individual investors watching these developments, the message is clear: the institutional adoption wave is just beginning, and its impact could be transformative. While a 1% allocation might seem conservative for an individual portfolio, when multiplied across trillions in institutional capital, it becomes a force capable of reshaping entire markets.

The convergence of regulatory progress, product innovation, and growing institutional comfort with digital assets suggests that we’re entering a new phase of crypto adoption—one where the conversation shifts from whether institutions should invest in crypto to how much they should allocate. And according to BlackRock’s analysis, even the most conservative answer to that question could unleash financial forces that fundamentally alter the crypto landscape forever.

Tags

BlackRock crypto ETF, Asia crypto adoption, institutional crypto investment, Bitcoin ETF inflows, digital asset allocation, IBIT fund growth, crypto market expansion, traditional finance crypto, $2 trillion crypto inflow, Asian household wealth, crypto portfolio strategy, Consensus Hong Kong, regulated crypto products, institutional crypto products, crypto ETF boom

Viral Sentences

A modest 1% shift from Asia’s $108 trillion household wealth could unleash a $2 trillion crypto tsunami that would double the entire market size.

BlackRock’s IBIT became the fastest-growing ETF in history, proving institutional money is ready to flood into crypto markets.

Asian investors are driving massive flows into U.S. crypto ETFs, showing the region’s sophisticated appetite for digital assets.

Even conservative portfolio allocations can create seismic market impacts when you’re dealing with pools of capital this enormous.

The math is simple but mind-blowing: 1% of Asia’s wealth equals nearly $2 trillion, which is 60% of today’s entire crypto market cap.

Traditional finance’s unbelievably large capital pools don’t need much adoption to create really significant financial results.

Hong Kong, Japan, and South Korea are racing to launch crypto ETFs as regulatory clarity improves across Asian markets.

BlackRock isn’t just participating in the crypto revolution—they’re actively building the bridges between traditional finance and digital assets.

The democratization of crypto access through ETFs is removing barriers that once kept retail investors on the sidelines.

We’re witnessing a fundamental shift where cryptocurrencies are viewed as legitimate portfolio components, not just speculative instruments.

The next challenge isn’t just product access—it’s matching crypto availability with investor education and strategic portfolio integration.

Crypto ETFs represent more than investment products; they’re signaling a complete transformation in how traditional finance views digital assets.

When trillions in institutional capital start flowing, even modest allocations become market-moving forces that can reshape entire industries.

The convergence of regulatory progress, product innovation, and institutional comfort suggests we’re entering crypto’s mainstream adoption phase.

This isn’t about mass retail adoption—it’s about measured, strategic allocations from the world’s largest capital pools that could transform the crypto landscape forever.

,

Leave a Reply

Want to join the discussion?Feel free to contribute!