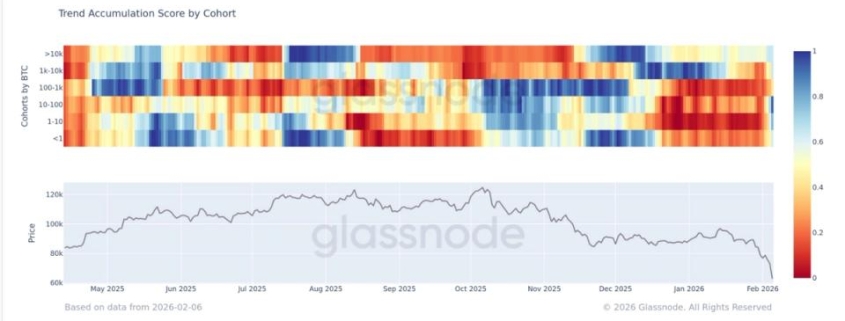

BTC is seeing accumulation across all cohorts, according to Glassnode

Bitcoin’s Capitulation Phase Shifts to Accumulation as Investors See Value in $60K Range

Bitcoin’s price action has taken a dramatic turn over the past two weeks, transforming what began as a period of retail panic into a coordinated accumulation effort across nearly all investor cohorts. The cryptocurrency, which started February trading around $80,000, experienced a brutal 25% plunge to $60,000 by February 5th, triggering what analysts are calling one of the most severe capitulation events in Bitcoin’s history.

The shift in market dynamics has been particularly striking. While retail investors were scrambling to exit positions during the initial selloff, large-scale “whale” investors were quietly positioning themselves for what they saw as a generational buying opportunity. Now, as the dust settles, the market is displaying clear signs of broad-based accumulation that spans across wallet sizes and investment strategies.

Glassnode’s Accumulation Trend Score by cohort provides compelling evidence of this behavioral transformation. This sophisticated metric evaluates the relative strength of accumulation across different wallet sizes by considering both the entity size and the volume of BTC accumulated over a 15-day rolling period. The scoring system operates on a simple principle: scores approaching 1 indicate active accumulation, while scores nearing 0 suggest distribution.

The most recent data reveals a significant milestone – the aggregate Accumulation Trend Score has climbed to 0.68, crossing the critical 0.5 threshold for the first time since late November. This metric’s historical correlation with market bottoms adds weight to the current narrative. The previous instance of such broad-based accumulation coincided with Bitcoin establishing a local bottom near $80,000, suggesting we may be witnessing a similar pattern unfold.

Among the various investor cohorts, one group has emerged as the most aggressive buyer during this dip: wallets holding between 10 and 100 BTC. These mid-tier investors have shown remarkable conviction as prices tested the $60,000 level, potentially signaling confidence in Bitcoin’s long-term value proposition despite the recent volatility.

The current market structure bears the hallmarks of a classic accumulation phase following capitulation. The more than 50% drawdown from Bitcoin’s October all-time high appears to have finally shaken out weak hands while attracting strategic buyers who view the current price levels as deeply discounted relative to Bitcoin’s fundamental value and adoption trajectory.

This accumulation pattern across multiple cohorts suggests a maturing market where different investor segments are beginning to coordinate their strategies based on shared assessments of value. The fact that both retail and institutional-sized wallets are showing accumulation signals indicates a broad consensus that Bitcoin’s price discovery process may have overcorrected to the downside.

However, market participants remain cautious about declaring a definitive bottom. The cryptocurrency market’s notorious volatility means that further price discovery could still occur, potentially testing lower levels before establishing a sustainable upward trend. Nevertheless, the current data suggests that the worst of the panic selling may be behind us, with investors increasingly viewing Bitcoin through a long-term value lens rather than reacting to short-term price movements.

The technical implications of this shift are significant. As accumulation continues across various wallet sizes, the available supply on exchanges continues to diminish, potentially setting the stage for a supply squeeze if demand were to increase suddenly. This dynamic, combined with the historical tendency for Bitcoin to perform well following periods of capitulation and subsequent accumulation, creates a compelling case for potential upside in the medium to long term.

The market’s response to this accumulation phase will be closely watched by analysts and investors alike. If the current trend continues, we may be witnessing the early stages of the next major Bitcoin bull cycle, with the recent capitulation serving as the necessary cleansing event that typically precedes significant price appreciation.

From a broader perspective, this market behavior reflects Bitcoin’s evolution from a speculative asset to a more mature store of value. The coordinated accumulation across different investor cohorts suggests growing sophistication in how market participants approach Bitcoin investment, with more emphasis on fundamental value and long-term potential rather than short-term trading opportunities.

As the cryptocurrency market continues to mature, these patterns of capitulation followed by accumulation are likely to become more pronounced and predictable, providing valuable signals to investors about potential market turning points. The current situation exemplifies this maturation process, with data-driven analysis providing clear insights into market sentiment and behavior.

Tags and Viral Phrases:

Bitcoin accumulation phase, whale accumulation, retail capitulation, Glassnode Accumulation Trend Score, Bitcoin bottom formation, $60K Bitcoin support, mid-tier Bitcoin investors, crypto market capitulation, Bitcoin supply squeeze, October all-time high retracement, Bitcoin value proposition, exchange supply depletion, next Bitcoin bull cycle, cryptocurrency market maturity, long-term Bitcoin investment, generational buying opportunity, Bitcoin price discovery, coordinated market accumulation, institutional Bitcoin buying, Bitcoin fundamental value, market turning points, cryptocurrency investment strategies, Bitcoin volatility, store of value narrative, data-driven crypto analysis, market sentiment indicators, Bitcoin technical analysis, crypto whale activity, retail vs institutional dynamics, Bitcoin supply dynamics

,

Leave a Reply

Want to join the discussion?Feel free to contribute!