BTC steadies at $67,000 as traders pay for crash protection

Bitcoin Stabilizes Above $66K After Sharp Drop, But Market Caution Persists

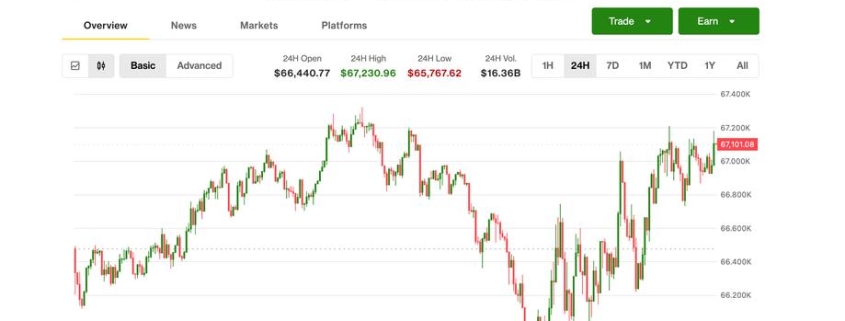

Bitcoin (BTC) found its footing on Thursday, stabilizing above a key technical level after briefly slipping below $66,000 in early U.S. trading. The largest cryptocurrency recently changed hands at around $67,000, up roughly 1% over the past 24 hours, signaling a modest recovery from Wednesday’s volatility.

The stabilization comes after Bitcoin experienced a notable dip that tested investor resolve, with the $66,000 level emerging as critical support that bulls fought to defend. This price action reflects the ongoing tug-of-war between buyers and sellers in a market still searching for clear direction.

Altcoins Show Weakness as Caution Dominates

The broader crypto market painted a less optimistic picture, with the CoinDesk 20 Index lagging behind Bitcoin’s modest gains. Major altcoins including ether (ETH), XRP, BNB, Dogecoin (DOGE), and Solana (SOL) traded flat to slightly lower during the same period, perhaps signaling continued caution in altcoins amid shaky crypto markets.

This divergence between Bitcoin and altcoins suggests that investors remain selective, with capital flowing toward the perceived safety of the largest cryptocurrency while smaller tokens face selling pressure. The muted performance of altcoins could indicate that traders are waiting for clearer signals before committing to more speculative positions.

Crypto Stocks Show Modest Gains

Crypto-related stocks climbed modestly higher across the board, with bitcoin miners CleanSpark (CLSK) and MARA (MARA) standing out with 6% gains. This positive performance in the equity market provides a counterpoint to the mixed results in crypto trading, suggesting that institutional investors may be finding value in mining operations despite recent price volatility.

The gains in mining stocks could reflect optimism about potential operational improvements or expectations of a recovery in Bitcoin’s price, which would directly benefit these companies’ profitability. However, the overall muted reaction in crypto equities suggests that broader market participants remain cautious about the sector’s near-term prospects.

Policy Developments Offer Glimmers of Progress

On the policy front, there were tentative signs of progress on the digital asset market structure bill. White House-hosted talks between crypto industry representatives and bankers yielded incremental movement, though no compromise has yet emerged. These discussions represent a crucial step toward establishing clearer regulatory frameworks for the cryptocurrency industry in the United States.

The ongoing negotiations highlight the complex balance between fostering innovation in digital assets and ensuring adequate consumer protections. Industry observers note that while progress is being made, the path to comprehensive legislation remains uncertain, with various stakeholders continuing to advocate for their interests.

Cracks in the Crypto Lending Sector Reemerge

At the same time, cracks from the recent crypto downturn are still surfacing. Chicago-based crypto lender Blockfills is exploring a sale after enduring a $75 million lending loss during the recent price crash and having temporarily suspended client deposits and withdrawals last week.

This development serves as a stark reminder of the risks still present in the crypto lending sector, which was at the center of the devastating collapses of Celsius and FTX in 2022. While the fallout from Blockfills’ troubles appears contained for now, it underscores the ongoing challenges facing companies that extend credit in the volatile cryptocurrency market.

Macroeconomic Headwinds Continue to Loom

Risks outside the crypto sphere continue to loom that leave investors hesitant to take risks. Worries about mounting stress in credit markets flared up after private-equity company Blue Owl permanently curbed redemptions in its $1.7 billion retail-focused private credit fund.

OWL fell 6% on Thursday, while the shares of other major private credit managers, including Apollo Global, Ares Capital, and Blackstone slid more than 5%. This stress in traditional financial markets creates a challenging backdrop for risk assets like cryptocurrencies, as investors may become more risk-averse amid concerns about broader economic stability.

Geopolitical Tensions Add to Market Uncertainty

Geopolitical tensions remain another overhang, with the prospect of U.S. military action against Iran still in play amid an ongoing regional buildup. Crude oil rallied another 2.8% over $66 per barrel, hitting its highest price since August.

The escalation in oil prices reflects growing concerns about potential supply disruptions, which could have ripple effects throughout the global economy. For cryptocurrency markets, this adds another layer of uncertainty, as higher energy prices could impact mining costs and potentially influence investor sentiment toward digital assets.

Derivatives Market Reveals Defensive Positioning

That caution is reflected in crypto derivatives markets, Jake Ostrovskis, head of OTC at trading firm Wintermute, pointed out. Many traders are buying downside protection while limiting upside participation, effectively paying for insurance against another drop while capping potential gains in a breakout to the upside.

This defensive positioning suggests that professional traders are preparing for continued volatility rather than expecting a smooth recovery. The prevalence of protective strategies indicates that market participants are prioritizing capital preservation over aggressive upside bets, a mindset that could limit the pace of any potential rally.

ETF Investors Face Paper Losses

The average U.S. bitcoin ETF cost basis now sits near $84,000, leaving a large share of ETF investors underwater – nursing a 20% paper loss on average – and potentially vulnerable to “capitulation selling” if prices slide further. This significant unrealized loss among ETF holders creates a potential source of selling pressure if these investors decide to cut their losses.

Still, total ETF holdings remain within about 5% of their peak in bitcoin terms, suggesting institutions are trimming exposure rather than rushing for the exits. This measured approach to reducing positions indicates that institutional investors may be taking a longer-term view, despite the current market weakness.

Market Technicals and Trading Ranges

Bitcoin’s ability to hold above $66,000 represents an important technical achievement, as this level has served as both support and resistance at various points in recent months. The cryptocurrency’s recovery from Wednesday’s lows demonstrates that buyers remain active at these levels, but the struggle to reclaim higher price points suggests that sellers are equally determined.

The 1% gain over 24 hours, while positive, pales in comparison to the volatility witnessed in recent sessions. This relatively muted movement could indicate that the market is entering a period of consolidation, with traders waiting for clearer signals before committing to more directional bets.

Institutional Sentiment and Market Structure

The continued presence of institutional investors in the market, despite recent losses, speaks to the maturing nature of the cryptocurrency ecosystem. Unlike the retail-driven rallies of previous cycles, the current market features significant participation from sophisticated investors who appear willing to weather short-term volatility in pursuit of longer-term opportunities.

However, the defensive positioning in derivatives markets and the significant unrealized losses in ETF positions suggest that institutional sentiment remains fragile. A further decline in prices could trigger a wave of selling from these investors, potentially accelerating any downside move.

Looking Ahead: Key Levels and Catalysts

As Bitcoin attempts to stabilize, traders will be watching key technical levels closely. The $66,000 support level has proven its importance, but reclaiming the $68,000-$70,000 range would provide a more convincing signal of strength. On the downside, a break below $66,000 could open the door to further declines toward $60,000.

Catalysts for the next major move could come from various sources, including regulatory developments, macroeconomic data, or shifts in institutional positioning. The ongoing policy discussions around market structure could provide clarity that either boosts confidence or introduces new uncertainties. Similarly, developments in traditional financial markets, particularly around credit conditions and geopolitical tensions, could influence risk appetite across all asset classes.

Market Psychology and Investor Behavior

The current market environment reflects a delicate balance between fear and opportunity. While recent price action has been challenging, the fact that Bitcoin has maintained support above key levels suggests that the long-term bullish thesis remains intact for many investors. However, the defensive positioning and selective capital allocation indicate that market participants are proceeding with caution.

This cautious optimism could persist until Bitcoin demonstrates the ability to reclaim higher price levels with conviction. Until then, traders are likely to remain focused on risk management, using options and other derivatives to protect against further downside while maintaining exposure to potential upside.

Tags & Viral Phrases:

- Bitcoin stabilizes above $66K

- Crypto market caution persists

- Altcoins show weakness

- Crypto stocks gain modestly

- Policy progress on market structure

- Blockfills explores sale after $75M loss

- Credit market stress emerges

- Geopolitical tensions escalate

- Traders buy downside protection

- ETF investors face 20% losses

- Institutional sentiment fragile

- Key technical levels tested

- Defensive positioning dominates

- Market consolidation phase

- Risk management priority

- Bitcoin support holds

- Regulatory clarity awaited

- Energy prices impact crypto

- Institutional investors trimming exposure

- Crypto lending sector risks

,

Leave a Reply

Want to join the discussion?Feel free to contribute!