Cathie Wood Buys $24.8M in Crypto Stocks Despite Slump — What’s Ark Invest’s Real Plan?

Cathie Wood’s Ark Invest Snaps Up $24.8M in Crypto Stocks Despite Market Bloodbath — Here’s the Bold Strategy

In a jaw-dropping move that’s got Wall Street buzzing, Cathie Wood’s Ark Invest doubled down on crypto-linked stocks this week, scooping up a massive $24.8 million worth of positions while the entire digital asset sector was bleeding red.

While most investors were hitting the panic button as Bitcoin tumbled below $80,000 and crypto exchange volumes cratered by 60%, Ark’s flagship funds were busy loading up on what they clearly see as deep-value opportunities in the blockchain space.

The Big Money Moves That Have Everyone Talking

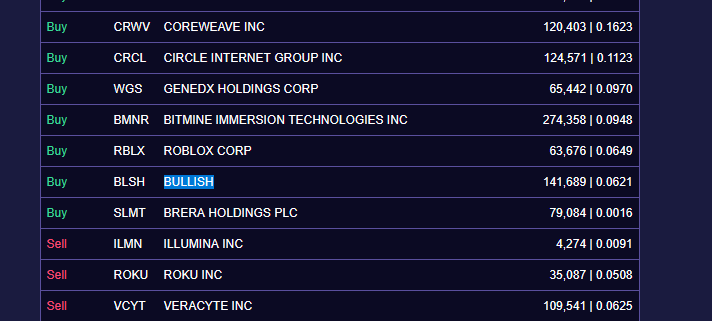

Ark’s flagship ARK Innovation ETF (ARKK) led the charge with some serious firepower:

- Robinhood (HOOD): 235,077 shares worth $21.1 million

- BitMine Immersion Technologies (BITM): 274,358 shares worth $6.2 million

- Circle (CRCL): $9.4 million worth of shares

- Bullish (BULL): $6 million investment

- Block Inc. (SQ): $1.9 million stake

- Coinbase (COIN): $1.25 million position

The timing? Absolutely brutal for crypto markets. Bitcoin had just broken below the psychologically crucial $80,000 level for the first time since April 2025, triggering over $2.5 billion in liquidations and sending exchange stocks into freefall.

While Others Panic, Ark Invests

While Robinhood and Circle were down nearly 10% and 8% respectively at market open, Ark was busy doing what it does best – buying the dip with conviction.

This isn’t Ark’s first rodeo during crypto carnage. Just last November, they deployed $42 million into crypto stocks following a 9.6% market crash. Their strategy seems clear: view crypto market weakness as buying opportunities for long-term structural plays.

The Numbers Don’t Lie

The broader crypto exchange landscape is facing unprecedented headwinds:

- Spot trading volumes have collapsed from $2 trillion in October to roughly $1 trillion by January’s end

- Coinbase shares have plummeted over 40% in six months

- Bullish is down nearly 57% over the same period

- Robinhood has held up relatively better with just 16% decline

Yet Ark presses forward, seemingly unfazed by the carnage.

Cathie Wood’s Master Plan Revealed

Ark’s aggressive buying spree isn’t random speculation – it’s part of a meticulously crafted long-term vision that’s nothing short of revolutionary.

In their bombshell “Big Ideas 2026” report, Ark forecasts the entire crypto market could explode to $28 trillion by 2030, with Bitcoin commanding roughly 70% of that total market value as institutional adoption goes mainstream.

This isn’t just wishful thinking. Ark is positioning itself at the intersection of traditional finance and blockchain infrastructure, betting big that companies like Coinbase, Robinhood, and Circle will become the backbone of tomorrow’s financial system.

The Contrarian King Strikes Again

Love her or hate her, Cathie Wood has built her empire on being exactly this kind of contrarian investor – buying when others are fearful, holding when others are panicking, and maintaining conviction when the market loses its mind.

With $16.8 billion in assets under management and ARK Innovation ETF alone holding $6.98 billion, every move Ark makes sends ripples through the market. Their Q4 2025 was brutal, with Coinbase delivering the largest quarterly drag across all Ark funds amid 9% quarter-over-quarter decline in spot trading volumes.

But instead of retreating, Ark doubled down.

What This Means for Crypto’s Future

Ark’s massive buying spree signals something profound: the smart money isn’t abandoning crypto – it’s consolidating positions for what they believe will be the next massive bull run.

By accumulating shares in exchange infrastructure, payment platforms, and mining operations during this downturn, Ark is essentially placing bets on the picks and shovels of the crypto gold rush.

The message is clear: when the next crypto bull market arrives (and Ark clearly believes it will), these companies will be positioned to capture unprecedented value as trading volumes, institutional adoption, and blockchain integration all surge simultaneously.

Whether you agree with Ark’s thesis or not, one thing’s certain – Cathie Wood isn’t just playing the game, she’s attempting to change it entirely.

tags #CathieWood #ARKInvest #Bitcoin #Crypto #Blockchain #Investing #MarketStrategy #DigitalAssets #InstitutionalAdoption #ContrarianInvesting #MarketOpportunities #FinancialRevolution #CryptoStocks #LongTermVision #MarketAnalysis #InvestmentStrategy #TechInnovation #FutureOfFinance

“Buying the dip with conviction”

“Positioning for the next crypto bull run”

“Smart money sees opportunity in chaos”

“The contrarian king strikes again”

“Revolutionizing traditional finance with blockchain”

“Institutional adoption is the future”

“Consolidating positions for massive upside”

“Changing the game entirely”

“Deep-value opportunities in crypto winter”

“Building the backbone of tomorrow’s financial system”

“The picks and shovels of the crypto gold rush”

“When others panic, Ark invests”

“Master plan for $28 trillion crypto market”

“Betting big on blockchain infrastructure”

“Unshaken conviction in digital assets”

“Market weakness as buying opportunities”

“Long-term structural plays in crypto”

“Leading the charge in crypto adoption”

“Positioning for unprecedented value capture”

,

Leave a Reply

Want to join the discussion?Feel free to contribute!