Ether.fi Moves Crypto Card Product to OP Mainnet From Scroll

Ether.fi’s Bold Leap: Why the Crypto Card Giant Is Swapping Scroll for Optimism’s Superchain

In a seismic shift that’s sending ripples through the Ethereum Layer 2 landscape, ether.fi has announced its decision to migrate its flagship consumer payments product, Ether.fi Cash, from Scroll to Optimism’s OP Mainnet. This isn’t just another infrastructure update—it’s a strategic masterstroke that will see roughly 70,000 active cards and 300,000 accounts make the jump, along with millions in Total Value Locked (TVL).

The migration, revealed in a bombshell blog post this Wednesday, represents one of the most significant real-world use case relocations in crypto this year. As Layer 2 networks battle for supremacy in the race to onboard mainstream users, ether.fi’s decision underscores a fundamental truth: in the world of consumer crypto payments, liquidity depth and ecosystem maturity trump all else.

The Numbers That Matter

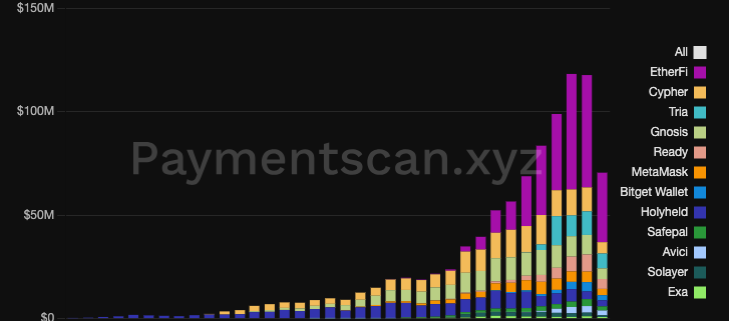

Let’s talk scale. Ether.fi Cash currently processes approximately $2 million in daily spend volume, facilitating nearly half of all crypto-native card transactions according to Paymentscan data. That’s not chump change—we’re talking about a product that has doubled its internal swaps (now at 2,000 daily) and spend transactions (28,000 daily) every two months.

The migration will leverage OP Enterprise’s dedicated support infrastructure, ensuring a smooth transition for users. Perhaps most impressively, ether.fi is committing to fully absorb gas fees for card transactions during and after the switch—a move that demonstrates both confidence in their decision and commitment to user experience.

Why This Move Changes Everything

Ether.fi didn’t become a payments powerhouse by accident. The company successfully pivoted from its asset restaking roots to launch Ether.fi Cash in 2024, creating a product that allows users to spend stablecoins or borrow against staked assets like eETH for real-world Visa purchases. It’s the kind of practical utility that crypto desperately needs to break into the mainstream.

The choice of underlying network is absolutely critical here. Just ask Moonwell, which learned this lesson the hard way when infrastructure failures led to catastrophic losses. For payment providers, operational stability isn’t optional—it’s existential. Ether.fi’s migration signals that, for this specific use case, the liquidity advantages of OP Mainnet currently outweigh the ZK-rollup benefits that Scroll offers.

What’s particularly fascinating is how this mirrors broader trends in the crypto space. Just as new frameworks are introducing unified liquidity and staking solutions to solve capital efficiency problems, ether.fi expects significantly deeper liquidity pools on OP Mainnet. This translates directly to better user experiences—lower slippage when converting crypto to fiat at the point of sale means more value stays in users’ pockets.

The Superchain Advantage

Let’s zoom out for a moment. The OP Stack processed a staggering 3.6 billion transactions in the second half of 2025 alone, representing 13% of all crypto transactions during that period. That’s not just impressive—it’s dominant.

OP Mainnet offers ether.fi access to the broader Superchain ecosystem, creating network effects that Scroll simply can’t match at this scale. It’s about more than just transaction costs or speed; it’s about being part of a thriving, interconnected DeFi ecosystem where liquidity flows freely and composability is the norm rather than the exception.

Winners and Losers in the L2 Wars

For Scroll, this represents a significant blow. The ZK-powered network had positioned itself as a serious contender for high-volume consumer applications, and ether.fi’s migration represents a notable loss of both volume and credibility. When one of crypto’s most successful consumer products decides your network isn’t the right fit, it sends a message to the entire industry.

For Optimism, this is a massive validation. Securing a high-retention consumer product like Ether.fi Cash reinforces OP Mainnet’s position as the go-to hub for real-world crypto applications. This comes at a particularly interesting time, as the broader Optimism ecosystem experiences internal shifts—notably with Base signaling moves toward a bespoke chain platform.

The implications extend beyond just these two networks. This consolidation reflects a maturing Ethereum ecosystem where projects are making pragmatic choices based on battle-tested infrastructure rather than chasing the latest technological novelty. It’s a sign that the crypto industry is growing up, prioritizing reliability and user experience over theoretical advantages.

What This Means for Crypto Users

For the average user, the backend changes won’t be immediately visible—your card will still work the same way. But behind the scenes, everything is getting better. Faster transactions, deeper liquidity, and lower slippage mean a smoother, more efficient experience. It’s the kind of infrastructure improvement that makes crypto more viable as an everyday payment method.

This migration also signals growing institutional confidence in the Ethereum ecosystem’s Layer 2 solutions. When a major player like ether.fi makes such a significant infrastructure bet, it sends a clear message to both users and other projects about where the real opportunities lie.

The Bigger Picture

Ether.fi’s migration is more than just a network switch—it’s a statement about the future of crypto payments. As the industry moves beyond speculative trading toward practical utility, the networks that can support high-volume, low-friction consumer applications will emerge as the true winners.

This decision aligns with broader market realities. Just as major funds have adjusted their ETH-related exposure to reflect prevailing market conditions, ether.fi is positioning itself for long-term success by choosing the infrastructure that best supports its growth trajectory.

The post Ether.fi Moves Crypto Card Product to OP Mainnet From Scroll appeared first on Cryptonews.

Tags & Viral Phrases

Layer 2 wars heating up, Scroll loses major client, Optimism scores big win, crypto payments go mainstream, ether.fi makes power move, Superchain dominance, ZK-rollup vs Optimistic rollup battle, $2M daily volume migration, 300K accounts on the move, Ethereum ecosystem maturing fast, institutional crypto adoption accelerates, crypto card revolution continues, liquidity depth wins the day, OP Enterprise partnership sealed, gas fees absorbed by protocol, payments infrastructure matters most, ether.fi cash scaling rapidly, 3.6 billion transactions processed, Base and Optimism dynamics shift, crypto native card transactions surge, unified liquidity solutions emerge, capital efficiency drives decisions, consumer crypto adoption accelerates, battle-tested infrastructure preferred, network effects matter more than tech specs, real-world crypto use cases expand, Layer 2 competition intensifies, crypto payments infrastructure evolves, ether.fi pivots successfully again, Visa crypto card integration deepens, staked ETH spending becomes reality, DeFi ecosystem maturity wins, Scroll ZK-rollup advantages questioned, OP Mainnet liquidity advantage proven, crypto payments user experience improves, institutional confidence in L2 solutions grows, practical crypto utility takes center stage, ether.fi migration signals industry maturation, crypto payments infrastructure consolidation continues

,

Leave a Reply

Want to join the discussion?Feel free to contribute!