McHenry predicts fast crypto deal as Witt brokers talks

Crypto Market Structure Bill Poised for Historic Passage as Washington and Industry Align on Landmark Legislation

In a stunning development that has sent shockwaves through both Washington and the global crypto industry, top policymakers revealed that comprehensive cryptocurrency market structure legislation could reach the President’s desk within months, marking what many are calling the most significant regulatory breakthrough in digital asset history.

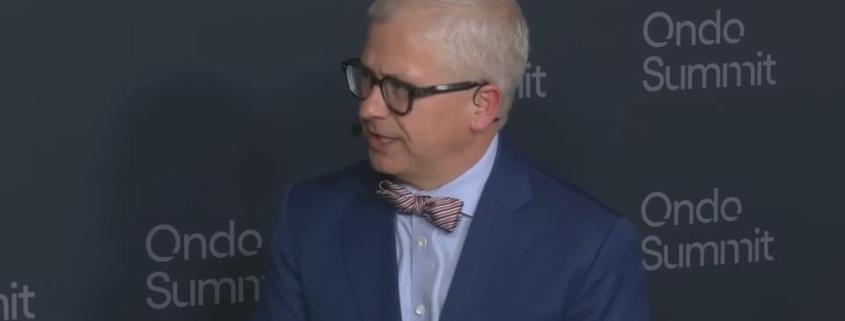

Speaking during a high-stakes CoinDesk Live session at the prestigious Ondo Summit in New York City, former House Financial Services Committee Chairman Patrick McHenry and senior White House advisor Patrick Witt delivered an electrifying assessment of the legislation’s trajectory, suggesting that what once seemed like a distant possibility is now within tangible reach.

Washington Optimism Reaches Fever Pitch

The atmosphere in Washington has shifted dramatically, with McHenry and Witt painting a picture of unprecedented momentum building across both ends of Pennsylvania Avenue. Industry insiders report that the political calculus has fundamentally changed, with lawmakers from both parties recognizing that comprehensive crypto regulation is no longer optional but essential for maintaining America’s competitive edge in the global digital economy.

“The stars are aligning in a way we haven’t seen before,” McHenry declared, his voice carrying the weight of someone who has witnessed countless legislative battles but sees something genuinely different this time. “We’re not just talking about incremental changes anymore. We’re looking at foundational reform that could redefine how digital assets operate in the United States.”

Witt echoed this sentiment with equal conviction, emphasizing that President Trump has personally elevated crypto legislation to a top-tier priority following the successful passage of the Genius Act. “When the President makes something a personal priority, things move quickly,” Witt noted, suggesting that bureaucratic inertia that typically slows major legislation may be overcome by executive urgency.

Inside the White House War Room

The negotiations taking place behind closed doors in the West Wing represent perhaps the most consequential regulatory discussions in crypto history. Witt provided rare insight into these high-level deliberations, describing recent White House-brokered meetings as “breakthrough sessions” that have begun transforming abstract principles into concrete statutory language.

“The magic is happening in the details,” Witt explained, revealing that negotiating teams are now “trading paper” – Washington-speak for exchanging actual draft legislative text. This marks a critical transition from conceptual agreement to practical implementation, where the rubber meets the road and theoretical consensus must survive the harsh reality of legal drafting.

The administration’s strategy appears to be one of aggressive mediation, with Witt positioning himself as the neutral broker tasked with finding common ground between traditionally opposed constituencies. “My job is to get to yes,” he stated plainly, acknowledging the delicate balance required to craft legislation that can survive both Senate scrutiny and House examination.

The Yield Wars: Battleground for Industry’s Future

At the heart of the legislative negotiations lies the explosive issue of stablecoin yield – a seemingly technical question that has become the nuclear option in crypto regulatory politics. The dispute cuts to the core of competing visions for America’s financial future, pitting traditional banking interests against the innovative forces of decentralized finance.

Witt outlined the contours of the debate with surgical precision: there is broad consensus on preventing deceptive marketing practices, particularly the dangerous practice of implying FDIC insurance for stablecoin products. However, the question of whether centralized exchanges should be permitted to pay passive yield on idle stablecoin balances has emerged as the make-or-break issue.

Community banks, especially smaller regional lenders, view yield-bearing stablecoins as an existential threat to their deposit base. These institutions argue that allowing crypto platforms to offer competitive returns could drain traditional banking of the very deposits that fund local lending and economic development. Conversely, crypto firms maintain that yield is not just a feature but a fundamental driver of platform engagement and user retention.

“The yield question isn’t just about economics,” Witt emphasized. “It’s about the future architecture of our financial system. Do we want a system that’s more open and competitive, or do we want to preserve the status quo?”

McHenry’s DeFi Manifesto: Decentralization as Destiny

Perhaps the most provocative element of McHenry’s presentation was his unequivocal declaration that “market structure legislation doesn’t work without DeFi.” This statement represents a fundamental philosophical shift in how Washington views cryptocurrency – not as a fringe technology to be regulated into submission, but as a transformative innovation that must be incorporated into the regulatory framework.

McHenry’s argument for decentralization goes beyond mere technological preference. He presented a compelling case that decentralization is the source of crypto’s competitive advantages: efficiency through disintermediation, transparency through public ledgers, and lower costs through automated protocols. His comparison of tokenized lending products to traditional securities lending was particularly striking, suggesting that DeFi protocols are already delivering tangible benefits to users.

“The market is voting with its feet,” McHenry asserted, pointing to the rapid growth of decentralized protocols despite regulatory uncertainty. “People are choosing these systems because they’re better, cheaper, and more transparent. Our job is to create a regulatory framework that enables that innovation while protecting consumers.”

Ethics in the Age of Crypto: Navigating Political Landmines

No discussion of crypto legislation would be complete without addressing the ethics controversies that have swirled around the industry. McHenry took a nuanced approach to these concerns, arguing for permanent, consistent ethics rules that apply equally to all officials rather than targeting specific individuals or administrations.

The former chairman’s comments on Democratic proposals for sweeping restrictions on officials’ spouses were particularly pointed. He characterized these measures as “grossly over-scoped,” suggesting that while ethics reform is necessary, it must be proportionate and not designed to weaponize regulation against political opponents.

Witt added that a narrower ethics compromise could unlock crucial bipartisan support, though he acknowledged that Republicans retain the option of pursuing partisan passage if necessary. This political realism underscores the delicate balance required to navigate crypto legislation through a divided Congress.

The Legislative Countdown: Racing Against the Clock

The timeline McHenry and Witt outlined represents nothing short of legislative blitzkrieg. With Senate action potentially coming before Easter and Memorial Day as the target for presidential signature, the crypto industry faces its most compressed regulatory timeline in history.

This accelerated schedule reflects both the growing political consensus around crypto regulation and the recognition that America cannot afford to fall behind in the global digital asset race. Countries from Switzerland to Singapore have already established comprehensive crypto frameworks, and U.S. policymakers appear determined to ensure American innovation isn’t hamstrung by regulatory uncertainty.

“What we’re seeing is the convergence of multiple forces,” Witt explained. “There’s political will, industry readiness, and a recognition that the status quo is unsustainable. When those align, things move fast.”

The Stakes: America’s Digital Future Hangs in the Balance

The implications of this legislation extend far beyond the crypto industry itself. Success would position the United States as the global leader in digital asset regulation, potentially attracting billions in investment and thousands of high-skilled jobs. Failure, conversely, could cede ground to international competitors and force American innovation offshore.

Industry leaders watching the proceedings expressed a mixture of excitement and anxiety. “This is our moment,” said one prominent exchange executive who requested anonymity. “But it’s also our test. Get this right, and crypto becomes mainstream. Get it wrong, and we could be looking at years of regulatory limbo.”

The legislation’s success will ultimately depend on whether lawmakers can bridge the remaining divides, particularly around stablecoin yield and DeFi regulation. But the growing optimism in Washington suggests that for the first time in crypto’s turbulent history, comprehensive, sensible regulation may be within reach.

As McHenry and Witt concluded their discussion, the message was clear: the era of crypto operating in regulatory darkness may be ending, replaced by a new dawn of clarity, certainty, and mainstream acceptance. Whether that dawn breaks this year or remains just over the horizon will depend on the political courage and wisdom of those tasked with crafting America’s digital future.

Tags

crypto regulation, market structure bill, Patrick McHenry, Patrick Witt, stablecoin yield, DeFi legislation, cryptocurrency legislation, White House crypto policy, Genius Act, digital asset regulation, blockchain legislation, crypto industry news, Washington crypto policy, Memorial Day legislation, Ondo Summit, CoinDesk Live, tokenized lending, decentralized finance, crypto ethics, bipartisan crypto legislation

Viral Phrases

“Memorial Day crypto breakthrough”

“DeFi is non-negotiable”

“The yield wars begin”

“Trading paper in the White House”

“Market structure without DeFi doesn’t work”

“President Trump’s personal crypto priority”

“Community banks vs crypto yield”

“Washington’s crypto fever pitch”

“Legislative blitzkrieg”

“America’s digital asset race”

“Regulatory darkness ends”

“Mainstream crypto acceptance”

“Global crypto leadership”

“High-stakes White House negotiations”

“Crypto’s make-or-break moment”

,

Leave a Reply

Want to join the discussion?Feel free to contribute!