Miners are being squeezed as bitcoin’s $70,000 price fails to cover $87,000 production costs

Bitcoin Plunges 20% Below Production Cost as Mining Sector Faces Mounting Pressure

Bitcoin has plummeted to levels that have sent shockwaves through the cryptocurrency mining industry, now trading nearly 20% below its estimated average production cost. With the flagship digital asset hovering around $70,000 per BTC while the estimated cost to mine one bitcoin sits at approximately $87,000, miners across the globe are facing unprecedented financial strain that threatens the very foundation of the Bitcoin network’s security infrastructure.

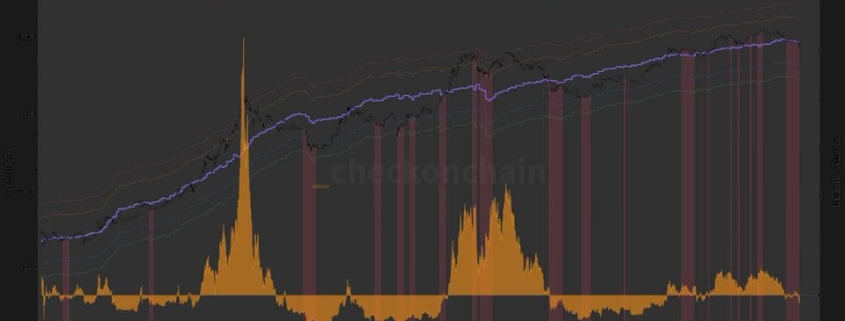

The alarming price divergence comes courtesy of data from Checkonchain, which utilizes network difficulty as a sophisticated proxy for the mining industry’s comprehensive cost structure. By establishing a mathematical relationship between difficulty and Bitcoin’s market capitalization, analysts have derived a model that provides crucial insights into the average cost of producing the world’s most valuable cryptocurrency. This methodology has proven remarkably accurate in previous market cycles, serving as a reliable barometer for industry health.

Historical precedent paints a concerning picture for current market conditions. During previous bear markets in 2019 and 2022, Bitcoin consistently traded below its production cost for extended periods before gradually recovering and converging back toward equilibrium levels. The current situation appears to be following this troubling pattern, with the cryptocurrency now testing the resolve of even the most well-capitalized mining operations.

The computational power securing the Bitcoin network, measured by hashrate, has experienced dramatic fluctuations that mirror the sector’s financial distress. Hashrate peaked near 1.1 zettahash (ZH/s) in October 2024, representing the pinnacle of mining infrastructure deployment. However, the subsequent 20% decline in total network computational power reveals the harsh reality facing miners who cannot operate profitably at current price levels. This hashrate contraction forced less efficient miners to shut down operations entirely, effectively self-regulating the network’s security budget through market forces.

Despite the severe downturn, there are tentative signs of stabilization emerging from the data. Recent measurements show hashrate rebounding to 913 EH/s, suggesting that the most efficient mining operations have weathered the storm and are beginning to expand their market share. This consolidation phase, while painful for individual companies, ultimately strengthens the Bitcoin network by ensuring that only the most efficient operators continue contributing computational resources.

The human cost of this market dislocation cannot be overstated. Mining companies that expanded aggressively during the 2023-2024 bull market, often taking on substantial debt to finance infrastructure investments, now find themselves trapped between fixed operational costs and collapsing revenue streams. Energy expenses, which represent the single largest operational cost for miners, continue to pressure profit margins even as bitcoin prices fall. The fixed nature of power purchase agreements and hosting contracts means that miners cannot simply reduce costs proportionally to falling bitcoin prices.

This financial squeeze has triggered a cascade of forced selling across the sector. Miners, facing negative cash flow positions, have been compelled to liquidate their bitcoin holdings to fund day-to-day operations, cover mounting energy bills, and service debt obligations. This ongoing miner capitulation creates a self-reinforcing cycle where selling pressure from struggling miners further depresses bitcoin prices, which in turn increases the number of miners operating at a loss.

Industry analysts point to the “hash ribbon” metric, which tracks the relationship between short-term and long-term moving averages of hashrate, as a potential indicator of market bottom formation. Historically, when hash ribbons compress and eventually cross, it has signaled the end of miner capitulation and the beginning of price recovery phases. However, the current environment remains characterized by persistent stress, with many analysts suggesting that additional pain may be necessary before a sustainable recovery can begin.

The broader implications for Bitcoin’s security model are significant. As mining becomes less profitable, the incentive structure that underpins the entire Bitcoin ecosystem comes under pressure. Reduced hashrate means decreased network security, potentially making the blockchain more vulnerable to various attack vectors. While the Bitcoin protocol’s difficulty adjustment mechanism ensures that blocks continue to be mined at regular intervals regardless of hashrate fluctuations, the economic sustainability of the mining sector remains crucial for long-term network health.

Institutional investors and market participants are closely monitoring these developments, recognizing that miner health serves as a leading indicator for broader market conditions. The current situation has sparked debate about the long-term viability of proof-of-work consensus mechanisms and whether alternative approaches might better align with the economic realities of cryptocurrency markets.

As the industry navigates this challenging period, the resilience of the Bitcoin network continues to be tested. The coming months will prove critical in determining whether the mining sector can adapt to these new economic realities or whether further consolidation and potential disruption lie ahead. What remains clear is that the current price environment represents a fundamental stress test for Bitcoin’s economic model, with implications that extend far beyond the immediate concerns of mining operators.

Tags: #Bitcoin #CryptoMining #Hashrate #BTC #Cryptocurrency #MiningCrisis #MarketAnalysis #Blockchain #ProofOfWork #DigitalAssets #MinerCapitulation #CryptoWinter #BitcoinPrice #MiningEconomics #NetworkSecurity

Viral Sentences:

Bitcoin mining apocalypse as hashrate crashes 20%

Miners bleeding cash as BTC falls below production cost

Bitcoin network security under threat as miners capitulate

The great mining shakeout has begun

Hashrate collapse signals deeper crypto winter ahead

Bitcoin’s economic model faces existential test

Mining death spiral accelerates as BTC prices plummet

Institutional investors watch mining sector for market clues

Bitcoin’s hashrate rollercoaster reveals industry stress

The $87,000 question: can miners survive?

Bitcoin mining: the unprofitable frontier

Crypto winter 2.0 hits miners where it hurts

Network difficulty tells the real story of crypto markets

Mining capitulation could signal bottom for BTC

Bitcoin’s security budget under pressure from falling prices

,

Leave a Reply

Want to join the discussion?Feel free to contribute!