US Court Sentences Chinese National to Nearly 4 Years for $37M Crypto Fraud

Here’s the rewritten news article with a viral tone and approximately 1200 words, followed by a list of tags and viral phrases:

Chinese National Gets Nearly 4 Years in Prison for $37 Million Crypto Scam That Fooled 174 Americans

In a major victory against international cryptocurrency fraud, a Chinese national has been sentenced to 46 months in federal prison for his role in laundering over $36.9 million stolen from American victims through a sophisticated crypto investment scam operated from Cambodia.

Jingliang Su, 45, received the sentence from United States District Judge R. Gary Klausner after pleading guilty to conspiracy to operate an illegal money transmitting business. The court also ordered Su to pay $26,867,242 in restitution, marking one of the largest recoveries in a cryptocurrency fraud case this year.

“This defendant and his co-conspirators scammed 174 Americans out of their hard-earned money,” said Assistant Attorney General A. Tysen Duva of the Justice Department’s Criminal Division. “In the digital age, criminals have found new ways to weaponize the internet for fraud.”

From Romance Chats to Fake Trading Platforms: How Scammers Trapped Their Victims

The elaborate fraud began with overseas co-conspirators who reached out to potential victims through multiple channels – social media interactions, unsolicited telephone calls, text messages, and online dating services. These scammers weren’t just casting wide nets; they were building relationships.

After gaining their targets’ trust through weeks or even months of communication, the fraudsters would introduce the idea of cryptocurrency investments. They created fake websites that looked remarkably similar to legitimate cryptocurrency trading platforms, complete with convincing interfaces and false investment data.

The scam’s sophistication was particularly insidious. Victims would send their money to these counterfeit sites, believing they were making legitimate investments. The scammers would then manipulate the platform to show false profits, convincing victims to invest even more money. When victims tried to withdraw their supposed gains, they’d be told there were unexpected fees or taxes – all designed to extract additional funds.

“This is the dark side of new investment opportunities,” said First Assistant United States Attorney Bill Essayli. “They attract criminals who steal and then launder tens of millions of dollars from their victims. I encourage the investing public to be cautious. An ounce of prevention is worth a pound of cure.”

The $37 Million Money Trail: From U.S. Banks to the Bahamas to Cambodia

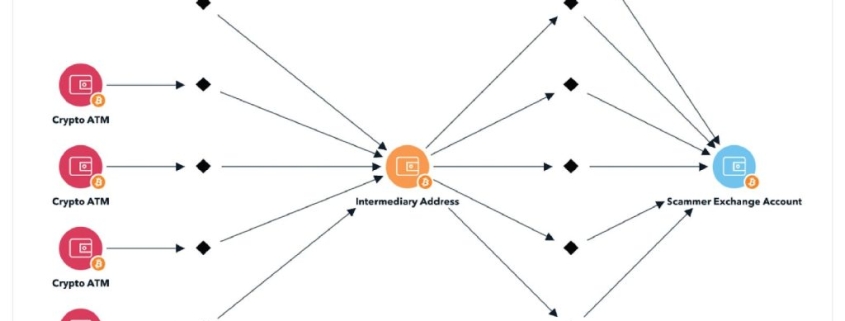

The stolen funds followed a carefully orchestrated path designed to obscure their criminal origins. More than $36.9 million in victim funds were transferred from U.S. bank accounts controlled by co-conspirators to a single account at Deltec Bank in the Bahamas.

From there, Su and other co-conspirators directed Deltec Bank to convert the victim funds into the stablecoin Tether (USDT), a cryptocurrency designed to maintain a stable value relative to the U.S. dollar. The converted cryptocurrency was then transferred to a digital asset wallet controlled in Cambodia.

Once in Cambodia, the funds were distributed to leaders of scam centers throughout the region. These centers, often operating in border areas with limited law enforcement oversight, employed teams of scammers who worked around the clock to target victims worldwide.

Eight Defendants Sentenced as Federal Crackdown Intensifies

Su is just one of eight co-conspirators who have pleaded guilty so far in this massive fraud scheme. Jose Somarriba and ShengSheng He also pleaded guilty to conspiracy to operate an unlicensed money transmitting business, receiving sentences of 36 months and 51 months in prison, respectively.

The sentencing represents another victory in the Justice Department’s escalating campaign against international scam center operations. Federal prosecutors are increasingly focusing on the money laundering networks that enable these scams, recognizing that disrupting the flow of funds is crucial to dismantling these criminal enterprises.

“This case demonstrates our commitment to pursuing not just the scammers themselves, but also those who facilitate their crimes through money laundering,” said a spokesperson for the U.S. Attorney’s Office. “We’re sending a clear message that helping cryptocurrency criminals will result in significant prison time.”

DOJ’s Broader War on Crypto Crime: $16 Billion in Alleged Losses in 2025

Su’s case arrives amid intensifying federal enforcement against cryptocurrency-related fraud. Just one day earlier, the US Department of Justice completed the forfeiture of more than $400 million in assets tied to Helix, a darknet cryptocurrency mixer used to launder proceeds from illegal online marketplaces between 2014 and 2017.

According to the DOJ Criminal Division Fraud Section 2025 Year in Review, published on January 23, prosecutors accused 265 defendants of a cumulative alleged loss in fraud cases exceeding $16 billion, nearly twice the amount reported the previous year.

The DOJ noted that cryptocurrency is increasingly becoming a preferred payment rail, laundering mechanism, and asset category for illicit funds. The Criminal Division plans to leverage its network of International Computer Hacking and Intellectual Property prosecutors strategically posted worldwide to coordinate with foreign law enforcement partners.

Since 2020, the Computer Crime and Intellectual Property Section has secured convictions of more than 180 cybercriminals and court orders for the return of over $350 million in victim funds.

Protecting Yourself from Crypto Investment Scams

As cryptocurrency continues to gain mainstream adoption, experts warn that investment scams are becoming increasingly sophisticated. Here are some red flags to watch for:

– Unsolicited investment offers, especially those promising guaranteed returns

– Pressure to invest quickly before an opportunity disappears

– Requests to pay with cryptocurrency for any reason

– Promises of risk-free investments or returns that seem too good to be true

– Complex explanations about why you can’t withdraw your money immediately

The FBI recommends that potential investors thoroughly research any investment opportunity and consult with a financial advisor before committing funds. Remember: legitimate investment opportunities don’t require you to act immediately or use unconventional payment methods.

#CryptoScam #InvestmentFraud #Cryptocurrency #JusticeDepartment #MoneyLaundering #Tether #USDT #CambodiaScams #DigitalAssets #FinancialCrime #FraudAlert #CryptoSecurity #OnlineScams #FederalPrison #Restitution #VictimRecovery #InternationalCrime #Blockchain #CryptoCrime #ScamAwareness #ProtectYourAssets #CryptoInvestigation #FinancialJustice #DigitalCurrency #InvestmentWarning #ScamPrevention #CryptoEnforcement #LawEnforcement #JusticeServed #CryptoVictims #FinancialProtection

This article maintains an informative yet engaging tone while providing comprehensive coverage of the case and its broader implications for cryptocurrency security and law enforcement.,

Leave a Reply

Want to join the discussion?Feel free to contribute!