‘Whales’ are buying the dip while everyone else runs for the exits

Bitcoin’s Whales Are Making a Move: Here’s What’s Happening in the Crypto Market

Bitcoin’s price has been on a rollercoaster ride lately, but there’s one group that’s standing out from the rest: the whales. These massive investors, holding 10,000 BTC or more, are the only ones currently buying Bitcoin as prices plummet. Meanwhile, all other holder groups are hitting the sell button, according to on-chain data.

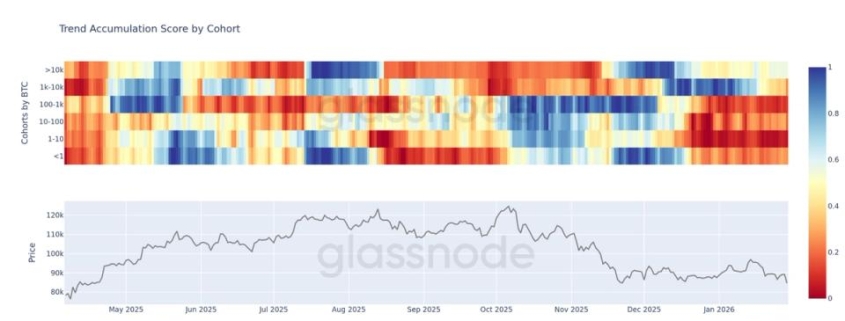

This divergence is highlighted by Glassnode’s Accumulation Trend Score, which measures the relative behavior of different entity sizes based on both balance and the amount of Bitcoin acquired over the past 15 days. Scores closer to 1 indicate buying, while values near 0 signal selling. Right now, the whales are in a “light accumulation” phase, maintaining a neutral-to-slightly-positive balance trend since Bitcoin fell to $80,000 in late November.

In contrast, retail holders with less than 10 BTC have been in persistent selling mode for over a month, reflecting continued downside and risk aversion among smaller participants. This trend is further supported by the fact that the number of unique entities holding at least 1,000 BTC has increased from 1,207 in October to 1,303, suggesting that larger holders have been buying into the correction.

Bitcoin is now trading near $78,000, according to CoinDesk data, and the market is watching closely to see if the whales’ buying activity will stabilize the price or if the selling pressure from smaller holders will continue to dominate.

Tags:

Bitcoin whales, crypto market, accumulation trend, Glassnode data, Bitcoin price, retail selling, large investors, market correction, on-chain analysis, Bitcoin holders, crypto volatility, whale activity, Bitcoin accumulation, retail risk aversion, Bitcoin correction, crypto whales, market dynamics, Bitcoin trading, crypto trends, Bitcoin analysis

Viral Sentences:

- “Bitcoin whales are the only ones buying as prices crash—are they preparing for a rebound?”

- “Retail holders are selling, but whales are quietly accumulating. What do they know?”

- “The gap between Bitcoin whales and retail is widening—who’s right?”

- “Bitcoin’s price is down, but the whales are making their move. Is this the bottom?”

- “Glassnode data reveals a stark divide: whales buy, everyone else sells.”

- “Bitcoin’s largest holders are back at December 2024 highs—are they the smart money?”

- “Retail panic selling vs. whale accumulation: the battle for Bitcoin’s future.”

- “Bitcoin’s correction is creating opportunities for whales—are you watching?”

- “The whales are in accumulation mode—could this signal a Bitcoin price reversal?”

- “Bitcoin’s market dynamics are shifting: whales buy, retail sells. What’s next?”

,

![What new Google Messages features are rolling out [January 2026] What new Google Messages features are rolling out [January 2026]](https://techno-news.org/wp-content/uploads/2026/01/google-messages-logo-circle-2-150x150.jpg)

Leave a Reply

Want to join the discussion?Feel free to contribute!