What does the disappearance of a $100bn deal mean for the AI economy? | AI (artificial intelligence)

OpenAI and Nvidia’s $100 Billion AI Deal Collapses: A Seismic Shift in the Tech World

In a stunning turn of events that has sent shockwaves through Silicon Valley and Wall Street alike, the much-hyped $100 billion AI partnership between Nvidia and OpenAI appears to have evaporated into thin air over a single weekend. What was once touted as the cornerstone of the AI revolution—a circular arrangement where Nvidia would invest billions into OpenAI, which would then funnel most of that money right back into Nvidia’s chips—now seems to be nothing more than vaporware in the volatile landscape of artificial intelligence.

The collapse of this monumental deal exposes the fragile foundations upon which the AI industry has been built, revealing a house of cards constructed from hype, speculation, and circular logic that would make even the most seasoned financial analysts blush.

The Circular Logic That Defined an Industry

Last September, when the $100 billion partnership was first announced, it seemed like the perfect symbiotic relationship. Nvidia, the undisputed king of AI chips, would provide OpenAI—the creator of ChatGPT—with massive financial backing. OpenAI would then use these funds to purchase Nvidia’s cutting-edge GPUs, creating what appeared to be a self-reinforcing cycle of growth and innovation.

But beneath the surface lurked a troubling reality that has now come to light. This wasn’t just a partnership; it was a financial ouroboros—the mythical serpent eating its own tail. Nvidia would essentially be paying itself through OpenAI, creating an illusion of market demand while potentially inflating both companies’ valuations to unsustainable levels.

Market watchers have been sounding alarms for months, drawing uncomfortable parallels to the dot-com bubble of 1999-2000. The eerie similarities are impossible to ignore: companies with astronomical valuations based on future potential rather than current profitability, massive investments flowing between interconnected players, and a pervasive sense that the entire ecosystem might be built on quicksand rather than solid ground.

The Weekend That Changed Everything

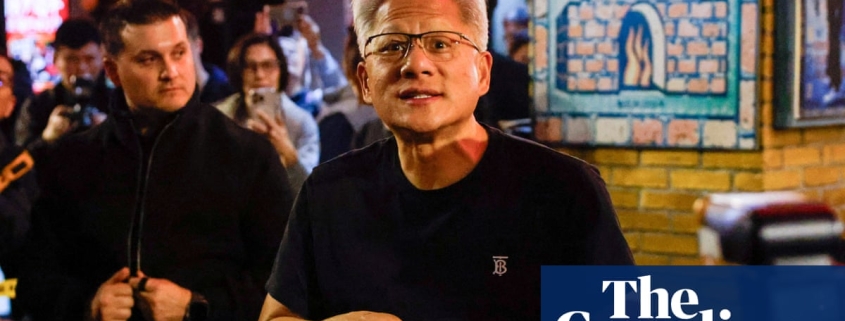

According to the Wall Street Journal, the deal’s unraveling began quietly, with negotiations stalling and Nvidia CEO Jensen Huang privately emphasizing that the agreement was “non-binding” and “not finalized.” This revelation came as a shock to many who had assumed the deal was as good as done, given the fanfare surrounding its initial announcement.

Huang himself seemed to confirm the deal’s diminished scope during a Saturday appearance in Taipei, telling reporters that while Nvidia would make a “huge” investment in OpenAI’s next funding round, it would be “nothing like” $100 billion. This understatement sent immediate ripples through the tech industry, with Nvidia’s stock taking a 10% hit in the days that followed.

The plot thickened when Reuters reported that OpenAI was “unsatisfied” with Nvidia’s advanced AI chips and was actively seeking alternatives. This revelation painted a picture of a partnership in crisis, with both parties seemingly looking for the exit door even as they publicly maintained a united front.

Damage Control and Corporate Spin

In the immediate aftermath of the deal’s apparent collapse, both companies launched into full damage control mode. Sam Altman, OpenAI’s CEO, took to X (formerly Twitter) to proclaim, “We love working with Nvidia and they make the best AI chips in the world. We hope to be a gigantic customer for a very long time.”

Oracle, which had been counting on OpenAI’s commitment to a massive $300 billion cloud computing deal, also scrambled to reassure investors. The software giant posted on X that it “still expects the startup to be good for its commitment even if it does not receive the full amount from Nvidia.”

The coordinated messaging from all parties involved was unmistakable: everything is fine, nothing to see here, business as usual. But the market wasn’t buying it. The very fact that such extensive damage control was necessary spoke volumes about the deal’s significance and the potential fallout from its collapse.

The $1 Trillion Question

To fully appreciate the magnitude of this situation, one must understand the scale of OpenAI’s ambitions. The company has committed to compute deals worth more than $1 trillion—a figure so astronomical it defies comprehension. These agreements represent the infrastructure necessary to build and power OpenAI’s AI tools, and they form the backbone of the company’s growth strategy.

The Nvidia deal was supposed to be a cornerstone of this infrastructure, providing both the financial backing and the technological foundation for OpenAI’s next phase of expansion. Its collapse raises serious questions about whether OpenAI can actually deliver on its massive commitments and whether the entire AI industry might be overextended.

Industry Analysts Weigh In

Alvin Nguyen, an analyst at Forrester Research, provides crucial context for understanding the deal’s collapse. According to Nguyen, OpenAI’s ambitious growth trajectory makes it nearly impossible for the company to remain loyal to a single vendor, especially as it plans new, computationally demanding AI models.

“They need chips. They need as many as possible,” Nguyen explains, highlighting the insatiable appetite for computing power that drives companies like OpenAI. This need for diversification may have been a key factor in OpenAI’s apparent dissatisfaction with Nvidia’s offerings.

As for Nvidia, Nguyen suggests that the company may never have been as committed to the $100 billion figure as public statements suggested. “They will not discourage people from overhyping. Why say something and immediately sucker punch your own share price?” he asks rhetorically.

This perspective suggests that Nvidia may have been perfectly content to let the hype build around the partnership, even if the actual commitment was far more modest. In the high-stakes world of AI, perception often matters more than reality, and Nvidia has been a master at managing both.

The Startup Mentality in a Corporate World

Nguyen also provides insight into OpenAI’s maneuvering, noting that CEO Sam Altman’s background as a startup founder influences the company’s approach to deals and partnerships. “You know [Altman’s] background as a startup person, and you know the manoeuvres he’s doing make sense from a startup perspective,” he observes.

This startup mentality—characterized by aggressive growth targets, flexible commitments, and a willingness to pivot when circumstances change—may be at odds with the expectations of larger corporate partners and investors who are accustomed to more traditional business arrangements.

For Nvidia, meanwhile, AI hype isn’t just a byproduct of its business—it’s an essential component of its sales strategy. “You don’t know what’s going to happen,” Nguyen says, “and so you let other people put numbers out there for you and let that drive the hype.”

This approach has served Nvidia well in the past, helping to establish the company as the dominant player in AI chips. But it also creates risks when the hype machine produces expectations that the company cannot or will not meet.

The Ripple Effects

The collapse of the Nvidia-OpenAI deal has implications that extend far beyond the two companies involved. Oracle’s scramble to reassure investors about its own massive deal with OpenAI demonstrates how interconnected the AI industry has become, with the fortunes of one company often tied to the performance of others.

More broadly, the deal’s collapse comes at a time when the investment landscape for AI is shifting dramatically. The initial euphoria that greeted the launch of ChatGPT and other generative AI tools is giving way to a more sober assessment of which aspects of the technology will actually generate sustainable profits.

This shift is already having real-world consequences. This week saw a massive sell-off in certain software stocks, prompted in part by the launch of a new Anthropic AI tool capable of performing various professional services. This development has sparked fears that business models exposed to competition from AI products will be disrupted, potentially wiping out billions in market value.

The Jagged Reality of AI

The concept of “jagged AI”—the idea that advanced AI tools have uneven talents, excelling at some tasks while struggling with others—is becoming increasingly relevant as the industry matures. While AI systems might be excellent at sifting through documents or generating code, they may struggle with complex mathematical problems or creative tasks that require genuine understanding.

This uneven capability profile has significant implications for which industries and companies will benefit from AI advances and which will be disrupted. Service industries that rely on tasks that AI can automate—such as legal research, basic accounting, or customer service—face existential threats, while companies in other sectors may find AI to be a powerful tool for enhancement rather than replacement.

At the top of the AI pyramid, the competitive effects are already becoming apparent. OpenAI’s ChatGPT has seen its market share erode from 69% to 45% in recent months, losing ground to competitors like Google’s Gemini, xAI’s Grok, and Anthropic’s Claude. This erosion of dominance suggests that OpenAI’s position at the top of the AI hierarchy may be more precarious than many assumed.

The Bottom Line

The apparent evaporation of a $100 billion deal between two of the most crucial players in AI may indeed be part of a broader pattern: the collision between last year’s sci-fi rhetoric and this year’s practical realities. The question that remains is who will be left holding the bill when the music stops.

“I think there will be knock-on effects,” Nguyen predicts. “I mean, it’s that statement: the markets can stay irrational longer than you can stay solvent.”

This observation cuts to the heart of the matter. The AI industry has been powered by irrational exuberance for years, with valuations and investments based more on potential than on current reality. But as the Nvidia-OpenAI deal demonstrates, even the most hyped partnerships can collapse when faced with the cold light of practical considerations.

The collapse of this deal may be a warning sign—a canary in the coal mine for an industry that has perhaps gotten ahead of itself. As investors, companies, and consumers grapple with the implications, one thing is clear: the AI revolution may be entering a new, more sober phase, where hype gives way to hard-nosed business realities and where only the truly viable survive.

For now, the tech world watches and waits to see what other dominoes might fall as the AI bubble adjusts to meet reality. One thing is certain: the landscape of artificial intelligence will never be quite the same.

Tags: #AI #Nvidia #OpenAI #TechBubble #ArtificialIntelligence #ChatGPT #SiliconValley #TechNews #Investment #AI chips #TechIndustry #MarketCrash #DotComBubble #TechBubble #AI Hype #TechCollapse #OpenAI #Nvidia #AIIndustry #TechBubble #ArtificialIntelligence #ChatGPT #SiliconValley #TechNews #Investment #AI chips #TechIndustry #MarketCrash #DotComBubble #TechBubble #AI Hype #TechCollapse

Viral Phrases: “The AI bubble is bursting,” “Nvidia’s $100 billion deal evaporates,” “OpenAI’s ChatGPT losing ground,” “Circular AI economy wobbles,” “Tech industry built on hype,” “AI revolution meets reality,” “The markets can stay irrational longer than you can stay solvent,” “$1 trillion AI commitments in question,” “Jagged AI reality bites,” “Silicon Valley’s house of cards,” “The weekend that changed AI forever,” “When hype meets hard business,” “The canary in the AI coal mine,” “Tech’s self-eating serpent,” “The $100 billion vaporware deal,” “AI industry overextended,” “Startup mentality vs. corporate expectations,” “Damage control in the tech world,” “The ripple effects of AI collapse,” “Who’s left holding the bill?”

,

Leave a Reply

Want to join the discussion?Feel free to contribute!