Looking back on internet of things stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Rockwell Automation (NYSE:ROK) and its peers.

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

The 7 internet of things stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1%. while next quarter’s revenue guidance was 2.6% below consensus. Stocks–especially those trading at higher multiples–had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, but internet of things stocks have shown resilience, with share prices up 5.3% on average since the previous earnings results.

Best Q1: Rockwell Automation (NYSE:ROK)

One of the first companies to address industrial automation, Rockwell Automation (NYSE:ROK) sells products that help customers extract more efficiency from their machinery.

Rockwell Automation reported revenues of $2.13 billion, down 6.6% year on year, exceeding analysts’ expectations by 3.5%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ organic revenue estimates and a decent beat of analysts’ earnings estimates.

“Execution in the second quarter was solid, and we continue to see sequential order improvement. However, there is more excess inventory at our customers, particularly machine builders, than we originally expected. As a result, we are not yet seeing the accelerated order ramp this fiscal year and are reducing our full-year guidance. Despite the lower FY24 outlook, we are gaining share across many of our most important product lines and in North America, our largest market,” said Blake Moret, Chairman and CEO.

The stock is up 4.2% since reporting and currently trades at $289.20.

Is now the time to buy Rockwell Automation? Access our full analysis of the earnings results here, it’s free.

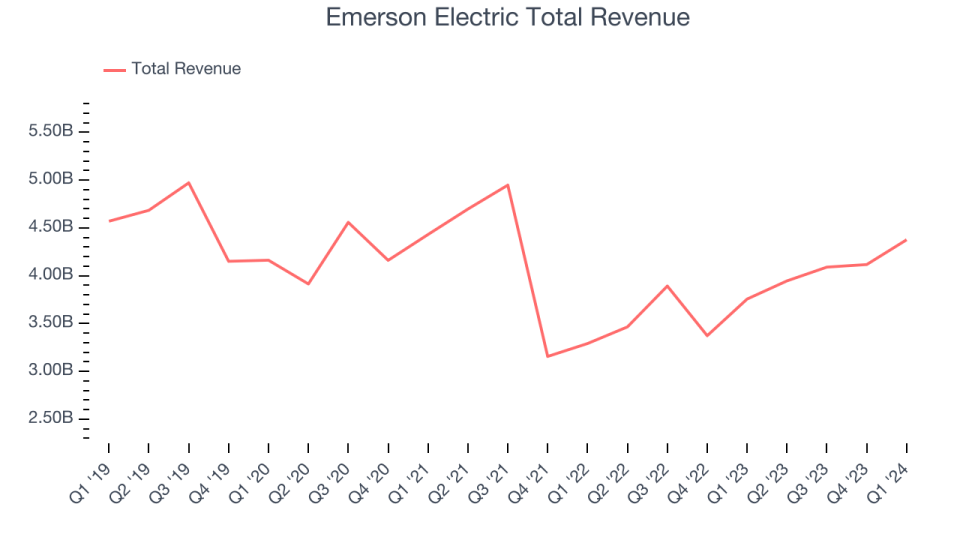

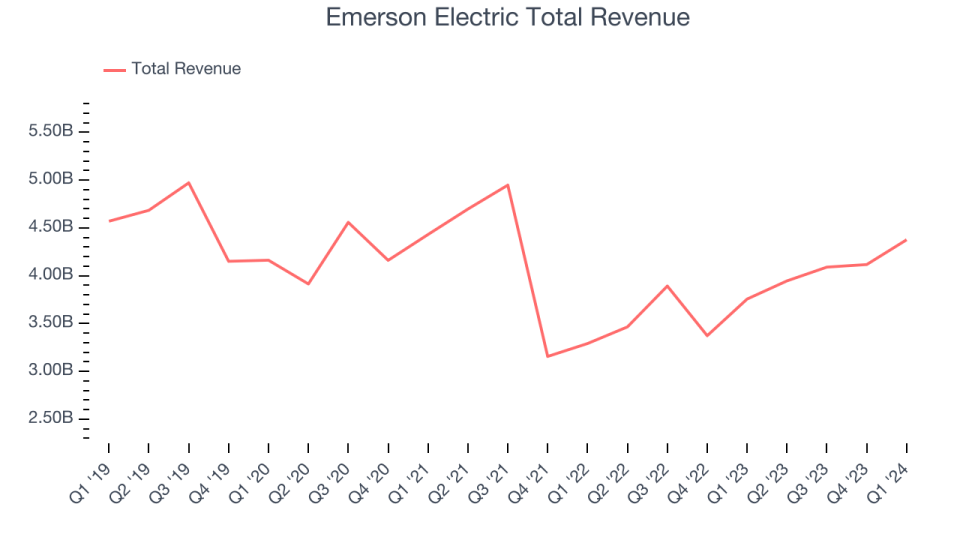

Emerson Electric (NYSE:EMR)

Founded in 1890, Emerson Electric (NYSE:EMR) is a multinational technology and engineering company providing solutions in the industrial, commercial, and residential markets.

Emerson Electric reported revenues of $4.38 billion, up 16.5% year on year, outperforming analysts’ expectations by 2%. It was a very strong quarter for the company with a decent beat of analysts’ earnings estimates.

Emerson Electric scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 9.3% since reporting. It currently trades at $117.38.

Is now the time to buy Emerson Electric? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SmartRent (NYSE:SMRT)

Founded by an employee at a real estate rental company, SmartRent (NYSE:SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

SmartRent reported revenues of $50.49 million, down 22.4% year on year, falling short of analysts’ expectations by 1.2%. It was a weak quarter for the company with a miss of analysts’ earnings estimates.

SmartRent posted the slowest revenue growth in the group. Interestingly, the stock is up 2% since the results and currently trades at $2.50.

Read our full analysis of SmartRent’s results here.

Trimble (NASDAQ:TRMB)

Playing a role in the construction of the Paris Grand, Trimble (NASDAQ:TRMB) offers geospatial devices and technology to the agriculture, construction, transportation, and logistics industries.

Trimble reported revenues of $953.3 million, up 4.1% year on year, surpassing analysts’ expectations by 4.5%. Zooming out, it was a solid quarter for the company with a decent beat of analysts’ earnings estimates.

Trimble delivered the biggest analyst estimates beat among its peers. The stock is down 3.3% since reporting and currently trades at $58.10.

Read our full, actionable report on Trimble here, it’s free.

Arlo (NYSE:ARLO)

With its name deriving from the Old English word meaning “to see,” Arlo (NYSE:ARLO) provides home security products and other accessories to protect homes and businesses.

Arlo reported revenues of $124.2 million, up 11.9% year on year, in line with analysts’ expectations. Overall, it was a weak quarter for the company with a miss of analysts’ earnings estimates.

The stock is up 23.1% since reporting and currently trades at $17.16.

Read our full, actionable report on Arlo here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

#Prize #Rockwell #Automation #NYSEROK,

#Prize #Rockwell #Automation #NYSEROK